While its mechanism of action remains unclear, ketamine, which has a moderately high binding affinity for, and can block the activity of, the N-Methyl-D-aspartic acid (NMDA) receptor, is making headlines as a breakthrough in the treatment of depression. Earlier in May 2016, a team of researchers out of the U.S. National Institute of Mental Health (NIMH) and the University of Maryland announced they may have discovered a potential breakthrough in the treatment of depression. The findings, published in Nature, highlight results from animal studies using a metabolite, or chemical byproduct, of racemic (R,S)-ketamine to reverse depression-like behavior (1).

Specifically, the group found that a single administration of a metabolite of ketamine, called hydroxynorketamine (HNK), resulted in rapid antidepressant-like effects in mice without ketamine-related side effects, such as anesthesia, or dissociative or addictive behavior. HNK, through unknown intermediates, increases the levels of another neuronal receptor protein, α-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid (AMPA). The data may implicate a novel mechanism underlying the antidepressant properties of racemic (R,S)-ketamine and have relevance for the development of next-generation, rapid-acting antidepressants (2).

Another recent Nature publication (3) offers a broader potential mechanism of action for the antidepressant effects of NMDA receptor antagonists. Rapid responses in subjects with treatment-resistant depression suggest a mechanism that results in fast changes in synaptic function and plasticity. Ketamine and other NMDA receptor antagonists increase mTORC1 signaling and increase synaptic number and function. Pre-administration of rapamycin, a selective mTORC1 inhibitor, blocks these effects. The paper suggests that NMDA receptor blockade increases glutamate transmission in rodents and humans via blockade of NMDA receptors on GABAergic interneurons. This release of GABA’s inhibitory effect activates AMPA receptors and stimulates mTORC1 signaling via the release of brain-derived neurotrophic factor (BDNF).

The mounting evidence for NMDA receptor modulation for the treatment of depression is relevant to Relmada Therapeutics (RLMD). Relmada announced last week news that its lead development candidate, d-methadone, produced statistically significant superior antidepressant-like effects to both ketamine and placebo in a preclinical study (4). Both Relmada’s d-methadone and ketamine are NMDA receptor antagonists. Relmada has previously studied d-methadone in three safety and dose-ranging Phase 1 trials and believes the drug has potential utility for the treatment of neuropathic pain. These new findings with d-methadone open a new pathway for the company. A pivotal proof-of-concept Phase 2 study in depression and/or neuropathic pain is expected to commence during the second half of 2016. This is expected to be a major driver for the shares.

Ketamine & Depression

Ketamine has long been suspected and used off-label for its antidepressant effects. Also known as “Special K”, ketamine first came on the scene as a psychedelic drug in the 1960’s but has since been embraced by emergency rooms as a quick and easy anesthetic. It induces a trance-like state, providing pain relief and sedation while having minimal effect on heart function, breathing, and airway reflexes. Ketamine is effective in reducing allodynia and hyperalgesia but long-term use for chronic pain creates undesirable cognitive and memory effects, including flashbacks, hallucinations, dysphoria, anxiety, insomnia, or disorientation.

Over the past decade, the drug’s enormous potential in the treatment of mental health issues has become a focus for researchers and psychiatrists trying to come up with a solution to severe depression where currently available medications have failed (5). Since 2006, dozens of studies have reported that it can also reverse the kind of severe depression that traditional antidepressants often don’t touch. The momentum behind the drug has now reached the American Psychiatric Association, which, according to members of a ketamine task force, seems headed toward a tacit endorsement of the drug for treatment-resistant depression (6).

“This is the next big thing in psychiatry,” says L. Alison McInnes, a San Francisco psychiatrist who over the past year has enrolled 58 severely depressed patients in Kaiser’s San Francisco clinic (credit: Sara Solovitch, The Washington Post). The results of this trial will be interesting to see, although physicians have been using ketamine off-label for the treatment of depression for decades. Anecdotal evidence suggests the drug works rather well (7). Hospitals and emergency rooms even use the drug to curb suicidal thoughts and prevent alcoholism (8).

Recent findings demonstrate that ketamine produces rapid antidepressant actions in difficult to treat depressed patients (9). In addition, preclinical studies demonstrate that ketamine rapidly increases synaptic connections in the prefrontal cortex by increasing glutamate signaling and activation of pathways that control the synthesis of synaptic proteins. Moreover, ketamine rapidly reverses the synaptic deficits caused by exposure to chronic stress in rodent models.

NMDA Receptor Targeting

The mechanisms of action for ketamine and other NMDA-receptor antagonists is one of enhancing synaptic function through a shift in activity to the AMPA precipitated by non-competitive inhibition of the NMDA receptor. Administration of ketamine increases extracellular levels of glutamate in the prefrontal cortex. The resulting burst of glutamate caused by ketamine then leads to activation of the signaling machinery (stimulation of BDNF-mTORC1 cascade) that stimulates synapse formation (10). The mechanism of action is one that could reverse mTOR blockage and synaptic deficits caused by long-term exposure to stress or chronic depression (11), sparking synaptogenesis and reversing depression in patients that have failed existing medications such as SSRIs or SSNIs.

Investigators at the U.S. NIMH seem rather excited about the potential of this new mechanism of action for the treatment of depression. As noted above, scientists have long assumed that NMDA-receptor targeting has antidepressant-like effects, but the chronic antagonism of the receptor by ketamine is not tolerable. The NIMH study is only testing a single dose of ketamine (12), so while the results to date have been very encouraging, researchers are a long way away from a solution.

Another widely-used NMDA-receptor antagonist, memantine (Namenda®) is marketed by Allergan for the treatment of moderate to severe Alzheimer’s disease, but the drug sees use off-label for the treatment of fibromyalgia (13) and depression (14). Human trials looking at the potential for the use of memantine in major depressive disorder and bipolar depression have been mixed. This is likely because the efficacy and toxicity of drugs like ketamine and memantine are affected by the location within the NMDA receptor channel where each drug binds (15). It is possible that ketamine binds deep in the channel pore, which leads to both its efficacy in depression and toxicity issues. Relmada’s d-Methadone may bind a little higher in the channel, which maintains its efficacy in depression but avoids the toxicity. Memantine may bind at the top of channel pore, which leads to limited efficacy in depression along with low toxicity (16). It’s the classic “Goldilocks” scenario. Regardless, Allergan sold $1.3 billion worth of Namenda® and Namenda® XR in 2015.

Relmada’s d-Methadone

Relmada’s d-Methadone

Relmada Therapeutics is currently developing REL-1017, otherwise known as d-methadone, for the treatment of neuropathic pain and depression. Methadone is a synthetic opioid analgesic used as an alternative to morphine and hydromorphone for patients with severe pain. Work published by Davis & Inturrisi, 1999, shows that systemically coadministered d-methadone prevents morphine-induced hyperalgesia in opioid experienced patients (17). Inturrisi later showed that coadministration of d-methadone and morphine prevented morphine tolerance in rats (18). The authors attributed these effects to the drug’s NMDA-receptor activity. Hyperactivity of NMDA receptors is one of the factors in the genesis of neuropathic pain (19). However, racemic methadone is most commonly used for preventing opioid dependence and as a replacement for heroin in medically-supported maintenance or detoxification programs (20).

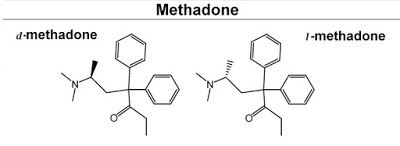

Methadone acts by binding to the µ-opioid receptor but also has some affinity for the NMDA ionotropic glutamate receptor. The dual-targeting of these receptors is due to the fact that methadone has an asymmetric carbon atom resulting in two enantiomeric forms resulting in dextro- and levo- isomers (S and R enantiomers, respectively). The racemic mixture (d/l-methadone) is the form most commonly used clinically and has potent analgesic and addictiveness characteristics comparable to morphine (21).

Work published by Fraser & Isbell, 1965, characterized the pharmacology and addictiveness of the dextro- and levo- isomers of methadone. The authors found that d-methadone is a weak analgesic of low addictiveness (22). Earlier work found that d-methadone does not induce morphine-like effects or ameliorate withdrawal from morphine. In contrast, l-methadone was very potent in inducing morphine-like effects in non-tolerant patients and in suppressing abstinence from morphine.

This is an important distinction between the methadone that most investors might know and REL-1017. Relmada is not developing another µ-opioid agonist for the treatment of moderate-to-severe chronic pain. Instead, d-methadone has unique and interesting characteristics that make the candidate potentially attractive for the development of neuropathic pain or depression. This activity relates to the drugs activity on the NMDA-receptor.

Relmada has a very interesting potential drug candidate with d-methadone. As a non-competitive antagonist of the NMDA-receptor, the opportunity exists to study d-methadone in neuropathic pain. This is clearly the low-hanging fruit. However, earlier in the month, Relmada released results from a preclinical study showing d-methadone has antidepressant-like effects similar to what has been seen recently with ketamine (23). Specifically, the company studied d-methadone in a well-validated rodent behavioral despair test, also known as the rat forced swim test (24). Results show that a single administration of d-methadone decreased the immobility of the rats compared to the vehicle, suggesting antidepressant-like activity larger than the effects of ketamine, also tested in the study.

Phase 1 Data

Phase 1 Data

Relmada has completed two Phase 1 studies to date with d-methadone. In June 2015, the company reported results from Study-111 evaluating the safety, tolerability, pharmacodynamics, and pharmacokinetics of single ascending doses (SAD) of d-methadone in healthy subjects. The data indicate that d-methadone was well-tolerated with a maximum tolerated dose (MTD) of 150 mg. PK data show an approximately dose-proportional linear relationship (doses tested: 5 mg to 200 mg) with peak plasma concentrations achieved 2.5 to 3 hours post-dose and a half-life between 32 and 40 hours. Opioid-associated adverse events were minimal and similar to placebo at doses between 5 mg and 100 mg.

In January 2016, the company reported results from Study-112 evaluating the safety, tolerability, pharmacodynamics, and pharmacokinetic profile of multiple ascending doses (MAD) of d-methadone in healthy subjects. The data indicate that d-methadone was generally well-tolerated with an adverse event profile similar to placebo at doses between 25 and 50 mg per day for 10 days. Doses of 75 mg per day for 10 days did show an increased incidence of somnolence and nausea. PK data show a linear relationship for dose exposure, with steady-state plasma concentration achieved after day six or seven.

Earlier in 2016, results from a small open-label proof-of-concept study with d-methadone were published by researchers at the Memorial Sloan Kettering Cancer Center (MSKCC) in the Journal of Opioid Management (25). A total of nine patients with moderate-to-severe chronic pain enrolled in the study and received d-methadone 40 mg twice daily for a total of 12 days. In additional to 40 mg d-methadone, subjects were allowed to continue taking their existing opioids and other psychotropic medications, both around the clock and as needed. Eight patients completed the study; one patient withdrew consent due to excessive sweating. Results of the study show the following:

– No change in background use of opioids over the 12 days

– No change in pain between baseline (4.1±1.9, range 0-10) and Day 12 (4.1±2.6)

– Slight improvement in anxiety between baseline (2.5±2.7, range 0-10) and Day 12 (1.5±1.5)

– Slight improvement in patient reported well-being between baseline (4.1±3.4, range 0-10) and Day 12 (2.9±3.4)

– No negative impact on cognitive function as determined by modified mini-mental state exam

– No meaningful impact on QTc

The researchers at MSKCC concluded that d-methadone appears safe and well tolerated at 40 mg BID. Eight of the nine patients that enrolled in the study had cancer pain and one had non-malignant back pain. Since these patients already had access to around-the-clock opioids, no change in pain score was expected. I suspect that given the mechanism of action, d-methadone is unlikely to find utility in patients with breakthrough cancer pain already heavily treated with opioids. Instead, the mechanism seems far more suited for neuropathic pain or depression. In this regard, the fact that patients in the study reported reduced anxiety and an improvement in overall well-being is very encouraging. These data, coupled with the recent findings in depression (26), suggest the most logical path forward for Relmada in Phase 2.

What’s d-Methadone Worth?

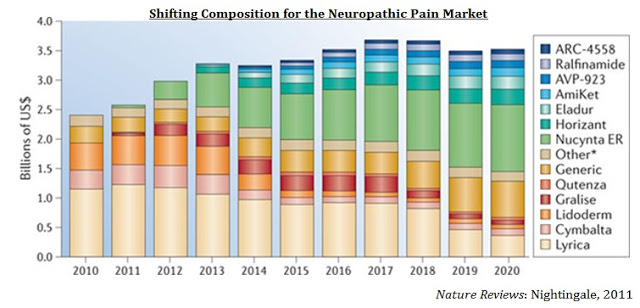

Relmada is currently preparing the investigational new drug (IND) application to begin Phase 2 clinical studies with d-methadone in the U.S. Given the mechanism of action, it seems logical to study d-methadone in neuropathic pain indications such as PHN or PPN. In this indication, would compete in a multi-billion-dollar market with drugs such as Pfizer’s Lyrica® ($5.2 billion in sales in 2014) and Depomed’s Nucynta® ER. The chart below from Nature Reviews shows the shifting dynamics of drug use in the neuropathic pain market (27). This chart only shows sales for these drugs in neuropathic pain, not nociceptive pain or fibromyalgia, or in depression.

Depomed acquired Nucynta® and Nucynta® ER from J&J in April 2015 for $1.05 billion (28). Analysts’ estimates on peak sales for the Nucynta® franchise vary greatly, but the drug is generally believed to achieve sales over $500 million annually in the next few years, peaking at around $1 billion in annual sales before the patient expiration in 2028. Even a small player in the neuropathic pain market, such as Depomed’s Gralise® ($81 million in sales in 2015) is worth a few hundred million on the open market. Solvay licensed Gralise (gabapentin extended release) from Depomed in 2008 for $25 million upfront and up to $370 million in milestones (29). Once Abbott Labs acquired Solvay, the company returned the rights to Depomed, along with $40 million in cash, in 2011.

However, given some of the recent data, the company is also looking at the opportunity to study d-methadone as an antidepressant. There is a confirmed link between depression and pain (30), and this is a market that Eli Lilly has been incredibly successful at targeting with Cymbalta® ($5.1 billion in sales in 2013), a drug approved for major depressive disorder, fibromyalgia, and chronic musculoskeletal pain. Other drugs such as Pfizer’s Effexor® XR and Pristiq® have also been blockbusters in this area.

Certainly, the recent excitement over the modulation of NMDA receptors for the treatment of depression bodes well for Relmada. The company is pursuing antagonism of NMDA receptors with d-methadone as a potential therapeutic approach to treating depression. The market is clearly interested in NMDA-receptor inhibition. In July 2015, Allergan agreed to acquire privately-held Naurex, Inc. for $560 million in cash (31).

At the time of the deal, Naurex was developing rapastinel, a once-weekly intravenous Phase 3-ready molecule that has demonstrated rapid, robust and sustained efficacy in multiple Phase 2 clinical studies in depression, and NRX-1074, a next-generation oral form in Phase 2 using an IV formulation. Both rapastinel and NRX-1074 are selective, weak partial agonists (mixed antagonist/agonist) of an allosteric site at the glycine site of the NMDA receptor complex.

After the close of the deal, the former Naurex executives formed a new company, Aptinyx Inc., again focusing on NMDA receptor modulators for the treatment of challenging disorders of the brain and nervous system (32). The company just announced last week the closing of a $65 million Series A financing (33). Yes, this is a hot area and focus for both biopharma companies and investors.

Relmada’s market capitalization is only $30 million. It is early to start ascribing a monetary value to d-methadone because at this stage we do not know the exact target indication; thus, forecasting peak sales and assigning levels of risk are too difficult. However, one can assume that with success in the upcoming Phase 2 study, in neuropathic pain or depression, the value of d-methadone alone will be worth multiples of the current $30 million market capitalization for all of Relmada.

Conclusion

This article focused solely on d-methadone and Relmada’s potential path forward with the planned Phase 2 study. Beyond d-methadone, Relmada has three other interesting drug candidates in its pipeline, BuTab®, LevoCap® ER, and MepiGel®, all improved formulations of approved pain medications under 505(b)(2) pathway development. These candidates, along with d-methadone, were covered at the company’s recent R&D Day (video replay). Below I provide a quick overview of each candidate:

– BuTab® is designed to be the first oral tablet formulation of buprenorphine for treating both chronic pain and opioid addiction. Relmada has demonstrated positive proof-of-concept with BuTab® and is evaluating plans for optimizing the formulation. I’ll be covering BuTab® in greater detail likely in my next article on Relmada.

– LevoCap® ER is an extended release, abuse-resistant formulation of levorphanol. Levorphanol is a broad spectrum opioid used to treat both nociceptive and neuropathic pain. The drug also has non-opioid activity, including targeting the NMDA, and serotonin-norepinephrine receptors. Relmada is preparing to meet with the U.S. FDA to review the development program.

– MepiGel® is a topical gel formulation of the local anesthetic mepivacaine. The company is developing MepiGel® for neuropathic pain indications, PHN and painful HIV-associated neuropathy. This is a market previously dominated by Endo’s Lidoderm® ($948 million in sales in 2014).

I find Relmada Therapeutics (RLMD) to be an interesting potential investment opportunity because the company is developing a portfolio of products over the entire spectrum of chronic pain. The candidate portfolio, coupled with the bafflingly low valuation of only $30 million, is intriguing given some of the issues larger pain-focused specialty pharmaceutical players such as Horizon (-35% YTD), Endo (-78% YTD), and Mallinckrodt (-23% YTD) are having. Depomed recently reiterated its intent to continue to expand its portfolio and the company’s recent deal to acquire cebranopadol suggests they are not shying away from doing R&D. Finally, now that the OxyContin® patent has expired, one would think privately-held Purdue Pharma is also looking to enhance its pipeline with several new pain assets.

On the CNS side, the number of independent studies reporting utility for ketamine in the treatment of depression is now too great to count (34). Researchers out of the NIMH are excited enough to call recent data a “breakthrough” and clearly both biopharma companies and investors are interested in this area given some of the recent news about Naurex and spin-out Aptinyx Inc.

Ketamine has been called the “next big thing” by Current Psychiatry (35). If Relmada can show efficacy and safety with d-methadone in depression in an upcoming Phase 2 study, new players with cross-over platforms in both pain and neurology, like Lilly, Pfizer, Merck, J&J, or Allergan, might think it is the “next big thing” and come calling. Either way, I like the potential here. Relmada looks to be in a good position with a bright future.