Shares of Matinas Biopharma Holdings Inc. (MTNB) have performed extremely well over the past few months, up a whopping 365% since September 1, 2016. That kind of impressive move is representative of why investors are attracted to small-cap biopharma stocks. The right call can make you a lot of money in just a short period of time.

That being said, I think the run for Matinas has just started and there is plenty of upside still left in the stock. But I wanted to do a quick article for investors on why I think Matinas has done so well over the past few months and how investors can learn from this move and potentially find other small-cap biopharma stocks that may make a similar move in the future. It starts with my 5 C’s of Biotech Investing™ and Matinas represents an excellent case study for investors in how to apply this technique as a screening tool to find future winners.

What Are BioNap’s 5 C’s?

A few years ago, I came up with what I think are five important characteristics that small-cap biopharma names must possess in order to see the stock price perform well. My 5 C’s are Cash, Catalysts, Charisma, Capital Structure, and Credibility.

Each of the 5 C’s is scored on a five-point scale, with one star (★) essentially equating to an “F” and five stars (★★★★★) essentially equating to an “A” on the standard academic grading scale. The C’s are not scored independently either. Low scores in cash and capital structure likely negatively impact credibility. Low cash might also negatively impact catalysts, whereas a company with high credibility and a clean capital structure may score better in charisma or in my analysis of their future financing capabilities.

I designed the 5 C’s as a screening tool for names prior to delving into the science or the nitty-gritty of clinical protocols and regulatory logistics. I noticed that small-cap biopharma stocks with these five characteristics were often “unencumbered” to move higher if the science proved legitimate and management executed well. Those last two points are important for investors to understand. My 5 C’s are a screening tool, not a recipe. Management still has to execute and the drug still has to work independently of possessing these important gating factors.

Matinas – A Case Study In The 5 C’s

Let’s look specifically at Matinas back in August 2016, prior to the run that started in September. On August 15, 2016, management filed SEC Form 10Q for the three and six month period ending June 30, 2016. The company reported a cash position of $0.6 million and negative working capital of $0.7 million. Operating burn during the first six months of the year averaged $0.4 million per month and it was obvious a financing was imminent.

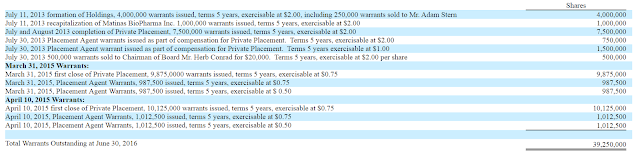

Cash at this point probably scored only one star (★) and the capital structure was messy. There were 57.6 million basic shares outstanding in August 2016, with another 47.5 million potentially dilutive securities not included in that number. Outstanding stock warrants totaled 39.3 million! A summary of equity warrants outstanding as of June 30, 2016, is presented below, all of which are fully vested.

With Matinas stock trading at $0.70 in August 2016, these warrants exercisable at prices ranging from $0.50 to $2.00 were a black eye on the capital structure. Luckily, Matinas had no debt and no ugly convertible instruments, so I’d score the capital structure at two stars (★★) in August 2016. Matinas also had no active clinical programs in August 2016, so catalysts were also severely lacking. Programs were expected to begin shortly, but it still only looked like one star (★).

Perhaps the two best things Matinas had going for it back in August 2016 was a very capable management team and a novel drug-delivery platform that truly looked like it was something investors could get behind. Having placed MAT-9001 on the back-burner and seeing a stock price that had done very little the previous 24 months, I’d say management credibility was lacking a bit, perhaps two stars (★★); however, over the next several months, management would build significant credibility with investors.

For example, in June 2016, Matinas presented preclinical data on MAT2501 at ASM/ICAAC via an abstract and poster presentation entitled “Oral Encochleated Amikacin Demonstrates Reduced Toxicity Compared to Intravenous Amikacin in Rats.” The company followed with another presentation of preclinical data on MAT2203 at the AIDS-Associated Mycosis Meeting in July 2016. The poster on MAT2203 demonstrated impressive efficacy in serious fungal infections. Importantly, management made (and continues to make) these posters available for investors on the company’s website. Finally, in September 2016, Matinas received its third QIDP designation and Fast Track status on MAT2203. The credibility of the story was starting to increase (+★).

Next, management addressed the cash issue. In September 2016, the company raised $8.0 million through the sale of Series A Preferred Shares. It was a relatively clean transaction with no ugly features to anger existing or new shareholders. While certainly not an enormous amount of money, it was enough to raise the cash level by two stars (+★★). Later that same month, the clinical program began with the initiation of an NIH-sponsored Phase 2a study examining MAT2203 as a treatment for mucocutaneous candidiasis infections. Investors could finally see the first major catalysts coming with the data in the first half of 2017. That’s another star (+★).

By the end of September, simply by addressing two major issues, the shares soared by 150%. Things were not perfect, but they were clearly getting better! Subsequently, in October 2016, Matinas was awarded an important U.S. Patent for the novel cochleate technology. A few days later, management was back at IDWeek 2016 presenting more impressive preclinical data on the platform showing utility in a murine model of influenza. More credibility, and importantly, charisma is now also on the rise (+★). The stock hit $2.00 per share by the middle of October 2016.

Management gave us another important catalyst in November 2016 with the initiation of a second Phase 2 study with MAT2203, this time in vulvovaginal candidiasis (VVC). Similar to the smaller NIH study, data were also expected during the first half of 2017. In December 2016, the clinical program with MAT2501 began with the initiation of a Phase 1 study in subjects with nontuberculous mycobacterium infections (NTM). Again, data are expected during the first half of 2017. Credibility received another boost shortly after this initiation when the Cystic Fibrosis Foundation Therapeutics awarded Matinas a contract for the development of MAT2501 in preclinical CF models.

Are you seeing a pattern yet? In August 2016 Matinas had virtually no clinical catalysts on the horizon. Four months later, we are now presented with the opportunity to invest ahead of three proof-of-concept read-outs coming in the first half of 2017. Catalysts went from one star to four stars (+★★★), cash went up two stars (+★★) and credibility followed with another two stars (+★★).

The final piece of the puzzle came in January 2017 when the company successfully completed a warrant tender, pulling in $13.5 million gross proceeds and eliminating 31.0 million warrants (84% of the outstanding warrants noted above). Wow! What a fantastic transaction that added one star (+★) to cash, two stars to capital structure (+★★), and further strengthened management’s credibility. The transaction also freed investors to invest in the stock ahead of the pending data read-outs with MAT2203 and MAT2501 without fear of imminent dilution from another financing.

In the next few months, I expect the company to seek an uplist to a major exchange, initiate a third clinical program with MAT2203, and report data from the three ongoing clinical programs. Both MAT2203 and MAT2501 target enormous commercial opportunities with clear unmet medical need. Charisma is on the rise (★★★★)!

With the 5 C’s now telling investors to pay attention, a more thorough analysis of the story is warranted.

Read more about MAT2203 here >> LINK

Read more about MAT2501 here >> LINK

Conclusion

Matinas Biopharma represents an interesting case study into how applying my 5 C’s can help identify potential winners in the small-cap biopharma market. Back in August 2016, Matinas likely scored only eight total stars on the cumulative scale of five (lowest) to 25 (highest). That equated to an only 1.6-star average – not very good! Would you buy a product on Amazon.com that scored only 1.6 stars? However, as of today, I’d score the company at 21 stars (4.2 average). That’s an incredible move!

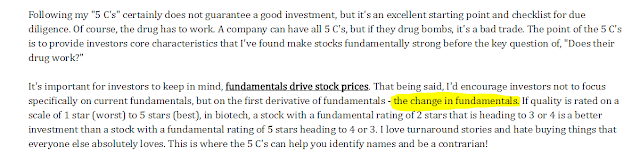

In my My 5 C’s article I tell investors that “fundamentals drive stock price”, but that fundamentals should not be analyzed in a vacuum. It’s more important to focus on the change in fundamentals – that is, the direction the fundamentals are going! My 5 C’s might not pick the exact bottom in the stock, but as soon as the 5 C score started moving higher in September 2016, the stock followed. Matinas is an excellent example of a company whose fundamentals made a dramatic turn to the positive over the past six months and shareholders have been rewarded with a +350% return in stock price as a result.

Stay tuned for important news on how I intend to apply these 5 C’s to more small-cap biopharma names in the future!