Investors familiar with Acadia Pharmaceuticals (ACAD, $1.28/share) know the company’s lead pipeline candidate, pimavanserin, a potent and selective 5-HT2A inverse agonist, failed the first phase 3 trial (Study -012) based on unusually high placebo response. When -012 failed, management discontinued the second phase 3 trial, Study-014, early.

What Went Wrong?

Upon detailed analysis of the failed -012 trial, I believe there are some key factors that led to the high placebo response in the control group. Mainly, this high response was seen in treatment centers outside the U.S, specifically in Eastern Europe (Bulgaria, Russia, and the Ukraine) and India where standards of care were below that of the U.S. and Western Europe (France and the UK). The hypothesis is that patients enrolled into the -012 study saw a dramatic step-up in care once enrolled in the -012 program. Though only on placebo, signs and symptoms of Parkinson’s disease psychosis (PDP) were reduced as a result of increased physician visits and increased quality of care standardized by the trial protocol. It is also possible that patients outside the U.S. might not have had as severe PDP as the patients in the U.S.

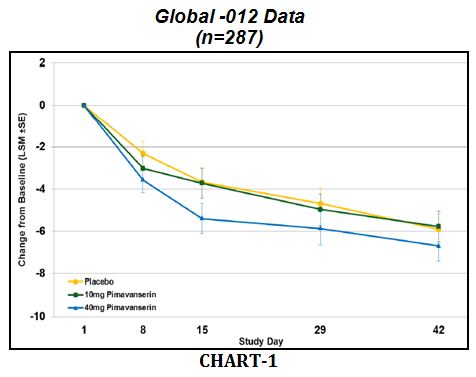

The charts below show the primary endpoint, mean reduction in Scale for the Assessment of Positive Symptoms (SAPS), for the global -012 data (CHART-1) vs. only those patients in the U.S. (CHART-2). We see that the data in the U.S. show a meaningful separation vs. placebo for the 40mg pimavanserin dose.

From this analysis, investors can now understand why management made the following changes for the ongoing third Phase 3 trial, Study-020:

1) Study-020 will take place only in the U.S.

2) Study-020 will test only the 40mg pimavanserin dose in a 1:1 randomization vs. placebo.

3) The treatment protocol will be standardized to conduct fewer patient visits to assess pimavanserin in a more traditional “real world” setting for the patient.

4) Study-020 has a two-week structured social lead-in period prior to randomization in order to pull initial placebo response prior to actual drug testing.

Management met with the U.S. FDA to discuss the SAPS primary endpoint. As it turns out, of the 20-item SAPS endpoint, only 9 of the items relate to Parkinson’s disease psychosis (delusions and hallucinations). The other 11 items are more applicable to schizophrenic or bipolar disorder patients. These 11 items had such a low baseline at the start of the -012 study that they masked the response in the other 9 items more applicable for how pimavanserin is designed to work in patients with PDP. The U.S. FDA agreed with management’s analysis on the SAPS, and allowed management to refine the SAPS endpoint to include only the 9 items that related to PDP disease for the -020 study.

5) Study-020 will analyze patients on only the 9-item SAPS endpoint.

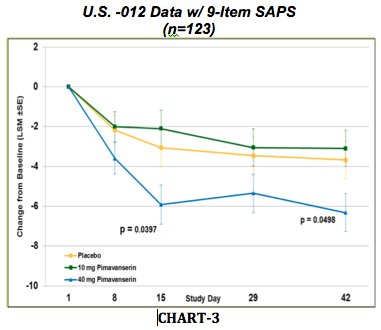

The chart below shows all U.S. -012 data analyzed with only the 9 items included in the SAPS primary endpoint which will be used in the -020 trial (CHART-3).

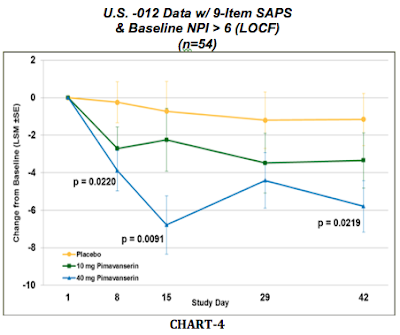

The final thing management did was look at the severity of patients with PDP enrolled in -012. What management found is that patients with severe PDP seems to respond better to pimavanserin treatment than patients with mild or moderate PDP. There were 54 U.S. patients in the -012 that qualified as having severe PDP based on the neuropsychiatric inventory (NPI) scale. Data from these 54 patients can be found in the final chart (CHART-4) below:

6) Study-020 will enroll only patients with severe PDP (NPI at baseline > 6)

Although, admittedly data-mining, Chart-4 above is the best representation of what to expect from the results of the third Phase 3 trial, Study-020. Chart-4 shows only U.S. patients analyzed with only the 9 items from SAPS that pertain to PDP. Results show a statistically significant separation from placebo at Day-15 (p=0.0091) and Day-42 (p=0.0219). If management can reproduce this data in the 200-patient -020 program with 40mg pimavanserin, the trial will be a success.

Worthy of a Redo

I am expecting enrollment to complete in the -020 study around the second quarter 2012. Data is expected early in the third quarter 2012. If positive, I expect management to look to move quickly into the fourth phase 3 trial, already dubbed -021. I expect this trial will be a mirror image to the -020 study if successful.

I also expect that positive results from the -020 program will open the door to a potential development and commercialization partnership around pimavanserin. I remind investors that pimavanserin offers potential in Alzheimer’s disease psychosis (ADP) and as an adjunct therapy for schizophrenia. The schizophrenia development plan is essentially phase 3 ready. Plans in ADP would be to conduct a phase 2 pilot study before progressing into the phase 3 trials. Management has noted before that it plans to seek a partner for pimavanserin. I think paramount to management is the belief from its potential partner that the drug has potential beyond PDP. Management at Acadia views pimavanserin as a “pipeline product”.

Acadia continues to conduct an open-label safety extension study (-015) that enrolled patients who completed either of two earlier Phase 3 PDP trials. Patients who complete the -020 study will also will have the opportunity to enroll in the -015 if the treating physician agrees the patient will benefit from continued treatment with pimavanserin. I believe this trial data will provide the necessary long-term data required by ICH guidelines for approval of a NCE in CNS indications. To date over 200 patients have been in the open-label extension study for over one year.

Conclusion

Acadia is currently trading with a market capitalization of $65 million ($1.28 / share). The company holds $36.2 million in cash and investments. This leaves a technology value for phase 3 pimavanserin, along with some early and mid-stage collaborations with Allergan and Meiji Seika, of around $30 million. Obviously the phase 3 trial will cost money to complete, but Acadia has this cash on hand to get into the middle of 2013. This makes the stock incredible cheap in my view. A phase 3 CNS asset for net $30 million in enterprise value! Additionally, I believe the drug works. The new trial design for -020 should prove that.

I believe ultimately that patience will be rewarded here.