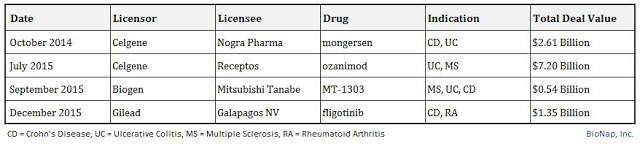

A proven late-stage asset for the treatment of inflammatory diseases is worth a lot of money to large pharma-biotech companies. Accordingly, a small biopharma company developing a potential novel approach to treating immune-inflammatory diseases is sitting on a potential goldmine when it comes time to strike a partnership. Examples of recent deals include:

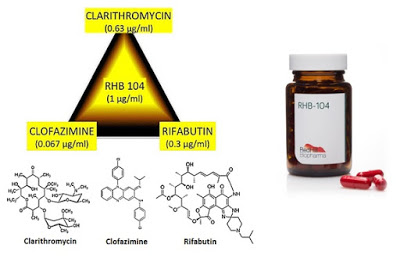

One of RedHill Biopharma Ltd. (NASDAQ: RDHL) ongoing Phase 3 programs is RHB-104, a patent-protected triple combination of the anti-mycobacterial, intracellularly acting drugs, clarithromycin, clofazimine, and rifabutin in a single oral pill for the treatment of Crohn’s disease (CD) and multiple sclerosis (MS). RedHill is currently conducting the first global Phase 3 trial with RHB-104 in 270 patients. An independent data, safety and monitoring board (DSMB) analysis expected during the second half of 2016.

RedHill’s concept is that chronic auto-inflammatory diseases, the cause of which is not known today, cannot be without a cause. As was the case with gastric ulcers in the past, proven to be caused by a specific infection called H. pylori, the cause of Crohn’s disease may well be a persistent and specific infection. If RedHill is right and RHB-104 is eventually approved and reaches the market, and Crohn’s disease is triggered by a specific infection, the treatment paradigm for Crohn’s disease, as well as other so-called ‘autoimmune’ diseases, may change forever.

Based on the deals noted above, a potential transaction for RHB-104 could be worth multiples of RedHill’s current market valuation of only $140 million. Only investors do not seem to be assigning significant value to this asset, likely because the potential breakthrough concept of a triple antibiotic for auto-inflammatory conditions like CD and MS has yet to resonate with both investors. For this article, I look at the link between MAP infection and CD, the clinical history of the drug, and the potential peak sales RHB-104 if approved.

Inflammatory Bowel Disease (IBD), which includes ulcerative colitis (UC) and Crohn’s disease, is a chronic, lifelong condition with serious quality of life implications. According to the Crohn’s & Colitis Foundation of America (CCFA), IBD affects as many as 1.4 million Americans, most of which are diagnosed before the age of 30. Crohn’s disease accounts for approximately 65% of the IBD market, which is about one million patients in the U.S.

The primary characteristic of the disease is inflammation of the gastrointestinal (GI) tract, which manifests in symptoms that include persistent diarrhea, abdominal pain, cramping, rectal bleeding, and fatigue. Crohn’s disease is distinguished from ulcerative colitis in that any part of the GI tract can be affected by the inflammation, although the most commonly affected area is the small intestine (the ileum) near the ascending colon or proximal colon. Crohn’s disease may also appear in patches, affecting some areas of the GI tract while leaving other sections completely untouched. Crohn’s disease tends to manifest with more severe inflammation than UC and the ulcerations may extend through all layers of the bowel creating transmural perforations and strictures.

Symptoms of IBD vary from person to person, and may change over time. With both Crohn’s disease and ulcerative colitis, patients go through periods of being symptom-free (remission) alternating with periods of having active disease (flare-ups). For CD, the CCFA estimates patients are in remission or have mild disease activity approximately 50% of the time. Approximately 35% of CD patients will report moderate disease activity with at least one or two flare-ups during the course of a year. Approximately 10-15% will report severe and/or chronically active disease (1).

The primary concern of moderate-to-severe disease is inflammation that leads to ulceration and perforation of the bowel wall leading to fistula (tunnel formations) to another part of the intestine, other internal organs, or to the skin surface. Left untreated, ulcers can lead to strictures (scar tissue) or abscesses that block the intestines and cause intense pain and discomfort. Patients with severe CD may also have nutritional deficiencies resulting from the inability to absorb proteins, vitamins, and fats through the damaged intestinal wall.

Treatment For IBD

In the decades since UC and CD were first identified, significant scientific progress has been made in understanding these chronic inflammatory diseases, particularly with respect to immunology, genetics, and microbiology. An increasing number of susceptibility genes have been identified, as have environmental and external factors including smoking (specific to CD) and diet. The primary method for treating IBD is by knocking down the body’s inflammatory response through the use of aminosalicylates, high-dose corticosteroids, and immunomodulators.

When these drugs fail, and they typically do over 50% of the time (source: GlobalData), gastroenterologists turn to the more powerful biologic drugs, including J&J’s Remicade® and Simponi®, AbbVie’s Humira®, UCB’s Cimzia®, Biogen’s Tysabri®, and Takeda’s Entyvio® (2). It’s an estimated $6 billion global market, and despite the availability of the aforementioned blockbuster drugs, patients remain vastly underserved. For example, according to the Crohn’s and Colitis Foundation of America, approximately 75% of people with Crohn’s will eventually require surgery. Many will require multiple surgeries.

Different types of surgical procedures may be performed depending on the reason for surgery, the severity of illness, and location of the disease in the intestines. Unlike ulcerative colitis, surgery does not cure Crohn’s disease. Approximately 30% of patients who have surgery for CD will experience a recurrence of their symptoms within three years and up to 60% will have a recurrence within ten years. (3).

J&J’s Remicade® (infliximab) is the market leader. According to J&J’s Phase 3 clinical trial with infliximab, 58% of moderate-to-severe CD patients responded to a single infusion of 5 mg/kg drug after two weeks. Unfortunately, the percent drops to only 18% placebo-adjusted after 30 weeks for the same dose used as a maintenance therapy (4), and the best idea big pharma can come up with since infliximab approval is to simply double the dose and take more drug (5).

The lack of consistent and durable response to the TNF-α and other biologic drugs, along with the potentially dangerous side effects and risk of both infection and malignancies that can occur with long-term use, has led to some calling into question the pharmacoeconomic benefit of these drugs. A study conducted by researchers at the Department of Public Health & Epidemiology University of Birmingham, UK concluded the anti-TNF drugs do offer a beneficial effect compared to standard-of-care, but that neither infliximab nor adalimumab (Humira®) are cost-effective as a maintenance therapy (6).

The Cause of IBD – The MAP Hypothesis

The lack of meaningful success in the treatment of CD/UC patients may stem from the lack of understanding of disease pathophysiology. Even after decades of research, the causes of IBD are not entirely understood. Researchers believed a number of factors including environmental influences, mucosal immune dysfunction, genetic predisposition, and gut microbiota play a role in disease pathology. The concept of bacterial infection, specifically Mycobacterium avium paratuberculosis (MAP), as a precursor and underlying cause for CD is gaining support. Nevertheless, there are no approved antibiotic combination therapies in the U.S. for CD.

Drugs like prednisolone, methotrexate, and the TNF-α and other biologic drugs treat only the symptoms of CD. To truly advance the treatment paradigm forward, researchers must start looking at the underlying causes of the disease. In this regard, an important link has been drawn between CD and another chronic inflammatory disease of the intestine that affects many animal species, including primates, called Johne’s disease (JD). Johne’s disease (also called paratuberculosis) is a contagious, chronic, and sometimes fatal infection that primarily affects the small intestine of ruminants (plant-eating mammals). The disease was first discovered and characterized by Heinrich Albert Johne in 1895 and is unequivocally caused by Mycobacterium avium paratuberculosis (MAP) (Wikipedia).

MAP is a slow growing obligate pathogenic bacterium, highly resistance to treatments with acid and alcoholic compounds due to a strong cellular wall with a high lipid composition. MAP is recognized as a multi-host mycobacterial pathogen with a proven specific ability to initiate and maintain systemic infection and chronic inflammation of the intestine of a range of histopathological types in many animal species, including primates. A 2007 survey conducted by the U.S. National Academy of Science Board of Agriculture found that nearly 70% of U.S. dairy herds are infected with MAP.

Significant similarities exist between Johne’s disease and Crohn’s disease, and scientists have spent the past decade characterizing the common neural and immune pathogenicity’s (7). I found dozens of papers that postulate a link between MAP and CD, some of the most prominent ones are listed below:

– Greenstein, R.J.; The Lancet Infectious Diseases, 2003 >> LINK

– Behr MA & Kapur V; Current Opinion in Gastroenterology, 2008 >> LINK

– Borody, T.J. et al.; Digestive and Liver Disease, 2002 >> LINK

– Taylor, J.H. et al.; Digestive and Liver Disease, 2002 >> LINK

– Borody, T.J. et al; Digestive and Liver Disease, 2007 >> LINK

– Chamberlin, W. et al.; American Journal of Gastroenterol, 2007 >> LINK

– Kirkwood, C.D. et al.; Inflammatory Bowel Diseases, 2009 >> LINK

– Naser, S.A. et al.; World Journal of Gastroenterology, 2014 >> LINK

– Mendoza, J.L. et al; World Journal of Gastroenterology, 2010 >> LINK

– Chiodini, R.J. et al; Critical Reviews in Microbiology, 2012 >> LINK

– McNees, A.L. et al; Expert Review of Gastroenterology & Hepatology, 2015 >> LINK

– Alcedo, K.P. et al; Gut Pathogens, 2016 >> LINK

Many researchers have noted the high correlation between MAP infection and incidence of CD. For example, MAP can be cultured from the peripheral mononuclear cells from 50–100% of patients with Crohn’s disease, and less frequently from healthy individuals (8, 9). Obviously, the association does not prove causation, but MAP would not be the first pathogenic bacteria known to cause gastrointestinal inflammatory conditions. The obligate pathogen H. pylori are the proven instigator of gastric and peptic ulcer disease (10).

Independent work conducted by a number of institutions has confirmed the link between CD and MAP infection. For example, a systemic review and meta-analysis published in Lancet Infectious Disease in 2007 noted a greater than 7x increase in odds for MAP infection (via PCR in tissue samples) and 1.7x increase in odds (via ELISA in serum) for patients with CD versus healthy controls (11). The authors, having looked at 28 case-controlled studies, concluded that, “The association of MAP and Crohn’s disease seems to be specific, but its role in the aetiology of Crohn’s disease remains to be defined.”

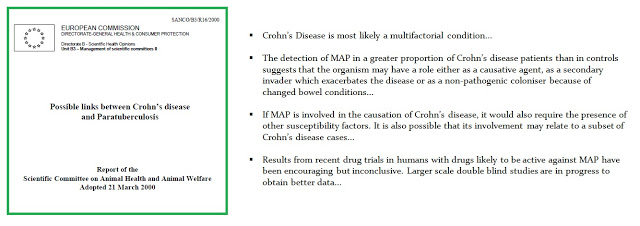

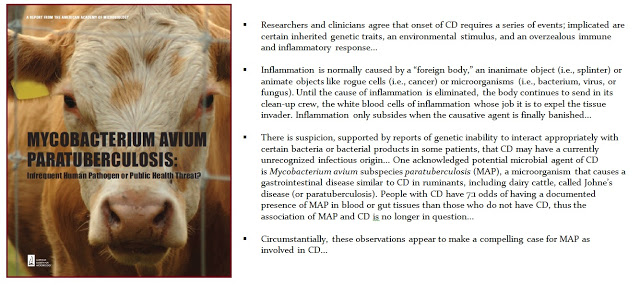

The “MAP-hypothesis” has gained enough steam that both the American Academy of Microbiology and the European Directorate General of Health and Consumer Protection conducted a separate, independent analysis of the link between MAP infection and incidence of CD.

The 2007 76-page EU-MAP Report makes the following conclusions:

The 2008 41-page US-MAP Report makes the following conclusions:

RHB-104 Clinical Studies

RHB-104 Clinical Studies

RHB-104 is a proprietary and potentially groundbreaking oral antibiotic combination therapy with potent intracellular, anti-mycobacterial and anti-inflammatory properties, currently undergoing a first Phase III study for Crohn’s disease and a Phase IIa study for multiple sclerosis. The development of RHB-104 is based on increasing evidence supporting the hypothesis that Crohn’s disease is caused by MAP infection in susceptible patients.

Journal articles and peer-reviewed publications concluding there is a link between MAP and CD is interesting stuff, but what investors really want to know is, “Does RHB-104 work?” To answer this question, one can look at the clinical results with the individual components of the drug. Recall, RHB-104 is a patented combination of three generic antibiotic ingredients, clarithromycin, rifabutin, and clofazimine, in a single oral capsule. RHB-104 was developed to treat MAP infections by Professor Thomas Borody at the Centre for Digestive Diseases in Australia. Professor Borody licensed the patents to RHB-104 to RedHill Biopharma in 2010.

– Clarithromycin is a broad-spectrum antibiotic with efficacy against Gram-positive infections such as Helicobacter pylori, Haemophilus influenzae, Streptococcus pneumoniae, and Streptococcus pyogenes. The drug was sold as Biaxin® by Abbott Labs but is now available as a generic in the U.S.

– Rifabutin is a semi-synthetic antibiotic with efficacy against both Gram-positive and Gram-negative bacteria, with primary use against mycobacteria for the treatment of tuberculosis.

– Clofazimine is an iminophenazine dye used in combination with other antibiotics for the treatment of leprosy (Mycobacterium avium leprae) and Mycobacterium avium infections (MAC) in AIDS patients. The drug was previously marketed under the brand name Lamprene® by Novartis, but generic supply is scarce and it is not readily available in the U.S.

In 1997, researchers out of St. George’s Hospital Medical School, London, UK tested rifabutin in combination with a clarithromycin or azithromycin. Results showed that of the 19 patients who were steroid dependent at the start of this study, only two continued to require steroids when treatment was established. A reduction in the Harvey-Bradshaw Crohn’s disease activity index occurred after 6 months treatment (P = 0.004) and was maintained at 24 months (P < 0.001) (12). A separate study out of the Department of Medicine, the University of Liverpool in the UK in 2000 showed an impressive response to clarithromycin in a group of patients with active Crohn’s disease, many of whom had been resistant to other therapy (13).

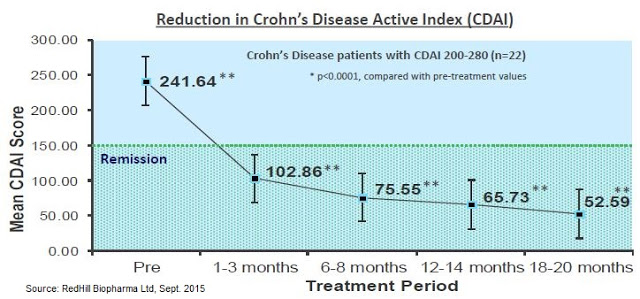

In 2002, Professor Borody in Australia published work with the triple combination The Phase 2a study in 12 patients with severe, obstructive or penetrating Crohn’s disease followed patients for a total of 54 months. Six out of 12 patients experienced a full response to the anti-MAP combination therapy achieving complete clinical, colonoscopic and histologic remission of Crohn’s disease (14). Four of these patients were able to cease treatment after 24-46 months, three of whom remained in total remission without treatment for up to 26 months and one patient relapsed after six months off treatment. A partial response was seen in two additional patients showing complete clinical remission with mild histologic inflammation, yielding an overall response rate of 75%. Return to normal of terminal ileal strictures occurred in five patients. This is as close to a cure for Crohn’s disease that researchers had seen to date.

Professor Borody published additional results from a second study in 54 patients in 2005. Results showed that 60% of the patients achieved a significant reduction in Crohn’s Disease Activity Index (CDAI) of > 70 points, and of the total evaluable patients, 85% saw a decrease in CDAI from baseline, along with other measures of response such as mucosal healing. Patients also saw reductions in CD-related symptoms, including abdominal pain and diarrhea (15).

The figure below shows a 22 patient subset of the Borody study in which patients were stratified by disease severity. This more homogeneous group had 100% remission within less than 3 months. This is the strongest data seen to date in CD, and would essentially blow away competing Phase 2 data from mongersen – a drug that Celgene paid $710 million to acquire in 2014 (16).

Big Pharma Shows Up

Big Pharma Shows Up

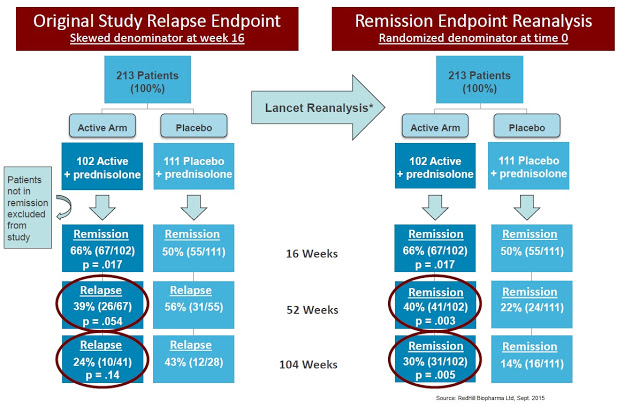

Prior to the deal with RedHill in 2010, Professor Borody licensed the rights to the triple antibiotic to Pharmacia, later acquired by Pfizer, for the Phase 3 Australian program. Two hundred thirteen patients were randomized to 450 mg/day of rifabutin, 750 mg/day of clarithromycin, and 50 mg/day of clofazimine or placebo, in addition to a 16-week tapering course of prednisolone. Those in remission (Crohn’s Disease Activity Index ≤ 150) at week 16 continued their study medications in the maintenance phase of the trial. Primary endpoints were the proportion of patients experiencing at least one relapse at 12, 24, and 36 months.

At week 16, there were significantly more subjects in remission in the antibiotic arm (66%) than the placebo arm (50%; P = 0.02). Of 122 subjects entering the maintenance phase, 39% taking antibiotics experienced at least one relapse between weeks 16 and 52, compared with 56% taking a placebo (P = 0.054). These results were encouraging, but the separation did not maintain statistical significance upon follow-up at week 104, 26% vs. 43% relapse rate, respectively (P = 0.14) (17). These results were published by Selby et al., in Gastroenterology in 2007.

The authors concluded that despite what looked to be an initial strong response to the triple antibiotic, there was no sustained benefit beyond sixteen weeks. For several reasons and given the results of the Phase 3 study, Pfizer (acquired Pharmacia in 2003) decided not to continue development of the triple antibiotic for CD.

A Flawed Study

Following the publication of the Phase 3 results by Pfizer, supporters of the triple antibiotic therapy everywhere called the study flawed. The initial criticism of the trial stemmed from the dosing strengths used, specifically with respect to under-dosing patients compared to the two studies conducted by Prof. Borody in the preceding years. The doses used in the 2005 Phase 2 study (n=54) were 600 mg/day of rifabutin, 1000 mg/day of clarithromycin, and 100 mg/day of clofazimine. Pfizer dosed 25% less rifabutin and clarithromycin and 50% less clofazimine in its trial. There were also serious dosing compliance issues with the Pharmacia Phase 3 trial.

A paper published by researchers out of the Gastroenterology Institute, Las Vegas, Nevada cited the following criticism of the Phase 3 program run by Pfizer (18):

According to recommended dosing for Mycobacterium avium infection rifabutin was underdosed by >30%, clarithromycin by approximately 50%, and clofazimine by >50% – and then in the crucial part of the trial, as admitted by the authors – clofazimine did not dissolve properly. Given the low doses and non-dissolution, it is highly likely that in the longer term the development of drug resistance – known to occur with mycobacteria – would have played a major role in the apparent increased relapse in the “active” group.

Several researchers/gastroenterologists had comments about the Pfizer data. J. Todd Kuenstner of the Memorial Hospital in West Allis, Wisconsin published this comment to the Selby paper (19):

The results of the Selby trial are encouraging (significantly better short-term remission rate in the treatment arm than the control arm) and suggest modifications of the current trial for future studies, which may lead to better outcomes… A blood culture method is now available to detect MAP infection in Crohn’s patients and could be used to assess MAP eradication in a properly designed controlled trial with more appropriate doses of the same drugs…

Dr. Judith E. Lipton and Dr. David P. Barash of the University of Washington in Seattle, Washington published this comment in response to the Selby paper (20):

No attempt was made to culture or do polymerase chain reaction testing for MAP, either before or after treatment, so no conclusion can be drawn about the effect of their protocol on putative Mycobacterium avium paratuberculosis (MAP) infection. Not only were the doses low, but the clofazimine was delivered in a double encapsulated form that may well have hampered bioavailability.

Professor Borody posted the comment below on the CDD website about Pfizer’s trial (21):

Unfortunately, the trial used sub-therapeutic doses, failed to test patients before they were treated for MAP presence and did not replace patients who were given non dissolving Clofazimine drugs so that the long-term maintenance part of the trial cannot be currently accepted as having any clinical significance.

Marcel Behr and James Hanley, Department of Medicine and Department of Epidemiology & Biostatistics at McGill University in Montreal, Canada, suggested Selby et al. used improper statistical analysis by only including responders as the denominators for the analysis conducted after week 16. The reanalysis was published in The Lancet and focused on remission rather than relapse rate, showing strong statistical significance using the same data (22):

Since randomisation occurred at week 0, an intention-to-treat analysis is indicated, using as denominators all patients recruited to the two study groups. With this approach, one instead observes that the absolute benefit seen at 16 weeks persists at 52 and 104 weeks, with significant differences at these timepoints (P = 0.003 and P = 0.005, respectively).

In short, the general conclusion from peers is that the Pfizer study was vastly underpowered in terms of size, used insufficient doses of the key active ingredients, had major dosing issues with respect to drug bioavailability, never bothered to confirm MAP infection in participants, looked at the wrong endpoint in relapse rates instead of remission in the ITT population, and conducted improper statistical analysis upon analysis after the primary endpoint. Yikes!

RedHill Initiates A New Phase 3 Trial

In September 2013, RedHill initiated a new Phase 3 trial with RHB-104 in patients with moderate-to-severe active Crohn’s disease (NCT01951326). According to ClinicalTrials.gov, there are 93 sites in the U.S., Canada, Israel, Australia, New Zealand, and Europe enrolling patients, with a target total enrollment of 270 patients at 120 centers randomized 1:1 to RHB-104 vs. placebo. The primary endpoint of the study is the percent of patients in remission at week 26 (CDAI ≤ 150), with secondary endpoints including response rate at week 26, time to remission, duration of remission and response, and maintenance of remission from week 26 to 52. The daily doses of RHB-104 have been optimized to 450 mg rifabutin, 950 mg clarithromycin, and 100 mg of clofazimine. According to a recent announcement by RedHill, nearly 200 patients have been recruited and an independent DSMB interim analysis is expected in the second half of 2016.

Despite the fact that the Selby W, et al., 2007 concluded the triple antibiotic MAP therapy for CD holds no sustained utility, the Phase 3 data actually provides very good support for RedHill achieving a positive outcome (see The Lancet paper by Behr & Hanley). For example, the primary endpoint for RedHill’s Phase 3 program is remission at 26 weeks. Looking at the Pfizer trial data, the under-dosed triple antibiotic achieved statistical significant at all time points tested on the remission endpoint.

A reanalysis of the Pfizer study was conducted by Behr & Hanley in 2008 and published in The Lancet. The authors took the data from the study and “reset” the baseline at week 16, looking at whether or not the 66% of the original patients in remission at week 16 maintained remission over the next two years. So instead of looking for relapse rates in the ITT population, the authors attempted to ascertain if patients that observed a benefit at week 16 (i.e. responders to anti-MAP therapy) saw persistent benefit at weeks 52 and 104. The results, presented below, show statistical significance at all time points (23).

The data also compare remarkably well, though this is an entirely theoretical comparison, with J&J’s original Phase 3 study (ACCENT-1) with infliximab, which showed only a 39% remission rate at 30 weeks and 28% remission rate at 54 weeks. The data published by Selby W, et al., 2007 showed a 42% improvement in remission compared to infliximab responders and 2.5x the response rate on an ITT basis, with the triple combination providing 40% vs. only 16% for Remicade®. Bafflingly, Pfizer returned the drug to Prof. Borody in 2006, prior to The Lancet reanalysis published by Behr & Hanley in 2008.

No Significant IP or Competitive Issues

In October 2013, RedHill presented, on behalf of Professor Borody’s Sydney-based center for digestive diseases (CDD), a poster at the American College of Gastroenterology Annual Scientific Meeting showing positive results from retrospective study with 10 pediatric patients suffering from Crohn’s disease treated with the triple combination by Professor Borody at the Centre for Digestive Diseases in Sydney, Australia. The result of the retrospective analysis demonstrated a clinical remission rate of 80% in 10 pediatric Crohn’s disease patients, aged 8 to 17 (median: 14.3), treated for six to 117 months. The state of remission was assessed and recorded regularly throughout treatment and was defined as Pediatric Crohn’s Disease Activity Index (PCDAI) < 10 for a minimum of three months, with stable, or reduction in, preexisting Crohn’s disease medications. In 2011, RedHill obtained U.S. FDA Orphan Drug status for RHB-104 for the treatment of Crohn’s disease in the pediatric population.

RedHill Bio’s RHB-104 is patent protected to 2029, with additional longer-term patents planned and pending and potential expansion of that under the GAIN act to 2034. Yes, the components of RHB-104 are three generic molecules, but given the optimized dosing of the single capsule and the fact that compounding pharmacies cannot legally recreate the formulation under the FDA’s Drug Quality and Security Act of 2013, I believe RHB-104 has no significant IP issues.

I also think the triple combination and convenient oral dosing will help drive uptake of RHB-104 once approved. Recently, scientists at the University of Central Florida published an analysis of RHB-104 compared to the individual components looking at the minimum inhibitory concentration (MIC) against 35 different MAP strains. The results of the study demonstrated that the RHB-104 active components, in their individual concentrations or in dual combinations, were not as effective against all strains compared to RHB-104 at MIC level. The authors concluded that lower concentrations of RHB-104 active components provided synergistic anti-MAP growth activity compared to individual or dual combinations of the drugs and, consequently, administration of RHB-104 is considered favorable and should lead to tolerable dosage that is desirable for long-term treatment of Crohn’s disease (24). The single tablet formulation should also mitigate the dosing and bioavailability issues seen during Pharmacia’s Phase 3 program.

In addition, clofazimine is only approved for the treatment of leprosy on a named-patient basis. It not available in the U.S. or the EU for any other use and is unlikely to be prescribed as part of any an unapproved treatment regimen. Additionally, U.S. FDA Orphan Drug status for pediatric Crohn’s provides, at a minimum, seven years of market exclusivity for the company. For these important reasons, significant barriers protect RHB-104 post approval.

An Enormous Market For RHB-104

According to the CCFA, there are an estimated 900,000 patients in the U.S. suffering from Crohn’s disease. There are easily another 1.1 million patients in commercially viable regions outside the U.S., such as Canada, Europe, and Israel. Approximately 50% of these 2.0 million patients are in remission or suffer from only mild disease. Another 750,000 or so patients suffer from moderate disease and may achieve an adequate response to aminosalicylates, corticosteroids, and immunomodulators. This leaves approximately 150,000 CD patients worldwide that seek advanced treatment options such as the TNF-α and other biologics.

Using the Phase 3 infliximab data as a point of reference, 50-60% of patients ultimately fail on these biologic drugs, and 70% eventually require some sort of surgery resulting from chronic CD. The TNF-α drugs and biologics such as natalizumab are also dangerous and carry FDA (“Black Box”) warnings for risk of infection (25) and hematologic malignancies. They are also incredibly expensive drugs, ranging in price from $2,500 to over $5,000 per month depending on dose.

I see an enormous opportunity for RHB-104, not only as a treatment option for patients failing biologic medications but as a first-line therapy in patients with confirmed MAP infection as a potential cure for CD. In this regard, RedHill is developing a diagnostic test for MAP infection in collaboration with Quest Diagnostics. This should both help improve the efficacy outcome of RHB-104 and provide meaningful pharmacoeconomic benefit in the eyes of payers once the drug is approved. Plus, RHB-104 has demonstrated good safety and it is an oral medication. All the biologic medications are IV/infusion.

I think RHB-104 is easily a multi-hundred million dollar drug. Pricing remains a wildcard at this point, but I’m going to assume that RHB-104 costs $1,500 per month, which is comparable to what the three individual generic components will cost (assuming one could theoretically obtain clofazimine in the U.S.). This is also consistent with what Prof. Borody envisioned, and anywhere from 40% to 60% cheaper than the biologic drugs that only treat the symptoms of the disease. RHB-104 targets the underlying cause of the disease and is designed to eradicate MAP infection. I suspect a typical course of therapy for the drug may be 24-36 weeks.

As such, the estimated cost of treatment for RHB-104 is $9,000 to $12,000 per patient per year. Investors should keep in mind that this is still very cheap for an Orphan Drug. In fact, it is even less than what I suspect the pricing will be for biosimilar infliximab in the U.S., once approved. Using some conservative assumptions that 50% of severe CD patients have MAP infection, the target population for RHB-104 is still 150,000 patients in the U.S. + EU markets. At 20% penetration into these active CD / MAP infected patients, with expected market and pricing growth, RHB-104 is a $700+ million drug.

However, I believe RHB-104 has the potential to have penetration rates far above 20% in the MAP-confirmed population. This could ultimately increase the peak sales of RHB-104 far in excess of billion dollars on a global basis. My model also assumes no contribution from sales in MS or RA.

Final Thoughts On RHB-104

RedHill Biopharma’s RHB-104 looks like a very interesting candidate and a potential paradigm changer for the treatment of Crohn’s disease. It’s a novel idea with demonstrated proof-of-concept in both early-stage and late-stage human trials. It looks to be safe and is a convenient oral capsule. The concept has amassed KOL support, and beyond this clear and sizable opportunity in CD, RedHill recently reported promising top-line results from RHB-104 in relapsing and remitting multiple sclerosis (MS). Management plans to start a proof of concept study in rheumatoid arthritis (RA) as well.

It is clear that RedHill sees RHB-104 with “biologic-like” label expansion into other immuno-inflammatory diseases, and with a lower price and better tolerability, I do not see why RHB-104 cannot be included on the list of blockbuster biopharma deals noted above. Celgene, Gilead, Biogen, AbbVie, Takeda, J&J… the players in this space are sizable and all have deep pockets. Remember, at one point pharmaceutical giant Pharmacia was interested in the asset, and despite what are obvious areas for improvement with respect to the dosing and protocol design, many believed the trial to be an excellent proof-of-concept study.

Conclusion

The opportunity for RedHill Biopharma with RHB-104 looks significant. If RedHill’s first Phase 3 trial is successful, I think the market will start to view RHB-104 as having potential peak sales in the $500-750 million range for the U.S., with potential expansion to over $1 billion on a global basis. RedHill’s current market capitalization is $140 million, and the company has a strong and debt-free balance sheet with approximately $53 million in cash as of the end of March 2016.

DSMB analysis from the ongoing Phase 3 study are expected later in 2016, and this could prove to be a major valuation inflection for the company, which has several other Phase 3 programs, including RHB-105 for H. pylori infection and Bekinda™ for gastroenteritis and gastritis.