Last week, the American Society of Hematology (ASH) released abstracts for the upcoming 58th Annual Meeting & Exposition to be held December 3-6, 2016 in San Diego, CA. Included as part of the release was abstract #4050 from Actinium Pharmaceuticals, Inc. (NYSEMKT: ATNM). The abstract highlights the company’s Phase 1 clinical results with Actimab-A for the treatment of Acute Myeloid Leukemia (AML). Below is a review of that abstract and a quick comparison to an abstract by Seattle Genetics and its similar CD33 targeting candidate.

The Actimab-A Story

At ASH, Actinium Pharma will present a detailed analysis of the company’s recently completed Phase 1 clinical trial with Actimab-A. Recall, Actimab-A is the CD33 targeting monoclonal antibody, lintuzumab, linked to the short-ranged (50-80 µm), high-energy (~100 keV/µm) α particle-emitting isotope, Actinium-225. CD33 is a cell surface antigen expressed in approximately 90% of AML, representing a promising target of therapy regardless of genetic or mutational heterogeneity.

The concept of Actimab-A holds significant scientific merit. We know CD33 is a validated target by the approval of gemtuzumab at Pfizer and the advancement of vadastuximab into Phase 3 trials at Seattle Genetics. Lintuzumab by itself has proven to be ineffective; but, linked to the radioactive isotope Ac-225, Actimab-A should see a powerful increase in cancer cell-killing effect.

The necessity for Actimab-A is significant. Elderly patients with previously untreated AML are often not candidates for standard induction therapy (i.e. continuous infusion cytarabine for 7 days and an anthracycline for 3 days “7+3”) due to antecedent hematologic disorder, poor-risk cytogenetic or molecular features, and significant comorbidities such as patients with congestive heart failure, coronary artery disease, ischemia, and hypertension). Anthracycline has been associated with significant cardiotoxicity. Actimab-A represents an effective way to induce remission without the risk of major treatment-related adverse events. Previous Phase 1 data (Jurcic et al., 2011) in a relapsed / refractory AML population show a single infusion to be safe at doses ≤ 3 µCi/kg.

The market opportunity is significant. Approximately two-thirds of the AML population is over the age of 60 years old and half of these patients are not eligible for the current standard of care due to anthracycline toxicities with contaminant medications, comorbidities, and/or physician expectations on the patient’s ability to tolerate 7+3 induction. In December 2014, Actimab-A was granted Orphan Drug status by the U.S. FDA. I estimate the patient population in the U.S. is approximately 6,500 individuals. The opportunity in Europe is another 7,500. Assuming a cost of approximately $65,000 per treatment in the U.S. and Japan and $42,500 in the EU (management guidance), the peak opportunity is easily $750 million. With 33% market share, Actimab-A looks to have sales in the $250 million range.

The trial was done well. Actinium enrolled 18 patients (median age: 77 years, with a range between 68 and 87). Enrollment took place at Baylor University Medical Center, Columbia University Medical Center, Fred Hutchinson Cancer Research Center, John’s Hopkins School of Medicine, Memorial Sloan Kettering Cancer Center, and the University of Pennsylvania Medical School.

Twelve (67%) patients had prior myelodysplastic syndrome (MDS), for which 10 (83%) received treatment with hypomethylating agents (n=9) or allogeneic hematopoietic cell transplantation (n=1). One patient (6%) had chronic myeloid leukemia in molecular remission prior to developing AML. Eleven patients (61%) had intermediate-risk and 7 (39%) had poor-risk factors designed by the NCCN criteria.

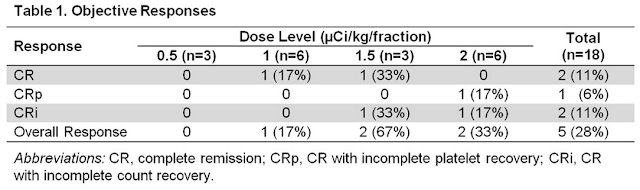

Four doses were tested, 0.5 (n=3), 1 (n=6), 1.5 (n=3), or 2 (n=6) μCi/kg/fraction. Although two patients experienced dose-limiting toxicities (grade 4 thrombocytopenia with marrow aplasia for > 6 weeks following therapy), one each in the 1 and 2 µCi/kg cohorts, investigators felt that the maximum tolerated dose (MTD) was not reached. The 30- and 60-day mortality rates were 0% and 17%, respectively. Importantly, Actinium will move forward with the 2 µCi/kg dose for the recently initiated Phase 2 trial.

The data look very good. Eleven of 14 patients (79%) evaluated after Cycle 1 had bone marrow blast reductions (mean reduction, 66%; range, 19-100%). Objective responses (2 CR, 1 CRp, 2 CRi) were seen in five of the 18 patients (28%), but only at doses ≥ 1 µCi/kg (Table 1). At the 2 µCi/kg dose, the CR rate was 50%. All responses occurred after one cycle of therapy, in contrast to historical data with LDAC alone, where the median time to response was three cycles. Median progression-free survival (PFS) for all patients was 2.7 months (range, 1.0-31.8+ months). Median overall survival (OS) was 5.6 months (range, 1.6-32+ months). Median response duration was 5.6 months (range, 4.9-32+ months).

The Upshot

The Upshot

The Phase 1 data compare very well to other experimental AML therapies. For reference, investors can take a look at the Phase 1 data (ASH abstract #590) from Seattle Genetics Phase 3 drug, vadastuximab talirine (CD33A). The Phase 1 trial was a similar dose-escalating study in newly diagnosed, elderly patients (median age: 74 years, with a range between 67 and 89) with AML deemed ineligible for standard 7+3 induction. The 30- and 60-day mortality rates were 0% and 15%, respectively. Of the 26 evaluable patients, 6 patients (23%) achieved a best clinical response of CR, 8 (31%) achieved CRi, and 5 patients (19%) achieved a morphologic leukemia-free state. Most remissions were achieved after 1 cycle.

As noted above, for the 2 µCi/kg dose, the response rate to Actimab-A was 50%. Besides finding the correct dose, an important discovery was made. Peripheral blood blast counts were a strong predictor of response. Among 38 patients treated in the two Phase 1 trials, responses were seen in 8 of 19 patients (42%) with blast counts < 200/µL, compared with 0 of 17 patients with blast counts ≥ 200/µL (P=0.002). This difference is likely due to decreased marrow targeting in patients with higher circulating blast counts when the subsaturating antibody doses used in this trial are given.

Conclusion

Actinium now has a validated safe and effective treatment for elderly patients with newly-diagnosed AML progressing in a Phase 2 clinical study. Importantly, the Phase 1 data shows that at 2 µCi/kg, the CR rate was 50%. This is the dose for the recently initiated Phase 2 trial. Also, the odds of success increase dramatically if the patient has a peripheral blood blast count < 200/µL. As such, the Phase 2 protocol calls for all patients to be pre-treated with hydroxyurea to reduce peripheral blast count. As noted above, all CR’s seen to date have been in patients with low peripheral blast burden.

Actinium plans to release the initial PB burden data from the ongoing Phase 2 program in early December 2016 (likely via press release during ASH). An interim report from the Phase 2 trial is expected around the middle of 2017. Full data is expected during the second half of 2017. I’m optimistic about the outcome of this program.

One final point worth noting – many investors have asked me about the potential for Actinium to partner Actimab-A. I’ve even sensed some frustration from shareholders that a deal has not been signed yet. Investors should keep in mind, Actinium has $25 million in cash on hand; and, while I certainly think Actimab-A is a partnerable drug, it made little sense for Actinium to enter into a transaction prior to the initiation of the Phase 2 trial. The economics just did not make sense so close to important proof-of-concept data.

However, with the Phase 2 trial now underway it likely does make sense to strike a deal in 2017. I’ll also note that any pharmaceutical company interested in the AML (or broader leukemia) space will have a business development presence at ASH. Actinium will be at ASH. Actinium will also be in San Francisco early 2017 for the JP Morgan / Biotech Showcase events – along with the rest of the biopharma world (including yours truly). These seem like very logical venues to advance partnership discussions.