On Monday, February 8, 2016, at the BioCEO conference, Immune Pharmaceuticals Inc. (IMNP) made available a new investor presentation for shareholders that lays out the company’s key goals for 2016. Despite the precipitous decline in biotech stocks over the past three months, which no doubt has hit shares of Immune disproportionately hard, management remains aggressive in pursuing activities designed to unlock value over the next few quarters. Below is a quick review of the key assets at Immune and pending catalysts for the shares.

Bertilimumab Development Continues

Both Phase 2 programs with bertilimumab, the company’s first-in-class fully human IgG4 monoclonal antibody, in ulcerative colitis (UC) and bullous pemphigoid (BP) continue to enroll patients. Management is also planning to initiate a third Phase 2 program in atopic dermatitis (AD) later in 2016.

In BP: I’m expecting that data from the BP study should be available in the second half of the year. As a reminder, this is a Phase 2a open-label, proof-of-concept, single group study targeting 10-15 adult patients with newly diagnosed, moderate to extensive BP (NCT0222146). The Sourasky-Ichilov Tel Aviv Medical Center in Tel Aviv, Israel is currently recruiting patients. In November 2015, management announced the U.S. FDA accepted the company’s investigational new drug (IND) application, opening the door to potential sites in the U.S. Additional sites in Europe are also expected to come online shortly, which should greatly speed enrollment in the trial.

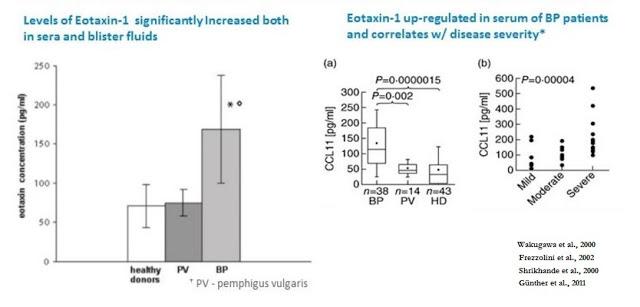

The scientific rationale for the use of bertilimumab in BP is extensive. Bertilimumab binds to eotaxin-1, a master regulator of the immune cellular network by inducing key immune cytokine responses, with very high affinity (~80 pM) and specificity. A study published in the European Journal of Dermatology found an increased level of serum eotaxin-1 in BP patients compared to patients with another skin blistering disorder, pemphigus vulgaris (PV), and healthy controls (Frezzolini et al., 2002). In addition, the authors found that eotaxin-1 is correlated with disease severity, with the level of eotaxin-1 in blister fluids found to be approximately 10-fold higher than in corresponding sera and when compared to blister fluid obtained from suction blisters from healthy volunteers.

Results published in the British Journal of Dermatology also showed the level of the eotaxin-1 was strongly associated with dermal infiltrating eosinophils in BP patients, and immunohistochemistry analysis showed that eotaxin was strongly over-expressed in epidermal keratinocytes around BP (Wakugawa et al., 2000, ) but not in healthy controls (Shrikhande et al., 2000). Data published in Clinical and Experimental Immunology examined the level of eotaxin-1 in BP patients stratified by disease severity. The authors found that the highest levels of eotaxin-1 were in patients suffering from the most severe disease, suggesting a correlation between the level of eotaxin-1 over-expression and disease severity (Günther et al., 2011).

Bullous Pemphigoid is a chronic autoimmune skin disease that involves the formation of blisters, known as bullae, at the space between the epidermis and dermis layers of the skin. There is no cure, and current treatment options primarily consist of class-1 anti-inflammatory agents (e.g., corticosteroids, tetracyclines, and clobetasol). While somewhat effective in knocking down flare-ups, long-term use of high-dose corticosteroids results in significant side effects, including weight gain, glaucoma, diabetes, high blood pressure, hormone imbalances, osteoporosis, and edema and thus is not suitable for patients with severe or recurrent BP (Mayo Clinic).

There are an estimated 65,000 patients in the U.S. and Europe with BP; thus, both agencies recognize BP as an Orphan Disease. If the open-label Phase 2a study above is successful, Immune will likely push forward into a Phase 2/3 clinical trial in 2017. Because BP is an Orphan Disease, it seems logical to assume that this next trial will count as one of the required pivotal studies required prior to U.S. FDA approval. As noted above, I’m expecting data in the second half of the year.

In UC: In November 2015, Immune announced enrollment of the first patient in the company’s Phase 2 program in UC. The trial is a double-blind, placebo-controlled program that will seek to randomize 42 adult patients with active moderate-to-severe UC at centers in Israel and Europe (NCT01671956).

Similar to BP, there is a strong scientific rationale for why Immune believes bertilimumab will work in UC. A paper by Chen et al., 2001 looked at the role of chemokines eotaxin-1 in the pathogenesis of inflammatory bowel disease (IBD). The author found that significantly increased serum eotaxin-1 levels were observed in both patients with Crohn disease (289.4+/-591.5 pg/ml) and ulcerative colitis (207.0+/-243.4 pg/ml) when compared with healthy controls (138.0+/-107.8 pg/ml) (p<0.01). Moreover, patients with active disease showed significantly higher serum eotaxin-1 levels than patients with quiescent disease. This work was confirmed by Mir et al., 2002 in a similar study.

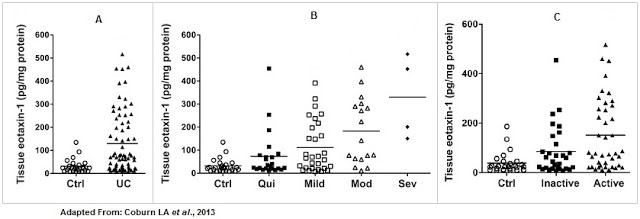

Work done by Coburn et al., 2013 showed that (A) tissue eotaxin-1 levels were significantly increased in UC patients compared to control patients, (B) the level of eotaxin-1 correlated with disease severity, and (C) the level of eotaxin-1 correlated with periods of active vs. inactive disease using the Mayo Disease Activity Index (DAI) and with eosinophil counts.

While BP represents the most near-term shot on goal for Immune and is an interesting orphan drug opportunity for the company, UC is the blockbuster indication. According to GlobalData, there are approximately 650,000 Americans with active UC, and another 765,000 in France, Germany, Italy, Spain, the UK, Canada, and Japan. Worldwide sales of pharmaceutical products to treat IBD are expected to exceed $14 billion by 2019, with the UC market approximately 35% of that total (source: EvaluatePharma, April 2015). If approved, Bertilimumab would represent a new mechanism of action and offer an patients and physicians an alternative treatment option to the modest efficacy of the TNF-α drugs. Data from the ongoing Phase 2 study is expected in 2017.

In AD: Beyond Immune’s belief that bertilimumab holds utility in BP, the underlying pathophysiology of atopic dermatitis (AD) leads management to believe the drug might have important utility in AD as well. For example, chemokines are thought to play an important part in the development of inflammation in AD (Yawalkar et al., 1999). A paper published in the Journal of Investigative Dermatology (1999) showed that skin biopsy specimens obtained from non-lesional and lesional skin of patients with AD had significantly increased levels of eotaxin and CCR3 compared to non-atopic controls. Non-lesional atopic dermatitis CCR3 expression was also significantly increased at the mRNA and protein level, whereas eotaxin was increased at the mRNA level only.

A separate paper published in Allergy (2001) investigated the level of circulating eotaxin in children with skin allergy in relation to clinical activity and lesion type. Plasma eotaxin was assayed in 78 infants and children, of whom 16 had AD, 19 had acute urticaria (AU), and 43 were healthy matched subjects. Results showed that the plasma eotaxin levels in children with AD (168±61 pg/ml) were significantly higher than the healthy control values (59.5±18.5 pg/ml) or in children with AU (124±33 pg/ml). The authors concluded that circulating levels of eotaxin increase in AD and during flares of AU, probably to serve in the recruitment and activation of eosinophils, and this may represent a biomarker of lesional activity (Hossny et al., 2001).

Nano-Cyclosporine A Expands Dermatology Focus For Immune

Immune’s focus on dermatology does not stop with bertilimumab. On the contrary, the company is eager to begin clinical studies with its topical nanocapsule formulation of cyclosporine A for the treatment of atopic dermatitis and psoriasis in 2017. Cyclosporine A is a powerful polypeptide immunosuppressant drug that reversibly inhibits T-lymphocytes, most notably through targeting T-helper cells, and to a lesser extent, T-suppressor cells. CysA also inhibits lymphokine production and release including interleukin-2 (IL-2) or T-cell growth factor. This mechanism of action has proved useful in the prevention of allogeneic organ transplantation rejection, with specific utility in skin, heart, kidney, liver, and bone marrow transplantation. The drug has also been used to treat autoimmune diseases such as severe psoriasis, atopic dermatitis, rheumatoid arthritis, and to generate tear production in individuals with dry eyes.

In the U.S., Neoral® is approved for the treatment of psoriasis. The label includes a bolded “Black Box” warning for many of the nephrotoxicity and neurotoxicity issues noted above, risk of serious infection, as well as a specific risk for the development of skin malignancies when used in combination with PUVA, radiation therapy, or methotrexate. The concept for a topical formulation of CysA is quite simple – you get all the benefits of the powerful efficacy of the drug and avoid the primary systemic side effects such as nephrotoxicity, neurotoxicity, anaphylactic reactions, GI-related adverse events, and serious risk of life-threatening infections. It is a commercially validated strategy with many medications, including corticosteroids and non-steroidal anti-inflammatory drugs. In fact, topical formulations of CysA already exist, most notably as Allergan’s Restasis®, which has been shown effective for the treatment of dry eyes (Perry HD, et al., 2008) and other ocular surface disorders (Tatlipinar & Akpek, 2005).

It is worth noting that with Bertilimumab and topical nano-CysA, Immune’s goal is to become a major player in immuno-dermatology. Bertilimumab has potential in both bullous pemphigoid and severe atopic dermatitis. In the latter disease, it appears to be the only clinical stage biologic competing with Regeneron/Sanofi’s Phase 3, dupilumab, a monoclonal antibody against IL-4 receptor alpha subunit, which blocks signaling from both IL-4 and IL-13. IL-4 and IL-13 are key cytokines that are required for the initiation and maintenance of the Th2 (Type 2 helper T-cell) immune response that is believed to be a critical pathway in allergic inflammation. Topical nano-cyclosporine A is one of a handful of novel treatments for patients with moderate atopic dermatitis and psoriasis, along with crisaborole (AN2728), a PDE-4 inhibitor being developed by Anacor that successfully completed a Phase 3 trial in atopic dermatitis and is now under U.S. FDA review.

Expanding Efforts in Immuno-Oncology

Over the past few months, Immune Pharma has been working vigorously to expand development within its immuno-oncology division. This is a relatively new focus for the company. The division is being headed up by Dr. Miri Ben-Ami, MD, Immune’s new EVP and head of Oncology. Dr. Ben-Ami joined Immune in November 2015. Also in November 2015, Dr. Monica E. Luchi, MD joined as the company’s Chief Medical Officer. Recall that in September 2015, Dr. Boris Shor, Ph.D., joined Immune to head up the research laboratory at the Alexandria Center for Life Science in New York City. Dr. Shor joined the company from the Pfizer Oncology Research Unit where he led internal and external collaboration project teams to develop novel antibody-drug conjugates (ADCs) for the treatment of cancer. It is clear through these new hires that Immune is gearing up to make a strong push into immuno-oncology.

For example, in December 2015, Immune presented a poster on its bi-specific antibody platform at the IBC Antibody Engineering & Therapeutics Conference in San Diego, CA. Company scientists and collaborators created a prototype bi-specific antibody that retained effector functions and mediated redirect killing of target HLA-DR+ cells by human CD5+ cytokine-induced killer T-cells demonstrating direct anti-cancer effects in vitro as well as anti-tumor activity and improved survival in vivo in a mouse xenograft model of disseminated leukemia. Results demonstrate alpha-HLA-DR-CD5 bi-specific antibodies mediate chronic lymphoid leukemia (CLL) cell phagocytosis comparable to rituximab (Rituxan®) with potentially less resistance due to greater specificity.

Also in December 2015, Immune further strengthened its efforts in immuno-oncology and bi-specific antibodies with the licensing of technology and patents from Atlante Biotech SAS, a privately-held European biotech company that was part of a European consortium working with Immune on the initial bi-specific antibody prototype noted above. Work at Atlante Biotech SAS was lead by Dr. Jean Kadouche, a scientific co-founder of Immune Pharma. The technology in-licensed by Immune expands the company’s platform to target immune checkpoint inhibitors and will help the company generate additional preclinical data with selected bi-specific drug candidates in 2016. By licensing the technology and patents from Atlante Biotech SAS, Immune’s will now be able to develop bi-specific antibody constructs targeting multiple immune checkpoint inhibitors. It’s a novel strategy, but one that could pay off with significant dividends if successful.

Yesterday, Immune put out a press release highlighting the filing of a new patent application for the combination of Ceplene and checkpoint inhibitors. The new invention provides methods of treating cancer by administration of Ceplene (histamine dihydrochloride) in combination with immune checkpoint inhibitors, as well as methods of predicting the efficacy of Ceplene and IL-2 therapy in patients with Acute Myeloid Leukemia (AML). Recently, Immune performed a new analysis of the Ceplene/IL-2 Phase 3 data, which previously demonstrated an improvement in progression free survival. Ceplene is approved and on the market in select countries in Europe, sold by Meda AB, but the company is not actively marketing the drug. A Phase 4 study with Ceplene/IL-2 was just recently completed in Europe with a publication pending.

Immune’s goal is to secure a new patent with Ceplene in combination with checkpoint inhibitors and then seek development partners for the U.S. Management believes Ceplene will improve the efficacy of checkpoint inhibitors and be an attractive licensing opportunity for a larger oncology-focused company.

Based on conversations with management, it seems that Immune’s strategy within immuno-oncology is to advance preclinical work in both bi-specific antibodies and NanomAbs, along with legacy products acquired from EpiCept, such as Ceplene, Azixa, and Crolibulin, and test these compounds in combination therapy with drugs such as Avastin® and approved checkpoint inhibitors. EpiCept did not have the cash or expertise in immuno-oncology to advance these candidates along this path. Over the past few months, Immune has brought in this talent with the hiring of Dr. Ben-Ami, Dr. Luchi, and Dr. Shor.

Ultimately, Immune is looking to create a private subsidiary to further fund the immuno-oncology program. The company would give up a small ownership stake in the immuno-oncology division in return for non-dilutive funding to complete the preclinical and planned clinical work, all the while continuing to keep the focus of the parent organization on the lead asset, bertilimumab. It is an interesting strategy and one I plan to delve into in greater detail for shareholders at a later date.

Still Working To Partner AmiKet

AmiKet is a Phase 3-ready drug that management previously guided they would secure a deal for over the summer 2015. When offers for AmiKet came in a few months ago, they were lower than management was willing to accept, primarily based on concerns over the intellectual property life of the drug. AmiKet is a topical analgesic for the treatment of peripheral neuropathies such as post-herpetic neuralgia and diabetic peripheral neuropathy. The product contains two FDA approved drugs, amitriptyline (4%) and ketamine (2%), and is designed to compete against Lyrica® ($5.2 billion in sales in 2014 at Pfizer) and Lidoderm® ($1.3 billion in sales in 2012 at Endo). Unfortunately, the patent on AmiKet expires in August 2021, and thus the NPV for a larger pharmaceutical partner does not match up with what Immune believes the drug is worth.

Instead of taking less money for the drug over the summer, management went out and licensed a nanoparticle delivery formulation in June 2015. The benefits of the nano-formulation are improved delivery and patent protection to 2036. Development of AmiKet-Nano is now being packaged in with the Phase 3-ready formulation and management is back out re-entertaining offers for the drug. Investors are squarely focused on the deal, hoping that out-licensing AmiKet will provide non-dilutive cash to fund the inflammatory and immuno-oncology pipeline. I ultimately believe a deal for AmiKet will get done, but obviously do not know when. The investor presentation lists partnering AmiKet as one of Immune’s key goals for 2016.

Conclusion

Immune’s presentation at BioCEO earlier in the week laid out some important catalysts and key milestones for the company in 2016. Key events can be seen in the slide below. Results from the UC may slip into 2017, but do believe data from the BP trial is on track for the second half of the year. I view this as the single biggest driver of a potential turnaround at Immune for shareholders.