Yes, investors, there are still millions of people who smoke cigarettes!

Bafflingly, despite all the science and meta-analyses, U.S. Surgeon General warnings and CDC case studies, the World Health Organization (WHO) estimates 5.6 trillion cigarettes were sold globally in 2014. Forty percent of these sales took place in Asia, where roughly two-thirds of the population smokes. Approximately one-third of all adult males around the globe smoke, and 10% of global mortality is directly attributable to smoking-relating diseases. According to Euromonitor International, the retail value of all cigarettes sold in 2014 totaled $744 billion. The U.S. remains the third largest cigarette market by dollar volume, behind China and Russia. Roughly 18% of Americans smoke and approximately 265 billion cigarettes were sold in the U.S. in 2014, generating $75 billion in retail sales. That is almost one-third the retail dollars spent on prescription drugs.

In light of this, the statement below by former U.S. Food and Drug Administration (FDA) commissioner, Dr. David Kessler, MD, JD, in June 2010, sums up the opportunity for 22nd Century Group. rather nicely:

“The FDA should quickly move to reduce nicotine levels in cigarettes to non-addictive levels. If we reduce the level of the stimulus, we reduce craving. It is the ultimate harm reduction strategy.”

Welcome to “The 22nd Century…”

22nd Century Group, Inc. (NYSE MKT: XXII) is a biopharmaceutical company founded in 1998 with proprietary technology in nicotine biosynthesis and tobacco plant-biotechnology. The company’s proprietary technology allows the company to increase or decrease levels of nicotine (and other nicotinic alkaloids) in the tobacco plant. More specifically, the company is engaged in the development of very low nicotine (VLN) tobacco, and produces a commercially-available cigarette called MAGIC® which yields approximately 95% less nicotine than other leading cigarettes previously marketed as “light” prior to The Family Smoking Prevention and Tobacco Control Act of 2009. The company also manufactures and commercializes an super-premium cigarette called Red Sun®, and provides contract manufacturing for other premium-brand cigarettes out of the company’s 61,000 square foot manufacturing facility in Mocksville, NC.

Beyond these commercially-available products, which I forecast to generate roughly $15 million in revenues in 2016, the company has publically announced that it will soon file an application with the U.S. FDA for a new VLN cigarette referred to as “Brand-A” that is expected to be the first U.S. FDA approved modified risk cigarette on the market. Recall, under the Tobacco Control Act of 2009, cigarettes are no longer allowed to be marketed as “light” or “ultra-light” or as having any reduced risk versus full flavor cigarettes without FDA approval. 22nd Century Group plans to file an application in December 2015 for Brand-A, which, if approved in 2016, will create a sizable competitive advantage for the company’s commercial marketing efforts. Another modified risk cigarette, “Brand-B”, is also under development. Unlike the VLN Brand-A cigarette designed to help people quit smoking, Brand-B is a low tar-to-nicotine ratio (TNR) cigarette designed to dramatically reduce the tar and smoke consumed by smokers, potentially reducing the risk of smoking-relating diseases, such as lung and esophageal cancers.

22nd Century Group is also working on a prescription-based cigarette, dubbed X-22, designed to help smokers quit smoking. The VLN tobacco cigarettes used in X-22 have shown efficacy helping smokers to quit smoking or to reduce the number of cigarettes smoked per day in numerous Phase 2 and Phase 3 independent clinical studies. The company is currently engaged in discussions with potential pharmaceutical partners to fund Phase 3 clinical trials using X-22. Once approved by the FDA, X-22 will compete against pharmaceutical products like Pfizer’s Chantix® (varenicline) or OTC nicotine replacement therapy (NRT) products (e.g. gums, patches, lozenges) in the $3 billion smoking-cessation market.

22nd Century Group already has an existing worldwide research and development licensing agreement in place with British American Tobacco, one of the four majors that dominate the global tobacco market, and a 5-year National Institute of Drug Abuse (NIDA) contract in place to provide its proprietary SPECTRUM® brand cigarettes for independent research of smoking cessation and behavioral studies. Management has also partnered with distributors to introduce its Red Sun® brand to retailers in the United States and its MAGIC® cigarettes into Europe, and is working to introduce its products in the Middle East, and China, the world’s largest cigarette market by far.

Proprietary Technology & Licensing

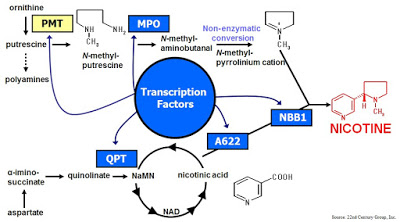

No biopharmaceutical company should be considered an attractive investment unless they have sound, proprietary technology that can not only be successfully defended, but monetized in the commercial market. At the center of the value-proposition for 22nd Century Group is an intellectual property portfolio consisting of more than 200 owned or controlled patents and more than 50 pending applications that relate to decreasing and increasing the expression of key genes and transcription factors responsible for the production of nicotine (and other alkaloids) in the tobacco plant and the tobacco and products produced therefrom. The figure below shows a model of the nicotine biosynthetic pathway and some of the important factors that control nicotine production around which 22nd Century Group has built its intellectual property portfolio.

Validation and importantly, monetization, of the company’s IP portfolio came in October 2013 when 22nd Century Group signed an exclusive worldwide research licensing agreement with British American Tobacco (BAT). BAT is one of the world’s largest producers and distributors of tobacco products, with operations in over 180 countries around the globe. BAT has a market capitalization of approximately $107 billion (NYSE:BTI), and the company posted £14 billion in revenues and £5.4 billion in profits in 2014.

Under terms of the agreement, 22nd Century Group granted BAT research rights to three of its patent families encompassing a cumulative 34 patents and patent applications in various countries and regions, along with an option to enter into a worldwide commercial license with 22nd Century in the future. Importantly, 22nd Century Group retained worldwide rights to the licensed technology and patents licensed to BAT for use worldwide by 22nd Century Group in its products and brands.

The research term of the BAT agreement is for a period of up to four years during which time 22nd Century and BAT will collaborate on research efforts to further develop the subject technology. Pursuant to the agreement, BAT can exercise its option to enter into a worldwide royalty-bearing commercial license at any time during the research term. If the option is exercised, a new licensing agreement would extend to at least the year 2028. In return for these rights, BAT paid 22nd Century Group an upfront payment of $7 million in October 2013, and agreed to pay an additional $7 million during the course of the research term upon the completion of certain development milestones.

The exciting opportunity for 22nd Century Group and its shareholders is not the existing research agreement. The $7 million upfront payment and $7 million in total potential milestones was a nice validation for the company and its technology, but the real upside for 22nd Century will come from the royalty-bearing commercial license, potentially to take place in 2016, and then the potential to sub-license the products co-developed with BAT in a 50/50 profit split. For example, if BAT were able to ramp a commercial product to $150 million in sales on a global basis (a measly 0.02% market share) then the annual royalties to 22nd Century Group could eclipse $20-25 million. Recall, BAT has annual revenues of £14 billion ($19 billion) on a global basis.

Sub-licensing the technology, potentially to another major player like Philip Morris, Reynolds America, Lorillard, Japan Tobacco, or Imperial Tobacco, could be a multi-hundred-million-dollar or even billion-dollar transaction. A commercial sub-license from BAT or 22nd Century to any third party can take place three years after the royalty-bearing commercial license is initiated, and 22nd Century Group and BAT will share profits equally from the transaction. That is clearly the potential exit strategy for 22nd Century Group shareholders, as the current market capitalization of only $85 million is a drop-in-the-bucket compared to what BAT could realize in profits by acquiring full ownership and control of 22nd Century’s technology.

Spectrum®, NIDA, and the New England Journal of Medicine

In August 2010, management from 22nd Century Group met with officials from the National Institute on Drug Abuse (NIDA), the U.S. FDA, the U.S. National Cancer Institute (NCI), the U.S. Centers for Disease Control and Prevention (CDC), and affiliates from RTI International to design “research cigarettes” with varying levels of nicotine, to be sold in the U.S. market so that the U.S. government can better understand smoking habits and addiction. Due to 22nd Century Group’s unique proprietary technology and ability to grow tobacco across a wide spectrum of nicotine levels, the company was chosen to be the provider of research cigarettes with varying levels of nicotine under this NIDA grant.

Approximately 22 million of 22nd Century’s SPECTRUM® brand cigarettes, in 24 styles with eight varying levels of nicotine, have been ordered to date. In September 2015, the company received a purchase order from NIDA for a new order of approximately 5.0 million SPECTRUM® research cigarettes that are expected to be shipped in December 2015. This will generate approximately $0.6 million in revenues to the company.

Since the initial sub-contract, 22nd Century Group has expanded its supply and distribution of SPECTRUM® brand cigarettes to NIDA. 22nd Century is also looking to sign up additional research agreements with accredited organizations interested in purchasing tobacco cigarettes with varying levels of nicotine in the future. The monopoly that 22nd Century has on the proprietary technology to significantly alter the nicotine content in tobacco means that 22nd Century is the sole source of such unique products.

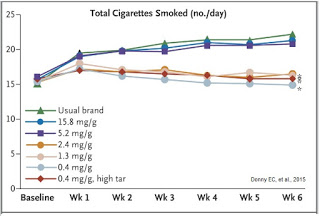

In October 2015, results from a randomized, double-blind, parallel-design trial using VLN SPECTRUM® brand cigarettes were published in The New England Journal of Medicine (NEJM). The 840 participant, six-week study (NCT01681875) took place between June 2013 and July 2014 at ten sites around the U.S. Eligibility criteria included adults smoking of five or more cigarettes per day, and no current interest in quitting smoking. Participants were randomly assigned to smoke for six weeks either their usual brand of cigarettes or one of six types of investigational SPECTRUM® cigarettes, provided free. The investigational cigarettes had nicotine content ranging from 15.8 mg per gram of tobacco (typical of commercial brands) to 0.4 mg per gram (VLN). The primary outcome was the number of cigarettes smoked per day during week six.

Results can be seen in the graph below. The data show cigarettes with lower nicotine content, as compared with control cigarettes, reduced exposure to and dependence on nicotine, as well as reducing cravings during abstinence from smoking, without significantly increasing the expired carbon monoxide level or total puff volume, suggesting minimal compensation increase when exposed to VLN cigarettes. Additional data show participants who were assigned VLN cigarettes smoked fewer cigarettes per day (14.9) than those assigned to their usual brand (22.2), and that smokers of VLN cigarettes doubled their quit attempts versus smokers of conventional cigarettes over the course of the study.

The study’s lead author, Dr. Eric Donny, explained in an article posted on usatoday.com, “The evidence is getting stronger that reducing nicotine reduces smoking and makes people less addicted to cigarettes and, in doing so, might make them more likely to quit.” Just as important to smokers is the fact that The New England Journal of Medicine articles reflected that smokers had negligible nicotine withdrawal symptoms when using the VLN cigarettes from 22nd Century.

X-22 – The Prescription Cigarette

Management at 22nd Century Group is positioning X-22 to be the world’s first prescription-brand cigarette. The data noted above with SPECTRUM® certainly suggests that the concept of a VLN cigarette is helpful in reducing cravings for cigarettes, which can result in fewer cigarettes smoked per day and a greater chance of quitting. X-22 smokes, tastes, smells, and looks like a regular cigarette, but contains 95% less nicotine than commercial “light” or “ultra-light” cigarettes. This is important in helping potential quitters reduce cravings for nicotine while maintaining smoking behavior, something that nicotine lozenges or going “cold turkey” often fail at. Studies show that providing greater relief from withdrawal symptoms and reducing nicotine dependence is paramount in helping individuals quit smoking, and X-22 is designed to aid in that process without the added side-effects of a drug like Pfizer’s Chantix®, which carries a FDA black box warning for serious neuropsychiatric events, including suicidal ideation, and increased risk of harmful cardiovascular events. X-22 should be more attractive to an active smoker than NRT products like gums, lozenges, or even e-cigarettes from an efficacy and behavioral standpoint.

Including the study published above in the NEJM, I have found six additional independent clinical studies that demonstrated efficacy and improved smoking cessation with 22nd Century’s proprietary VLN cigarettes. I will share this data with investors in the near future. 22nd Century Group is currently seeking a development partner to move X-22 into a Phase 3 clinical study designed to support U.S. FDA approval as a prescription-based smoking cessation product.

Red Sun® & MAGIC®

Although the company’s licensing and clinical research efforts are certainly exciting and represent tremendous upside to the company, 22nd Century Group also has retail and manufacturing operations that are generating meaningful revenues today. Revenues during the first nine months of 2015 totaled $5.6 million, and were derived through a combination of sale of products and contract manufacturing. Financial results for the three previous quarters have exceeded Street expectations, and forecasts for 2016 have doubled over the past year.

The two key products on the market are Red Sun®, a super-premium brand that contains roughly twice the amount of nicotine per cigarette versus leading premium brand cigarettes and MAGIC®, a very low nicotine (VLN) cigarette that contains roughly 95% less nicotine per cigarette versus commercially available brands. On the cusp, these two products seem to offer conflicting strategies; however, there is clear rationale for both, and both fit into 22nd Century’s core mission: Reduce the Harm Caused by Smoking. I believe each of these products serve to accomplish this goal.

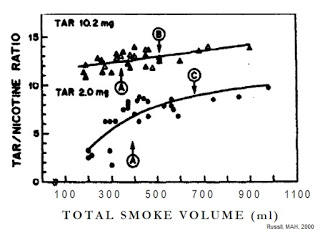

The majority of mass-produced commercially available cigarettes in the U.S. (e.g. Marlboro®, Newport®, Salem®, Basic®, Camel®, etc…) yield 12 to 15 mg of tar per cigarette, while delivering only 1.0 to 1.2 mg of nicotine. That equates to a tar-to-nicotine ratio (TNR) of between 12 and 14 on average. Brand B is being developed to deliver a TNR of around 7 – about half that of other brands. This would allow smokers to inhale a satisfactory amount of nicotine per cigarette while inhaling less “tar” and carbon monoxide. Nicotine is the reason why most smokers smoke, while tar and smoke, and other toxic agents found in cigarettes, is what causes cancer and other smoking-related diseases. The company believes smokers who desire to reduce smoke exposure but are less concerned about nicotine will find Brand B beneficial. An interesting aside, though not stated on the company’s website, I believe 22nd Century Group’s Red Sun® brand is very similar to its Brand B cigarettes.

Studies show that if you increase the amount of nicotine delivered per cigarette, smokers will actually smoke fewer cigarettes per day. For example, work done by Armitage AK, et al, 1988 concluded that smokers generally seek and maintain a consistent level of nicotine per day, suggesting that if you double the amount of nicotine per cigarette, the number of cigarettes smoked per day drops by 50%, greatly reducing intake of tar and carbon monoxide. Fagerström KO, 1982 published results from a small study with 12 subjects smoking cigarettes yielding varying concentrations of tar, carbon monoxide, and nicotine, finding that nicotine-enriched cigarettes yielded the lowest levels of tar and carbon monoxide. The author concluded that a cigarette with low tar and carbon monoxide, but medium to high nicotine yield, would seem to produce less hazardous effects to smokers.

The American Public Health Organization in 2000 studied the idea of varying tar and nicotine ratios in cigarettes as a way to potentially reduce the harmful effects of smoking. The author, Michael A.H. Russell, FRCP, FRC Psych, concluded that increasing pure nicotine levels per cigarette is a “brilliant idea” and “works well in rats” to reduce intake of tar, carbon monoxide, and other toxic components from smoking, but the author expressed concern that human behavior could result in non-linear outcomes. This is completely understandable, as depicted in the figure below from the report, but I would contend that any reduction in these harmful byproducts offers potential utility to the average smoker.

The strategy for MAGIC® has already been eloquently conveyed by former U.S. FDA commissioner, Dr. David Kessler, when he stated in June 2010 that reducing cravings through lower nicotine levels is the best path forward for individuals seeking to quit smoking. MAGIC® offers approximately 95% less nicotine per cigarette than the commercially available brands, and numerous independent clinical studies, headlined by the NEJM paper discussed above, note that if you reduce nicotine addiction, the urge to smoke wains over time. As noted above, I plan to cover the concept for MAGIC® and X-22 in greater detail in my next article.

However, it is important for investors to understand, Red Sun® and MAGIC® are targeting two different markets. Red Sun® is for the super-premium brand smoker who is not looking to quit, but would still like to reduce risk. MAGIC® is for the smoker who wants a cigarette with very low nicotine and who may be looking to quit, but going “cold turkey” is simply not a viable option.

The roll-out of Red Sun® in the U.S. is progressing nicely, with the product being distributed in approximately 600 retail outlets around the country. 22nd Century Group has a contract manufacturing agreement with Smoker Friendly, a retail chain of premium tobacco outlets with more than 800 locations around the U.S. 22nd Century Group is manufacturing Smoker Friendly’s private label brand cigarettes (SF) out of its 61,000 square foot facility in North Carolina. Smoker Friendly is also distributing Red Sun® in its corporate smoke shop retail outlets. For MAGIC®, 22nd Century is partnering with distributors in Europe, with the rollout across Europe expected to gain steam in 2016.

One of the primary reasons for my confidence that the rollout of Red Sun® and MAGIC® will continue to gain steam in the coming years is because of the management team at 22nd Century. The current CEO at 22nd Century, Henry Sicignano, previously served as the Vice President and Marketing Director at Santa Fe Natural Tobacco, maker of the American Spirit brand, from 1997-2002. Mr. Sicignano helped grow Santa Fe annual revenue from $30 million to $145 million before the company was acquired by R.J. Reynolds for $356 million in July 2002. The marketing message of American Spirt was “all natural” and “100% additive-free” tobacco.

I liken the ramp up of the American Spirt brand in the late-1990s to the “organic” food craze of the past decade or the current “craft beer” craze of today. It points to the fact that despite all the evidence and awareness that cigarettes are harmful and cause serious diseases such as cancer, smokers are very aware of these issues and are looking to reduce the risks as much as possible, often through premium or super-premium brands. At one point, “light” and “ultra-light” cigarettes controlled 83.5% of the market prior to the banning of these terms in 2009 (source: NCI, 2007). As noted above, a brand with approximately $150 million in global sales still only controls 0.02% of the market. This type of penetration is achievable with Red Sun® and MAGIC® in my opinion, in only a few years.

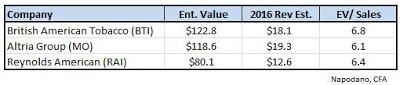

For 2016, I forecast 22nd Century Group will post revenues of approximately $15 million. The major players in the market all trade with an enterprise value approximately 6-7x projected sales. Applying a multiple of 6.5x projected sales to our forecast pegs the fair-valuation of 22nd Century Group at roughly $100 million in value, suggesting the current enterprise value of only $80 million is both undervalued from a commercial standpoint and factoring in no upside from the potential clinical or royalty-bearing commercial license or sub-licensing opportunity. If management at 22nd Century Group were to grow the current commercial operations to $150 million in annual sales (about the size of the American Spirt brand before R.J. Reynolds took it over) then 22nd Century Group could be worth ten-times what the stock is traded at today.

Modified Risk Cigarettes

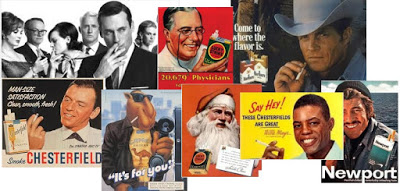

Branding, marketing, and advertising have changed dramatically for cigarettes over the past few decades. As anyone who watches Mad Men on AMC knows, smoking went from being “cool” in the 60s to almost universally shunned today. As consumer perception of smoking has changed, so has the ability of cigarette manufacturers to market and promote their products. Gone are ads promoting cigarettes like the ones below that feature the products as a cool lifestyle, or with well-known cartoon characters or celebrity endorsers.

Almost all tobacco marketing practices ceased following the tobacco Master Settlement Agreement (MSA) of 1998. The agreement was entered into at the time by the country’s four major players, Philip Morris, R.J. Reynolds, Brown & Williamson, and Lorillard, and the attorneys general of 46 states. The MSA settled Medicare lawsuits targeting these major firms by the states, banned almost all commercial advertising of tobacco products, seeded anti-smoking advocacy groups, and funded education and awareness for smoking-related diseases. In 2009, the U.S. Congress passed The Family Smoking Prevention and Tobacco Control Act, which gave the U.S. FDA broad authority to regulate the manufacture, distribution, and marketing of tobacco products in the U.S. That is when additional restrictions on advertising and promotion came into play for the industry, and the U.S. FDA took over review of “modified risk” language on product labels to prevent potentially misleading claims.

Since the Tobacco Control Act of 2009, tobacco cigarette products can no longer use terms like “light,” “ultra-light,” “low tar,” or “all-natural.” To gain approval for these types of claims, tobacco manufacturers must file applications with the U.S. FDA for review. The application must contain clinical data supporting the modified risk claim.

In March 2012, the U.S. FDA issued Modified Risk Tobacco Product Applications Draft Guidance. The draft guidance provides details for those who seek to market a tobacco product as modified or lower risk including how to organize and submit an application, what scientific studies and analyses should be submitted, and what information should be collected through post-market surveillance and studies. 22nd Century Group is in the process right now of filing an application with the U.S. FDA for Brand A, and is expected to be the first tobacco manufacturer to obtain a modified risk claim for its commercially available VLN cigarettes in the U.S.

Brand A is a VLN tobacco cigarette. Management has not said what exactly the difference is between MAGIC®, Brand-A, and X-22, but we suspect that the products are similar in nature and vary potentially by nicotine concentration. Nevertheless, if the market for a product like MAGIC® is $150 million based on the success of the American Spirt brand, then Brand A, enhanced by the potential of being the only U.S. FDA-approved modified risk cigarette on the market has sales potential many multiple of that.

For example, according to research done by JP Morgan, 90% of smokers would be willing to try a new brand if it were “safer” than their usual brand. Recall, “light” cigarettes had 83.5% of the market prior to 2009. Roughly 45 million American’s smoke and the retail sales of cigarettes in the U.S. was approximately $75 billion in 2014. A product that appeals to 90% of the market is potentially a very big product. 22nd Century is working on a second modified risk cigarette, Brand-B, (which is a low tar-to-nicotine cigarette) that I believe is similar to the Red Sun® brand. This application is likely 12 to 18 months behind the application for Brand-A.

Conclusion

I would venture to guess the majority of biotech and specialty pharmaceutical investors are not looking at the tobacco or cigarette market. I’ve personally shied away from medical marijuana stocks because most are not financially sound investments and do not have sustainable competitive advantages that make them interesting long-term secular plays. 22nd Century Group, on the other hand, has many of the key attributes I look for in a quality investment.

– As of the end of September 2015, the company had $6.7 million in cash on the books. I project this is enough to sustain operations until the middle of 2016. I typically like to look for at least twelve months of cash on the books, so 22nd Century Group does fall short in this category. The company does have some warrants that will expire in January 2016 that could provide some additional cash, but it is likely that the company will need to raise additional cash in 2016. The best potential source for non-dilutive capital is to secure a development partnership for X-22 or to strike a distribution agreement with a major player in the industry once Brand-A receives clearance from the U.S. FDA on its modified risk label.

– The biggest catalysts for the stock include: 1) filing and hearing back from the U.S. FDA on the modified risk label for Brand-A, 2) finding a commercial and development partnership for Brand-A, Brand-B, or X-22, and 3) continuing to ramp sales of Red Sun®, MAGIC®, and SPECTRUM®.

– The U.S. tobacco market is an estimated $75 billion in size. I find management to be highly credible, having a proven track record in launching and growing premium tobacco brands, and believe that a company with an enterprise value only $80 million targeting a potential market of $75 billion with a product 90% of consumers have stated they are interested in, is certainly interesting. Beyond the commercial brands, the $3 billion global smoking cessation market is wide open, as evidenced by the initial surge in sales of Pfizer’s Chantix®, only to drop significantly after the U.S. FDA mandated a “black box warning” due to multiple adverse events related to the controversial drug. Considering the collapsing e-cigarette market and smokers’ general lack of interest in nicotine replacement products like gums, patches, and lozenges, 22nd Century’s proprietary technology seems to hit all the key points, including safety, behavior, cost, and efficacy. In this regard, X-22 and could be a major success in the right hands.

22nd Century Group may not be the traditional type of investment that biotech and specialty pharmaceutical investors are looking for, but in the midst of the recent political pressure on the industry with respect to pricing and the clear burst of the biotech-bubble inflated by overly exuberant expectations, a small commercial organization, even in the sin-sector of cigarettes, provides interesting diversification. I see tremendous upside in the stock based on the commercial success of existing products, labeling advantages for potential new products, an interesting pipeline opportunity in the prescription market, and licensing and contract manufacturing opportunities. At $1.21 per share, I think 22nd Century Group warrants further investigation.