The psychiatric community may be on the verge of a paradigm shift when it comes to treating the severely depressed. New treatment options are desperately needed, because what is clear today is that generic antidepressants do not work for many patients. A 2007 report by the Agency for Healthcare Research and Quality (AHRQ) compared the effectiveness of first- and second-generation antidepressants by reviewing available literature and reported data from 187 randomized and/or placebo-controlled clinical trials. For patients diagnosed with major depressive disorder (MDD), 38% of patients did not respond at all to treatment and only 46% achieved remission (1).

Independent placebo-controlled clinical trials with selective serotonin reuptake inhibitors (SSRIs) show remission rates that average only 35%; and, newer-generation serotonin-norepinephrine reuptake inhibitors (SNRIs) fair only slightly better at 45% (2). Despite these low rates of control, sales of drugs to treat depression totaled $12 billion in 2008 (3).

A breakthrough in the treatment for depression may come from targeting a fundamentally different pathway from where SSRI and SNRI drugs exert their effect. The target is the N-Methyl-D-aspartic acid (NMDA) receptor, and psychiatrists have seen impressive results by using NMDA-targeting drugs like ketamine in select patients resistant to SSRIs and SNRIs. In my article below, I delve further into some recent literature around NMDA-targeting and highlight several pharmaceutical companies with mid-to-late stage assets for treatment-resistant major depressive disorder (MDD).

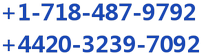

According to the CDC’s National Center for Health Statistics, 7.6% of the U.S. population over the age of 12 years suffer from depression (4). Based on 2015 Census data, this equates to approximately 21 million individuals. Data from the U.S. National Institute of Mental Health (NIMH) pegs the number slightly lower at 6.7% of all U.S. adults, equating to 16 million individuals (5). Whatever the exact number, it’s clearly a larger market. The Anxiety and Depression Association of America (ADAA) pegs the direct costs of the disease at $42 billion per year (6).

According to NIMH research, about half of U.S. patients with MDD experience major depression and receive treatment (7). Results of the NIMH-sponsored 4,000-patient Sequenced Treatment Alternatives to Relieve Depression (STAR*D) showed remission rates of 36.8%, 30.6%, 13.7%, and 13.0% for the first, second, third, and fourth acute treatment steps, respectively. The overall cumulative remission rate was 67% (8). These data were published in the American Journal of Psychiatry in November 2006. The 33-38% that fails to show response are classified as having treatment-resistant depression. The numbers work out to a target of around 3 million patients in the U.S. each year.

One of the primary reasons why existing first- and second-generation antidepressants do not work is because of their slow onset of action. For example, results from the STAR*D trial conducted by the NIMH found that the average time to remission was 5.4 to 7.4 weeks. In other words, MDD patients did not begin to see a clinical benefit until over a month after initiation of treatment. This lag time is far too long between initial symptoms such as suicide ideation and clinical efficacy and a major drawback to currently available MDD treatments (9). The initial treatment period for antidepressants is when suicide risk is the highest and slow-acting drugs like SSRIs and SNRIs can increase the risk of suicide upon initiation of therapy (10). Conversely, ketamine, an NMDA-receptor antagonist, has been shown to provide rapid resolution of suicidal ideation after only a single dose (11).

The NMDA-Receptor – A Major Mediator of Psychiatric Pathology

Recent compelling evidence has suggested that the glutamate system is a primary mediator of psychiatric pathology and also a target for rapid-acting antidepressants (12). The NMDA receptor is a glutamate-gated ion channel widely expressed in the central nervous system that plays a key role in excitatory synaptic transmission (13). Abnormalities of glutamate and NMDA receptors contribute an imbalance in glutamatergic neurotransmission, which may contribute to increased levels of NMDA agonism, thereby enhancing excitatory activity in most brain circuits involved in patients with major depression (14). Rapid responses in subjects with treatment-resistant depression suggest a mechanism that results in fast changes in synaptic function and plasticity (15).

– Ketamine

While its mechanism of action remains unclear, ketamine, which has a moderately high binding affinity for and can block the activity of, the NMDA receptor, is making headlines as a breakthrough in the treatment of depression. In May 2016, a team of researchers out of the U.S. NIMH and the University of Maryland announced they may have discovered a potential breakthrough using a metabolite, or chemical byproduct, of racemic (R,S)-ketamine to reverse depression-like behavior.

The findings, published in Nature (16), show that a single administration of a metabolite of R-ketamine, called (2R, 6R)-hydroxynorketamine (HNK), resulted in rapid antidepressant-like effects in mice without ketamine-related side effects, such as anesthesia, or dissociative or addictive behavior. (2R, 6R)-HNK, through unknown intermediates, increases the levels of another neuronal receptor protein, α-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid (AMPA). The data may implicate a novel mechanism underlying the antidepressant properties of racemic (R, S)-ketamine and have relevance for the development of next-generation, rapid-acting antidepressants (17).

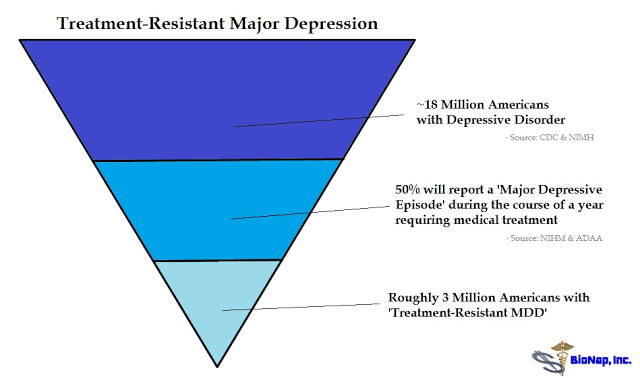

The mechanisms of action for ketamine and other NMDA-receptor antagonists is one of enhancing synaptic function through a shift in activity to the AMPA receptor precipitated by non-competitive inhibition of the NMDA receptor. Administration of ketamine increases extracellular levels of glutamate in the prefrontal cortex. The resulting burst of glutamate caused by ketamine then leads to activation of the signaling machinery (stimulation of BDNF-mTORC1 cascade) that stimulates synapse formation (18). Pre-administration of rapamycin, a selective mTORC1 inhibitor, blocks these effects.

The mechanism of action is one that could reverse mTOR blockage and synaptic deficits caused by long-term exposure to stress or chronic depression (19), sparking synaptogenesis and reversing depression in patients that have failed existing medications such as SSRIs or SSNIs.

Investigators at the U.S. NIMH seem rather excited about the potential of this new mechanism of action for the treatment of depression. As noted above, scientists have long assumed that NMDA-receptor targeting has antidepressant-like effects, but the chronic antagonism of the receptor by ketamine is not tolerable. Ketamine, colloquially known as “Special K”, is addictive and has a high potential for abuse or misuse (20). The NIMH study is only testing a single dose of ketamine (18), so while the results to date have been very encouraging, researchers are a long way away from a solution.

The NMDA-Targeting Pipeline

– Esketamine (Johnson & Johnson)

Johnson & Johnson (NYSE: JNJ) is developing esketamine, the S(+) enantiomer of ketamine, for MDD, treatment-resistant depression (TRD), and prevention of suicide in high-risk individuals. J&J’s clinical efforts to date have been extensive (21). The company is developing both an intravenous and intranasal formulation of the drug. The intranasal formulation is currently in a long-term safety and tolerability follow-up program from a Phase 3 clinical trial (NCT02782104). J&J believes that esketamine has the rapid antidepressant effects of racemic (R, S)-ketamine without the nasty side effects.

Phase 2 data with intravenous esketamine was recently published in Biological Psychiatry in November 2015 (22). The trial (NCT01640080) enrolled only 30 patients and tested two doses of esketamine, 0.2 mg/kg and 0.4 mg/kg, versus placebo. The primary endpoint was the change in Montgomery-Åsberg Depression Rating Scale (MADRS) total score from day 1 (baseline) to day 2. Of the enrolled patients, 97% (29 of 30) completed the study. The least squares mean changes from baseline to day 2 in MADRS total score for the esketamine .20 mg/kg and .40 mg/kg dose groups were -16.8 (±3.00) and -16.9 (±2.61), respectively, and showed significant improvement (P = .001) for both groups compared with placebo (-3.8 ±2.97).

J&J may be in the lead with esketamine, but that does not necessarily mean they will be the market leader. Treatment-emergent adverse events in the Phase 2 trial were dose-dependent, with the most common being headache, nausea, and dissociation. The authors noted that the dissociation was transient and did not persist beyond four hours from the start of the esketamine infusion, but it concerns nevertheless. The side effects of esketamine may stem from the drug’s affinity for the PCP binding site of the NMDA receptor. Esketamine increases glucose metabolism in the frontal lobe, which has been shown to increase dissociative or hallucinogenic effects (23).

There is little reason to believe the intranasal formulation will reduce these effects and is likely only in development for the convenience of administration. While certainly more desirable than an intravenous infusion, it is still far less desirable than an oral tablet. With the risk of dissociative or hallucinogenic effects, esketamine use may be relegated to a rescue therapy for patients at high risk of suicide.

– Rapastinel & NRX-1074 (Allergan plc)

If J&J is the 800-pound gorilla in this market, Allergan plc. (NYSE: AGN) is not too far behind. Allergan entered the market in July 2015 when it acquired privately-held Naurex for $571.7 million in cash upfront, plus up to an additional $1.15 billion in future potential milestone payments (24). The lead candidate at Allergan is rapastinel (GLYX-13), a NMDA receptor modulator with GlyB site partial agonist properties. Preclinical and early-stage clinical data points to rapid and long-lasting antidepressant activity, along with potential cognitive improvements in patients with post-traumatic stress disorder (PTSD) (25). In January 2016, the U.S. FDA awarded Breakthrough Therapy Designation to rapastinel as an adjunctive treatment for MDD (26).

Rapastinel’s rapid-acting antidepressant properties appear to be mediated by its ability to activate NMDA receptors leading to enhancement in synaptic plasticity processes associated with learning and memory. Alterations in dendritic spine morphologies associated with the maintenance of long-term changes in synaptic plasticity have been demonstrated in rats following single dose injections of rapastinel (27). These data suggest that rapastinel produces its long-lasting antidepressant effects via triggering NMDA receptor-dependent processes leading to hippocampal long-term potentiation (28).

Not enough yet is know about the long-term safety and tolerability of rapastinel. Naurex reported that in Phase 2 studies with rapastinel, no subjects dropped out due to safety or tolerability issues and that there were no signs of psychotomimetic side effects associated with NMDA receptor antagonists, such as ketamine (29). This is clearly encouraging, but will need to be fully vetted in the planned Phase 3 studies. If there is a knock on rapastinel, it is that the drug is dosed through intravenous infusion. In this regard, Allergan is developing NRX-1074, a backup compound to rapastinel that looks to be more potent and is an oral formulation. NRX-1074 is in Phase 1 clinical studies (30).

– AV-101 (VistaGen Therapeutics Inc.)

Allergan’s acquisition of Naurex and subsequent breakthrough therapy designation for rapastinel should stimulate investor interest in VistaGen Therapeutics (NASDAQ: VTGN) because AV-101 looks to be a better version of rapastinel. AV-101 is an orally available prodrug candidate rapidly converted in vivo into its active metabolite, 7-chlorokynurenic acid (7-Cl-KYNA). 7-Cl-KYNA is a full antagonist of the GluN1 subunit with a similar mechanism to rapastinel (note: rapastinel is a partial agonist). Regarding potency, Naurex’ preclinical data shows that that AV-101 is a more potent GlyB site modulator (31). Phase 1 studies showed good dose proportionality with Tmax of 1-2 hours and a half-life of 2-3 hours. These data compare favorably to the half-life of only 5-8 minutes for rapastinel (32).

In this regard, AV-101 looks more like NRX-1074, only the drug is already in Phase 2 clinical studies. An NIMH-sponsored Phase 2a study (NCT02484456) is currently taking place at the NIH Clinical Center in Bethesda, MD, under the principal investigation of Carlos A. Zarate, MD. Dr. Zarate is one of the nation’s foremost experts in the field of depression and has authored over 100 papers on the subject, including paradigm-shifting work with ketamine recently published last month in Nature (33). Target enrollment for this study is 24 to 28 adult subjects with treatment-resistant MDD. Data are expected during the first half of 2017.

VistaGen is currently planning a company-sponsored Phase 2b study with AV-101 separate from the NIMH-sponsored Phase 2a study noted above. The Phase 2b study will be a randomized, double-blind, placebo-controlled study targeting enrollment of 200-300 patients with inadequate response to standard antidepressants. Oral doses of AV-101 will be studied as an adjunctive treatment to background antidepressants in a sequential parallel comparison design (SPCD). SPCD (shown below) was established by the Massachusetts General Hospital Psychiatry Academy to mitigate placebo-response and assess the true efficacy of the drug over a two-stage format.

The primary endpoint is efficacy as assessed by the MADRS. Maurizio Fava, M.D. of the Massachusetts General Hospital and Professor of Psychiatry at Harvard Medical School, is the principal investigator of this study. Dr. Fava was the lead investigator on the NIMH-sponsored STAR*D trial discussed above. Between Dr. Zarate and Dr. Fava, VistaGen has some pretty impressive individuals running its clinical programs with AV-101.

– D-Methadone (Relmada Therapeutics Inc.)

What AV-101 is to rapastinel (i.e. a better version), Relmada Therapeutics’ (OTC: RLMD) REL-1017 looks to be to ketamine or J&J’s esketamine. REL-1017 (dextromethadone) is the d(+) enantiomer of the synthetic opioid analgesic (d,l)-methadone. Methadone acts by binding to the µ-opioid receptor but also has an affinity for the NMDA ionotropic glutamate receptor. The dual-targeting of these receptors is due to an asymmetric carbon atom resulting in two enantiomeric forms, with levomethadone binding primarily to the µ-opioid receptor and dextromethadone being primarily an NMDA-receptor antagonist.

Levomethadone is a potent analgesic that exhibits pharmacology and addictiveness characteristics comparable to morphine (34), whereas dextromethadone a weak analgesic of low addictiveness (35) and exhibits strong antidepressant-like effects (36). Relmada recently reported preclinical data with REL-1017 in a well-validated rodent behavioral despair test, also known as the rat forced swim test (37). Results show that a single administration of d-methadone decreased the immobility of the rats compared to the vehicle, suggesting antidepressant-like activity larger than the effects of ketamine, also tested in the study (see the data here).

Relmada’s Phase 1 data with REL-1017 show the drug to be safe and well-tolerated (38, 39). Data from an independent study conducted by the Memorial Sloan Kettering Cancer Center (MSKCC) published in the Journal of Opioid Management (40) showed patient reported improvements in anxiety and well-being, with no negative cognitive effects or impact on subjects’ mental state. Relmada is currently in the process of planning a Phase 2 clinical study with REL-1017 treatment-resistant depression. In short, REL-1017 looks to be a better version of esketamine. It’s oral, and results so far show no concerning dissociative or hallucinogenic effects.

– CERC-301 (Cerecor Inc.)

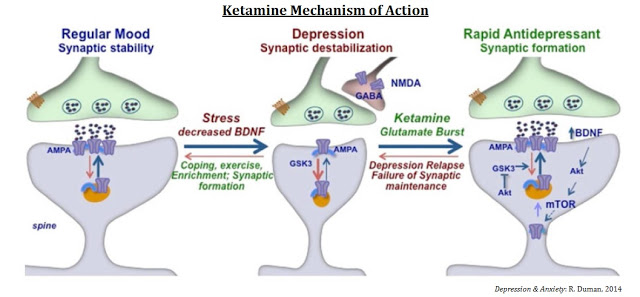

Cerecor Inc. (NASDAQ: CERC) is developing CERC-301, a selective NR2B antagonist of the NMDA receptor subunit. NMDA receptor channels are heteromers composed of the key receptor subunit, NR1, and one or more of the six subunits, NR2A, NR2B, NR2C, NR2C, NR3A, and NR3B. NR2B is the glutamate binding side of the NMDA receptor and important in synaptic signaling events and protein-protein interactions. The NR2B subunit is involved in modulating functions such as learning, memory processing, pain perception, and feeding behaviors, as well as many human disorders (41).

Merck initially developed CERC-301 (then called MK-0657) for the treatment of Parkinson’s disease, but the trial ultimately failed, and Merck discontinued development. At the time of the Parkinson’s trial failure, a Phase 2 study in MDD was enrolling patients. Truncated results from the study show no significant improvement in patients receiving MK-0657 compared to placebo as assessed by the primary outcome measure (MADRS). However, MK-0657 was shown to improve depressive symptoms when assessed by the Hamilton Depression Rating Scale (HDRS) and the Beck Depression Inventory (BDI) (42). Cerecor has since acquired the asset from Merck and is pursuing development of CERC-301 as an adjunctive medication in patients with severe MDD who are not responding to current antidepressants.

The cartoon below is a representation of the NMDA receptor pharmacology showing the different targets for ketamine, d-methadone, CERC-301, rapastinel / NRX-1017, and AV-101.

What We Know

What We Know

We know that depression is a debilitating disease that affects approximately 18.5 million Americans. We know existing generic antidepressants are only 35-45% effective and that roughly 3 million Americans are in desperate need of new treatment options. We know scientists recently discovered that abnormalities of the NMDA receptor contribute to imbalances in glutamatergic neurotransmission that may lead to depressive pathology. We know antagonism of the NMDA receptor by ketamine has been shown in both preclinical and clinical models to reverse depressive states rapidly and resolve suicidal ideation after only a single dose. Given all that we know, it is not surprising that Current Psychiatry called ketamine the, “Next big thing for Depression” (43).

Several biopharma companies are developing drugs that target the NMDA receptor, including behemoths Johnson & Johnson and Allergan. Micro-caps VistaGen, Relmada, and Cerecor are not far behind, and both VistaGen and Relmada look to have improved drugs versus their larger competitors. To me, that makes these companies very interesting. Allergan conveniently set the price for a post-Phase 2 asset in this market at a whopping $572 million, an 18 and 22-fold increase over the current market value for VistaGen and Relmada, respectively.

It is far too early to declare a winner in the NMDA space. Instead, we are likely looking at multiple winners. Remember, at one point antidepressants were the third best-selling drug class with peak sales in excess of $12 billion in 2008, and pharmaceutical companies have historically promoted multiple products targeting these same patients (e.g., Pfizer promoting Zoloft, Effexor, and Pristiq, Glaxo promoting Paxil and Wellbutrin, Forest Labs promoting Celexa and Lexapro, Eli Lilly promoting Prozac and Cymbalta).

Consequently, investors should not look at the NMDA space as a zero-sum game. What is likely to happen is that good news for the NMDA-targeting concept will be seen as good news for these smaller players. And if we assume these new NMDA-targeting drugs cost about the same as what Bristol’s Abilify® costs today ($25 per day), then 1% penetration of the 3 million patients in need of new treatment options results in $275 million in sales!

Conclusion

Yesterday, Sage Therapeutics (NASDAQ: SAGE) added nearly $500 million in market value for positive Phase 2 data in only 21 subjects with postpartum depression (44). This validates what Allergan paid for Naurex. The market says a successful Phase 2 drug in depression is worth $500+ million.

We do not know if AV-101 or REL-1017 will be successful in Phase 2 clinical trials; however, with positive data, we know that these respective assets will be worth at least $500 million, roughly 20x more than the market has them valued at today. We also know that only 4% penetration puts sales of these drugs into the blockbuster (> $1 billion) territory, and that makes these companies certainly ones to watch over the next year.