RedHill Biopharma Ltd (RDHL) continues to intrigue me from an investment standpoint. In October, I wrote an article detailing the company’s Phase 3 triple-antibiotic therapy for the treatment of Crohn’s disease. Investors can view that article >> HERE <<. In that article, I also provided a quick background on the company and briefly mentioned two other Phase 3 assets under development at RedHill, RHB-105 for H. pylori infection and Bekinda™ for gastroenteritis/gastritis and irritable bowel syndrome with diarrhea (IBS-d). As a reminder, RedHill has several late-stage assets under development and a strong balance sheet with $66 million in cash and no debt on the books. In this article I would like to cover the merits of RHB-105, a drug that already has one successful Phase 3 trial in the books and looks like the potential new standard of care for H. pylori infection.

Background On H. Pylori

Helicobacter pylori is a Gram-negative microaerophilic bacterium largely found in the gut (gastric species) of mammals. Like other typical Gram-negative bacteria, the outer membrane of H. pylori consists of phospholipids and lipopolysaccharide (LPS); however, the outer membrane also contains cholesterol glucosides, which are found in few other bacteria and likely contribute to the ability of the bacterium to survival in the inhospitable conditions found at the gastric mucosal surface in mammals (Kuster JG, et al., 2006). Additionally, all known gastric Helicobacter species are urease positive and highly motile through flagella (Yoshiyama H, et al., 2000). Urease is thought to allow short-term survival in the highly acidic gastric lumen, whereas motility is thought to allow rapid movement toward the more neutral pH of the gastric mucosa lining (Nakamura H, et al., 1998).

Colonization with H. pylori is not a disease in itself, but a condition that affects the relative risk of developing various clinical disorders of the upper gastrointestinal (GI) tract. In fact, H. pylori infection is rather common, with an estimated 30-40% of the U.S. population infected (Peterson WL, et al., 20Everhart JE, 2000).

Despite being a relatively common pathogen, roughly 80% of individuals infected with H. pylori are asymptomatic (Dooley CP, et al., 1989). This may be because the bacterium plays an important role in the natural stomach ecology (Blaser M, 2006). Nevertheless, both duodenal and gastric ulcer diseases are closely associated with H. pylori infection, and the pathogenesis of H. pylori is believed to be associated with infection-initiated chronic gastritis, which is characterized by enhanced expression of many inflammatory genes.

For example, work done by Kuipers EJ, et al., 1995 shows that an infected individual has an estimated lifetime risk of 10-20% for the development of peptic ulcer disease, which is at least 3-4 fold higher than in non-infected subjects. H. pylori infection can be diagnosed in 90-100% of duodenal ulcer patients and in 60-100% of gastric ulcer patients. What is more interesting, is that the authors’ work shows that after eradication of the infection, the risk of recurrence of ulcer disease is reduced to below 10% for gastric ulcer disease and to approximately 0% for duodenal ulcer disease.

In 2005, Barry J. Marshall and J. Robin Warren were awarded the Nobel Prize in Physiology or Medicine for their discovery of “The bacterium Helicobacter pylori and its role in gastritis and peptic ulcer disease” dating back to the early 1980s. Fellow Australian gastroenterologist, Thomas Borody, collaborated with Marshall and Warren and is credited with developing the first triple therapy for H. pylori infection, called Helidac®. In 1994, the International Agency for Research on Cancer classified H. pylori as a Group I carcinogen. As a result of work done by Marshall & Warren, et al., it is now universally accepted that H. pylori infection causes chronic gastritis and peptic ulceration, and is the strongest risk factor for the development of gastric cancer (Lamb A, et al., 2013).

Eradication As A Strategy?

Given the now ubiquitous acceptance of the causality between H. pylori infection and clinical disorders of the upper GI tract, it is logical to pursue eradication as both a treatment option and potential prophylactic for peptic ulcer disease and gastric cancer. The clinical evidence over the past decade supports this strategy. For example, a meta-analysis including 24 randomized controlled trials and randomized comparative trials including 2,102 patients with peptic ulcer disease revealed that the 12-month ulcer remission rate was 97±2% for gastric ulcer, and 98±1% for duodenal ulcer in patients successfully eradicated of H. pylori infection, compared with 61±9% for gastric ulcer and 65±10% for duodenal ulcer in those with persistent infection (Leodolter A, et al., 2001).

According to the American Cancer Society, gastric cancer is the second leading cause of cancer death in the world at approximately 750,000 cases per year. There are an estimated 1.05 million new cases each year. In the U.S., approximately 25,000 people will be diagnosed with stomach cancer in 2015, causing approximately 11,000 deaths. The National Cancer Institute pegs the five year survival rate at only 29%. A H. pylori eradication strategy as a prophylactic for gastric cancer is still an emerging strategy, but early clinical work looks encouraging.

For example, in a randomized, placebo-controlled trial, Wong BC, et al., 2004 recruited 1,630 asymptomatic H. pylori infected subjects in a high-risk region of China, and randomly allocated them to eradication therapy or placebo, after which they were followed for 7.5 years. The authors found that a subgroup of H. pylori carriers without precancerous lesions at index endoscopy had significantly lower incidence of gastric cancer following eradication therapy than in those receiving placebo (p= 0.02). This study supports the possibility that H. pylori eradication may reduce the risk of developing gastric cancer in individuals without precancerous lesions.

In 2014, the International Agency for Research on Cancer (IARC), a division of the World Health Organization (WHO), published a report titled, “Helicobacter pylori Eradication as a Strategy for Preventing Gastric Cancer.” The 190-page IARC report concludes:

Randomized clinical trials have found that H. pylori treatment is effective in preventing gastric cancer, and models indicate that H. pylori screening and treatment strategies would be cost-effective. However, uncertainties remain about the generalizability of results and about the cost–effectiveness and possible adverse consequences of programmes applied in community settings. The Working Group therefore recommends that countries explore the possibility of introducing population-based H. pylori screening and treatment programmes, but cautions that decisions as to whether and how to implement H. pylori testing and treatment must hinge on local considerations of disease burden, other health priorities, and cost–effectiveness analyses. Moreover, these programmes should be implemented in conjunction with a scientifically valid assessment of programme processes, feasibility, effectiveness, and possible adverse consequences.

Current Treatment Options

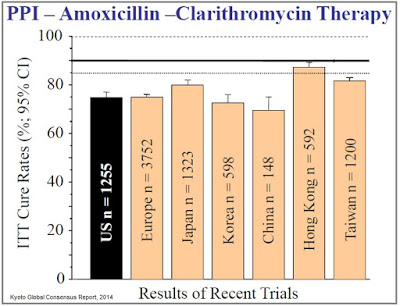

In the U.S., the recommended primary therapies for H. pylori infection include: a proton pump inhibitor (PPI), clarithromycin, and amoxicillin, or metronidazole (clarithromycin-based triple therapy) for 14 days or a PPI or H2RA, bismuth, metronidazole, and tetracycline (bismuth quadruple therapy) for 10–14 days (Chey WD, et al., 2007). When given at the recommended doses, approval studies from over a decade ago report intention-to-treat (ITT) eradication rates in the range of 80%. For example, results of the Quadrate Study (Department of Gastroenterology, Concord Hospital, University of Sydney, West, Australia) demonstrated the following (Katelaris PH, et al., 2002):

(1) 78% eradication (ITT) for pantoprazole 40 mg, amoxicillin 1000 mg, and clarithromycin 500 mg, all twice daily, for 7 days,

(2) 82% eradication (ITT) for pantoprazole 40 mg twice daily, bismuth subcitrate 108 mg, and tetracycline 500 mg, both 4 times daily, and metronidazole 200 mg 3 times daily and 400 mg at night for 7 days.

A meta-analysis conducted by Gene E, et al., 2003, compared triple therapy (proton pump inhibitor, clarithromycin and amoxicillin/imidazole) to quadruple therapy (proton pump inhibitor, tetracycline, metronidazole and a bismuth salt) and found very similar results, with the quadruple therapy outperforming 81% vs. 78% (ITT) over the triple therapy. Another study conducted by Vakil N, et al., 2004 found a different combination of triple therapy, rabeprazole 20 mg bid., amoxicillin 1000 mg bid., and clarithromycin 500 mg bid, offered 78% eradication (ITT) after 10 days. Large randomized trials suggest that the inclusion of amoxicillin or metronidazole yields similar results when combined with a PPI and clarithromycin (Bochenek WJ, et al., 2003).

It is important for investors to understand, these are relatively cheap and short-duration treatments. For example, a recently a meta-analysis by Ford A, et al., 2003 analyzed data from 52 trials and found that H. pylori eradication over a one to two week regimen reduces the recurrence of peptic ulcer disease and is cost-effective. In fact, eradication may actually be more cost effective than long-term acid suppression therapy. A five year prospective, randomized, controlled study by Liu CC, et al., 2003 in 82 Taiwanese patients with a history of ulcer bleeding demonstrated that maintenance acid suppression was not routinely necessary to prevent ulcer recurrence after successful H. pylori eradication and ulcer healing. In this regard, it is important that physicians have effective medications to treat H. pylori infection because there are clear pharmacoeconomic and health benefits to effective eradication therapy.

The issue with the current standard of care, however, is emerging antibiotic resistance, which has led to declining eradication rates over the past decade. In 2008, Graham & Shiotani concluded, “The prevalence of antimicrobial drug resistance is now so high that all patients infected with H. pylori should be considered as having resistant infections.” The authors note that cure rates below 80% are, “No longer acceptable as empiric therapy,” and that new treatment options delivering cure rates above 90% should be the primary goal for first-line treatment. Investigators are now establishing the bar for clinical efficacy at >90% eradication (Fischbach, 2010), a level at which the current standard of care has failed to achieve in almost every randomized control trial (source: Kyoto Global Consensus Report, 2014).

RedHill’s RHB-105

RedHill’s RHB-105

RedHill Biopharma is developing RHB-105, a new fixed-dose combination therapy of two antibiotics, amoxicillin and rifabutin, and a proton pump inhibitor, omeprazole. Benefits of the drug include an “all-in-one” oral capsule and powerful efficacy as demonstrated to date in human clinical trials. H. pylori resistance to both amoxicillin and rifabutin is low – estimated by the company at less than 1.5% for both drugs, and omeprazole, sold by AstraZeneca as Prilosec®, posted peak sales over $2 billion prior to the patent expiration in 2001. RHB-105 has received FDA Qualified Infectious Disease Product (QIDP) designation under the GAIN Act for serious or life-threatening infections. RHB-105 has received FDA Fast Track development, Priority Review, and will be eligible for extended market exclusivity for a total of eight years post approval (Borody TJ, et al. at the Centre for Digestive Disease, NSW, Australia, and published in 2006. The authors tested 130 patients who had failed one or more (mean 2.3 attempts per patient) eradication attempts with standard of care and were able to demonstrate 90.8% eradication on an ITT basis over a 12 day course of therapy (note: this formulation used pantoprazole instead of omeprazole). A higher overall eradication rate of 96.6±4.4% was obtained in patients treated higher doses of amoxicillin (1.5 g TID vs. 1.0 g TID). Side effects in the trial were mild.

Success With The First Phase 3

In December 2013, RedHill Biopharma enrolled the first patient in the Phase 3 ERADICATE HP study, a randomized, double-blind, placebo-controlled, study evaluating RHB-105 as a first-line therapy for H. pylori bacterial infection. The trial was originally designed to enroll 90 patients at eight centers in the U.S., but in August 2014 RedHill expanded the trial and increased the targeted enrollment after discussions with the U.S. FDA to enhance the statistical powering of the trial and seek a broader label indication for H. pylori eradication in all patients rather than just patients with a recent history of ulcers. In April 2015, enrollment was completed at 118 patients at a total of 13 centers in the U.S. Subjects were randomized in a 2:1 ratio to receive either RHB-105 or placebo for a period of 14 days, and assessed for eradication of H. pylori infection 28 to 35 days after completion of treatment.

In June 2015, RedHill Biopharma reported top-line results from the ERADICATE HP study. The primary endpoint of the study was to show superiority in eradication of H. pylori infection over historical standard of care efficacy levels of 70% effectiveness. Top-line results from the study demonstrated 89.4% efficacy in eradicating H. pylori infection with RHB-105, which was highly statistically superior over the 70% benchmark (p <0.001). Importantly, no serious adverse events, new or unexpected safety issues were noted in the study.

In September 2015, the company reported follow-up analyses from the open-label portion of ERADICATE HP. Patients on the placebo during the blinded portion of the trial were subsequently treated with standard of care (lansoprazole + clarithromycin + amoxicillin) for 14 days. Results show these patients achieved only 63% eradication, below the historic ~80% effective rate noted in the several peer-reviewed papers discussed above from the mid-2000s and well below the ~90% goal established by Graham & Fischbach. RedHill anticipates receiving the final Clinical Study Report in the fourth quarter 2015, at which time we may learn additional information with respect to RHB-105 efficacy and safety/tolerability, and patient reported Severity of Dyspepsia Assessment (SODA).

RedHill management plans to meet with the U.S. FDA in the fourth quarter 2015 or the first quarter 2016 to discuss the clinical and regulatory path for approval of RHB-105 as a potential best-in-class, first-line therapy for H. pylori infection. I suspect that the company will be in position to conduct a second Phase 3 trial similar to the first by the middle of 2016. The first Phase 3 program took 18 months from first patient enrollment to top-line data. Assuming a similar time frame for the second study puts the potential top-line data late 2017, and a New Drug Application (NDA) in 2018.

A Large Market

In the U.S., H. pylori infection is rather common, with an estimated 30-40% of the population infected. Outside the U.S., infection rates are even higher, with prevalence tied closely to socioeconomic conditions (Everhart JE, 2000). According to a WGO Global Study, up to 80% of individuals in under-developed areas of the world are H. pylori positive. Nevertheless, 80% of patients are asymptomatic. Thus, of the roughly 115 million individuals in the U.S. that are H. pylori positive, eradication therapy is only necessary in 20-25 million. This is still an enormous market, and the total target population eclipses 100 million when including Europe, Japan, and China.

The American College of Gastroenterology (ACG) estimates that 3.5 to 7.5 million Americans suffer from peptic ulcer disease (PUD), with an estimated 0.5 million new cases per year. The U.S. CDC estimates the number to be approximately 6.0 million per year, resulting in approximately 185,000 hospitalizations per year. Infection with H. pylori is the most significant cause of PUD in the U.S., with up to 80% of all gastric ulcers and 90% of duodenal ulcers believed to be associated with the bacterium. Interestingly, the number of Americans with functional dyspepsia (non-ulcerative disease) may be as much as five times as large (Mahadeva & Goh, 2007).

The majority of these patients are treated with proton pump inhibitors or acid suppression therapy. The most common PPIs in the U.S. are omeprazole (Prilosec®), lansoprazole (Prevacid®), pantoprazole (Protonix®), rabeprazole (Aciphex®), and esomeprazole (Nexium®) (source: ACG). In fact, data listed in the Prilosec label demonstrates duodenal ulcer healing rates in excess of 80% after only four weeks of treatment. Data listed in the Nexium label is even superior, noting 90-94% healing rates after eight weeks of therapy. However, these drugs do not eradicate H. pylori.

Accordingly, the ACG recommends that all patients presenting with dyspepsia, who do not have alarm symptoms, have not been using NSAIDS, and who are not > 55 years of age, should be tested for H. pylori prior to being prescribed PPIs. As such, we suspect the targeted patient population in the U.S., when we eliminate NSAID-associated PUD and whittle down the remaining population to H. pylori infected individuals is in the neighborhood of 3.0 million patients.

There are a number of combination therapy products on the market in the U.S. These products include various combinations of PPIs and antibiotics. As noted above, these are relatively inexpensive products. According to information we found on Healthcare Bluebook, 10 days of treatment with Omeclamox-Pak® (omeprazole + clarithromycin + amoxicillin) costs $585; however, recreating the branded therapy with the generic components costs far less, estimated at only around $105. Another branded product, PrevPac® (lansoprazole + clarithromycin + amoxicillin) costs approximately $800 for 14 days of treatment, whereas the generic components cost roughly $150. Pylera® (omeprazole + bismuth subcitrate potassium + metronidazole + tetracycline) costs a similar $625 for a course of treatment.

Conservatively, if RedHill Biopharma were to price RHB-105 at $500 for a course of treatment, the market opportunity for the drug in the U.S. would equate to approximately $1.5 billion (~3.0 million patients x $500 per treatment). I think it is fair to assume that RedHill’s RHB-105 becomes the new standard of care for H. pylori infection. After all, Phase 3 data demonstrated superiority over the current standard by 42% (89.4% vs. 63%) and RHB-105 is a convenient all-in-one capsule. I expect the company to price the drug comparable to competitors, and with QIDP designation and a potential label advantage that includes all patients with H. pylori infection, not just those with peptic ulcer disease, RHB-105 is the best-in-class drug.

Roughly 33% market penetration would yield peak sales of $500 million for the product. Upside to RedHill comes with approval outside the U.S. For example, number of addressable patients in Europe is about twice that of the U.S., although we would expect pricing in Europe to be about 50% of the U.S. branded cost. Nevertheless, if we include Europe another 1-2 million targetable patients in Japan, on a global basis, not including China, RHB-105 has peak sales in excess of $1 billion.

We note that RedHill recently entered into an agreement with Recipham AB, a leading Contract Manufacturing Organization for the manufacture of RHB-105. Under the terms of the agreement, Recipharm will be responsible for manufacturing RHB-105 for the planned second Phase 3 study and for future potential commercial supply of the drug. In order to support the manufacturing of RHB-105, Recipharm will invest approximately 13 million SEK (approximately $1.55 million) in manufacturing capabilities. Recipharm operates development and manufacturing facilities with approximately 2,200 employees in Sweden, France, the UK, Germany, Spain, Italy and Portugal and is headquartered in Jordbro, Sweden.

Conclusion

Peptic ulcer disease affects approximately 6 million American per year, resulting in approximately 185,000 hospitalizations (source: CDC). Many of these cases are brought on by use of NSAIDs or alcohol abuse, while others are hereditary in nature; nevertheless, 80-90% of these cases are associated with H. pylori infections. Standard of care is combination therapy of a proton pump inhibitor and antibiotics such as clarithromycin, amoxicillin, or metronidazole. Unfortunately, because of growing resistance, eradication rates for first-line treatments are rapidly declining. Meta-analysis reviews (noted above) show cure rates well below 80%. In RedHill’s recent Phase 3 clinical trial, standard of care resulted in only a 63% cure rate, unacceptable in the eyes of several notable Board Certified Gastroenterologists.

RedHill’s RHB-105 is a convenient fixed-dose combination therapy of two antibiotics, amoxicillin and rifabutin, and a proton pump inhibitor, omeprazole. Clinical data generated to date shows cure rates of approximately 90% (90.8% in the Phase 2 & 89.4% in the Phase 3). The U.S. FDA has granted RHB-105 QIDP designation under the GAIN Act. RHB-105 has received FDA Fast Track development, Priority Review, and will be eligible for extended market exclusivity once approved. The proposed label will include all patients with active H. pylori infection, potentially doubling the market opportunity over drugs like Omeclamox-Pak® and PrevPac®. I expect the company to initiate a second confirmatory Phase 3 trial around the middle of 2016, which is likely to offer data in 2017. This could led to a NDA in 2017 and potential approval in 2018 under priority review.

Treatment of peptic ulcers in the U.S. is an estimated $1.5 billion market. On a global basis, the number is closer to $4.5 billion. Given the differentiated and convenient characteristics of RHB-105, I believe the drug has sales potential of $500 million in the U.S. and in excess of $1 billion on a global basis. I consider the drug to be one of the key assets for the company and reason for further analysis of RedHill Biopharma, Ltd by investors. For my next articles, I plan to cover Bekinda™ for gastroenteritis/gastritis and irritable bowel syndrome with diarrhea and RHB-106, currently nearing the start of a Phase 3 trial for bowel preparation at Valeant Pharmaceuticals.

RedHill Biopharma has a solid balance sheet, with $66 million in cash on the books and no debt. The current market capitalization is only $142 million. Key assets include Phase 3 RHB-104 (see my positive news). The company is led by what looks to be quality management, non-promotional in their dealings with the market, and backed by an impressive group of institutional investors (e.g. Orbimed, Broadfin, Special Situations, Visium, Longwood, Sabby, Rosalind, Fred Alger, etc…). Stay tuned for more to come!