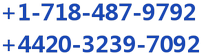

Earlier this week, InVivo Therapeutics (NASDAQ: NVIV) announced that the sixth-implanted patient in the INSPIRE clinical study improved from complete AIS-A spinal cord injury to an incomplete AIS-B spinal cord injury. This is the fourth patient to show improvement from the INSPIRE trial, equating to two-thirds of the first six patients enrolled in the study. It is clearly fantastic news for InVivo, especially following news last week that the eight-implanted patient died just two days after the procedure.

On Patient #8: InVivo’s press release on April 19th noted that the implantation of the eight Neuro-Spinal Scaffolding (NSS) took place on April 12, 2016, approximately 71 hours after a severe motor vehicle accident. The patient died approximately two days later, apparently succumbing to injuries from the accident. Dr. Travis Dumont, M.D., Director of the Neurovascular Program and Principal Investigator at Banner University Medical Center in Tucson, Arizona, believes the death to be unrelated to the implantation of the NSS device. Nevertheless, the Data Safety Monitoring Board (DSMD) and U.S. FDA will review the incident.

Enrollment in INSPIRE remains open at this time. I’m not terribly concerned with the death of patient #8. While tragic, it sounds like InVivo’s device did not have anything to do with the death of the patient. At one point, Dr. Dumont believed the patient healthy and stable enough for the device implantation, so what transpired between implantation and the death will likely come out at a later date. In the meantime, at least enrollment is moving forward – slowly, but moving forward.

On Patient #6: On February 23, 2016, InVivo announced the sixth device implantation took place at Barnes-Jewish Hospital at Washington University Medical Center in St. Louis, Missouri. The implantation took place only 10 hours post injury. Earlier this week, InVivo announced this patient has converted to AIS B, almost exactly two months later.

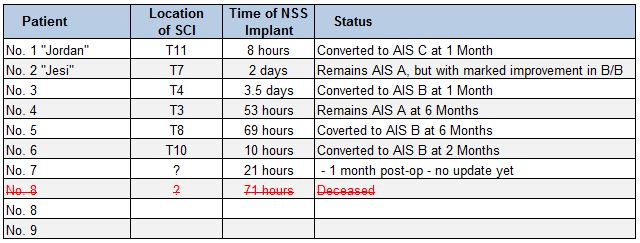

This is obviously fantastic news for InVivo. Patient improvement has now been documented in four of the first six patients (67%), far exceeding the 25% hurdle rate set by the U.S. FDA as the objective performance criteria (OPC) to define success of the INSPIRE trial. Quite simply, they’re absolutely crushing it. We do not know yet the status of the seventh patient. The NSS implantation was announced just over a month ago on March 24, 2016. To date, there seems no discernable pattern in patient recovery vs. time to NSS implantation or location of the injury (see below).

Perhaps as the number of patients enrolled in the INSPIRE trial increases, management and investigators will get a better sense of the ideal patient and how to best select patients for future studies. Nevertheless, with a conversation rate of 67%, it’s hard to argue that they are not already doing a fantastic job. And on a side note, I dare you to go tell Jesi she isn’t making progress! There is far more to patient improvement than simply a rating on the ASIA Impairment Scale. Jesi’s scores on other secondary measures have shown improvement.

Based on historical benchmarks for AIS conversion rates (see below), InVivo needs only one of the remaining 13 patients still left to enroll in INSPIRE to meet the FDA’s OPC. Should the current pace continue, it is likely that INSPIRE becomes a foregone conclusion before the trial even hits 50% enrollment. And keep in mind, the OPC is looking at the percent of patients that convert at six months post-implantation, so there is still plenty of time for the seventh patient to convert.

The current 67% conversion rate is based on reported patients per protocol. Even on an intent-to-treat basis, which includes the now deceased eighth patient, InVivo is still far ahead of the hurdle rate. My guess is that if the conversion rate for InVivo’s NSS in INSPIRE remains above 50% after the tenth patient passes six-month post-implantation, InVivo may approach the U.S. FDA about filing the Humanitarian Device Exemption (HDE) early.

The agency has already agreed to a modular submission and review process for the NSS. This is essentially “Fast Track” and “Priority Review” for drugs and biologics. InVivo could file for approval of the HDE early and gain accelerated approval under the agreement that enrollment in INSPIRE will continue until at least 20 patients have been enrolled.

Enrollment remains a key issue for investors. Management guidance is to, “Approach full enrollment by the end of this year.” I think far too much focus from investors has been placed on the pace of enrollment and not enough on the outstanding results demonstrated to date. Focusing on the pace is losing sight of the fact that InVivo’s NSS has the potential to become the new standard of care for AIS-A spinal cord injury.

Full enrollment will happen; whether it is in six months or twelve months is irrelevant. The market is there. I believe enrollment is slowed by the stringent entry criteria for the study and a management team that is being diligent and conscientious on site selection. Implantation of the NSS is cutting edge neurosurgery. There is far more involved than simply popping a pill. Plus, InVivo has plenty of cash thanks to a recent $32 million public offering. There’s no reason to rush.

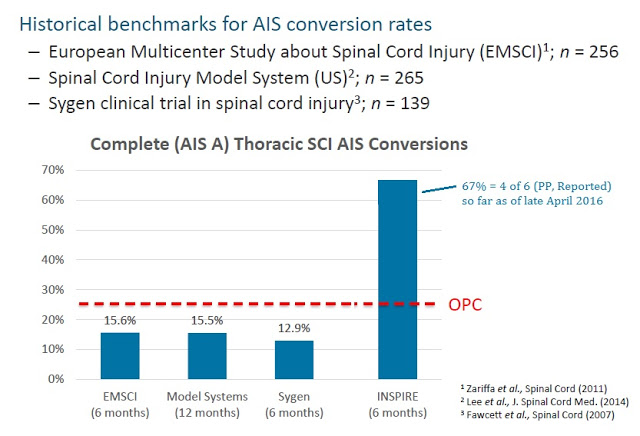

I think investors need to stop worrying about when full enrollment will take place and start focusing on how big NSS will be once approved. In this regard, I have built a discounted cash flow model that predicts peak sales of the NSS device alone (no stem cells or bioengineered version 2.0) at roughly $1.2 billion in 2026. Concomitant use of neural stem cells, something we all know InVivo is working on, has the potential to vastly increase the size of the market, potentially opening up an opportunity in non-acute injuries, a market that is roughly 100x the size of the population eligible for the INSPIRE trial. Keep that figure in mind when worrying about the pace of enrollment.

My model is below for investors to see. It is fairly straightforward, so I’ll save the verbiage and simply just present the model for peer-review. I see fair value today at $21 per share.

I’m happy to take questions in the comments below!