I’ve been following VistaGen Therapeutics (NASDAQ: VTGN) for several months now. The California-based biotech is developing AV101, a glycine B (GlyB) receptor antagonist that negatively modulates the N-Methyl-D-aspartic acid (NMDA) receptor. AV-101 is an oral prodrug candidate that has demonstrated impressive antidepressant effects and safety in preclinical and Phase 1 studies.

The mechanism of action is similar to ketamine, which means it might also prove useful in other psychiatric disorders such as bipolar depression, suicidal ideation, obsessive-compulsive disorder, and anxiety. AV101 may induce synaptogenesis, which might hold utility to treat neurodegenerative diseases like Huntington’s disease or in patients following a traumatic brain injury. The drug is also unlikely to be abused, which opens the potential for lack of DEA scheduling and expanded patient populations like adolescents and the elderly.

In short, I think AV101 has tremendous potential. It reminds me of Abilify® (aripiprazole), one of the most successful drugs of all time. Aripiprazole was developed by Otsuka Pharmaceuticals Co. Ltd of Japan and was co-promoted in the U.S. for over a decade by Bristol-Myers Squibb. The agreement expired in 2012, at which time Otsuka regained full rights. Sales peaked at nearly $9.5 billion worldwide in 2013, nearly $7 billion of which was in the U.S. The patent has since expired and the drug is now widely available as a generic.

For the purpose of this article, I thought I’d look at the potential for AV101 to be “the next Abilify”, or at the very least, be used similarly to Abilify as an adjunct therapy for patients failing first- and second-generation antidepressants. That market alone is blockbuster in size. Adding on some of the additional indications, like bipolar depression, acute suicide prevention, or anxiety, could put AV101 in the same category as Abilify as one incredibly successful CNS drug.

Abilify – The Most Successful CNS Drug Of All Time

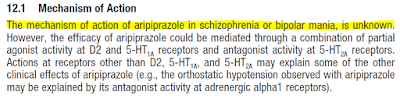

Abilify® is the most successful CNS pharmaceutical product of all-time. Sales peaked at $9.5 billion in 2013; and, to date, it ranks as the fifth best-selling drug ever by dollar volume (1). That’s darn impressive for a drug whose inventors admit are unsure how it even works!

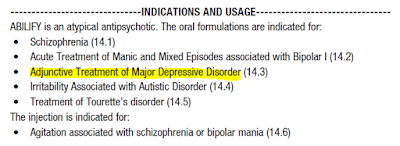

Regardless of the exact mechanism, Abilify is approved for some incredibly large indications. There are nearly 45 million American’s with mental illness (2), and the Abilify label hits several of the largest populations, including schizophrenia, bipolar mania, depression, and agitation.

Abilify was first approved in November 2002 for schizophrenia. Of particular interest to shareholders of VistaGen Therapeutics is the third approval, which came five years later in November 2007 for the adjunctive treatment of major depressive disorder (MDD). This is the initial target population for AV101 in the current Phase 2a clinical trial being conducted by researchers at the National Institute of Mental Health (NIMH), part of the National Institutes of Health (NIH), under the principal investigation of Dr. Carlos A. Zarate, MD. Only in this study, the NIMH is studying AV101 as a monotherapy.

Either as a monotherapy or an adjunct to ineffective standard-of-care, treatment-resistant depression (TRD) is an enormous market opportunity. According to data from the NIMH and CDC, roughly 7% of the U.S. population over the age of 12 years suffer from depression. Based on 2015 Census data, this equates to approximately 20 million individuals. NIMH research shows about half of these patients receive pharmacotherapy. Unfortunately, results of a 4,000-patient NIMH-sponsored trial in 2006 (STAR*D) showed only 36.8% achieve remission on first-line (generic) antidepressants.

Nearly two-thirds of these patients will try alternative antidepressants, which may include switching to a different selective serotonin reuptake inhibitor (SSRI) or trying a serotonin-norepinephrine reuptake inhibitor (SNRI), a tricyclic antidepressant (TCA), or a monoamine oxidase inhibitor (MAOI). Even with all these alternatives, the overall cumulative remission rate is only 67%. This means one-third of subjects with depression, a target of around 3-4 million patients in the U.S. each year, are in desperate need of an alternative treatment option.

Abilify Was Incredibly Successful…

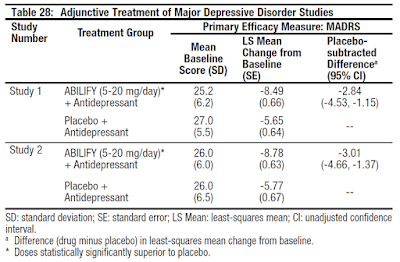

Many of these patients turned to Abilify when it was approved in 2007. Results of two short-term (6-week) clinical trials with Abilify, when added to underlying antidepressant therapy in patients with inadequate response, showed an improvement in depression scores.

In the two trials (n=381, n=362), Abilify was superior to placebo in reducing mean Montgomery-Asberg Depression Rating Scale (MADRS) total scores (Studies 1, 2 in Table 28) when receiving 5 mg/day as an adjunctive to antidepressants (paroxetine, venlafaxine, fluoxetine, escitalopram, or sertraline). An examination of population subgroups did not reveal evidence of differential response based on age, choice of prospective antidepressant, or race.

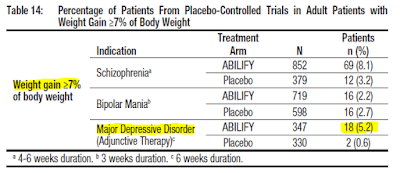

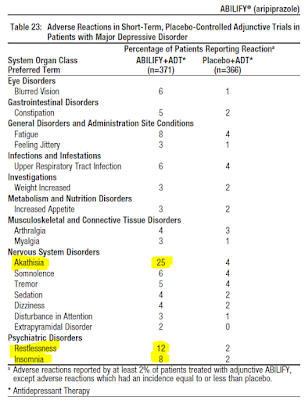

This type of broad-scale response, along with some very clever marketing by Bristol-Myers, made Abilify an easy drug to prescribe. Abilify also has a better safety profile and improved tolerability compared to other big-name antipsychotics like Zyprexa® (olanzapine) and Risperdal® (risperidone). A systemic review by the Cochrane Schizophrenia Group found that Abilify compared about as well in terms of efficacy to Zyprexa and Risperdal, but with less side effect such as weight gain and extrapyramidal symptoms (3). A separate comparison of several atypical antipsychotics done by Therapeutic Research Center found that Abilify had significantly less metabolic effects (weight gain, risk of diabetes, and dyslipidemia) than clozapine, olanzapine, quetiapine, and risperidone (4). The lower side effect profile made the drug ideal for adjunct therapy.

This type of broad-scale response, along with some very clever marketing by Bristol-Myers, made Abilify an easy drug to prescribe. Abilify also has a better safety profile and improved tolerability compared to other big-name antipsychotics like Zyprexa® (olanzapine) and Risperdal® (risperidone). A systemic review by the Cochrane Schizophrenia Group found that Abilify compared about as well in terms of efficacy to Zyprexa and Risperdal, but with less side effect such as weight gain and extrapyramidal symptoms (3). A separate comparison of several atypical antipsychotics done by Therapeutic Research Center found that Abilify had significantly less metabolic effects (weight gain, risk of diabetes, and dyslipidemia) than clozapine, olanzapine, quetiapine, and risperidone (4). The lower side effect profile made the drug ideal for adjunct therapy.

…But There’s Still Room For Improvement

Despite what looks like an improved safety profile compared to other atypical antipsychotics, Abilify still carries an FDA “Black Box” class warning for increased risk of mortality in elderly patients with dementia and thoughts of suicidal behavior in children, adolescents, and young adults when used with antidepressants.

Additionally, even though the use of Abilify resulted in less weight gain compared to drugs like Zyprexa, Clozaril, and Risperdal, the effects are still pronounced. The Abilify package insert notes 5.2% of MDD subjects will experience a ≥ 7% increase in body weight while on Abilify compared to only 0.6% for the placebo.

And perhaps the most important side effect of Abilify is an increased risk of akathisia, restlessness, and insomnia. Akathisia is a movement disorder characterized by a feeling of inner restlessness and a compelling need to be in constant motion. Increased incidence of akathisia and restlessness has been associated with higher risk of suicidal ideation (5).

Finally, the clinical studies with Abilify as an adjunct to antidepressants note the effect takes one to two weeks to kick in. This does not seem like a long time, but for a person suffering from severe depression, that two weeks is an eternity, especially if side effects like akathisia and restlessness show up before symptom relief. This is why the FDA warns on the risk of suicide when adding Abilify to antidepressant therapy.

One of the primary reasons why existing first- and second-generation antidepressants do not work is because of their slow onset of action. Results from the aforementioned STAR*D trial conducted by the NIMH found that the average time to remission was 5.4 to 7.4 weeks. In other words, severely depressed patients did not begin to see a clinical benefit until over a month after initiation of treatment. This lag time is far too long between initial symptoms such as suicide ideation and clinical efficacy, and this is a major drawback to currently available treatments.

Why Targeting NMDA Makes Sense

A patient with severe depression might start on fluoxetine or paroxetine. Six weeks later, if that’s not working, the patient might switch to sertraline or escitalopram. If that does not work, six weeks later they might try venlafaxine or desvenlafaxine, or amitriptyline. It could be several months later before the physician might suggest adding in Abilify; and, then even that takes another two weeks to see if it helps.

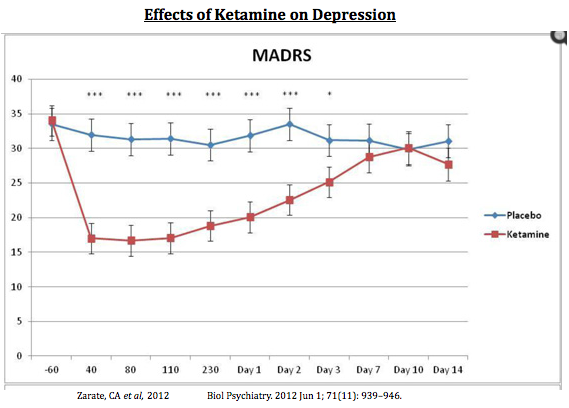

Conversely, NMDA-receptor antagonists like ketamine (and potentially AV-101) have been shown to provide rapid resolution after only a single dose! For example, a paper by Carlos A. Zarate, MD published in Biological Psychiatry in 2012 tested single doses of ketamine in 15 subjects with bipolar I or II depression. Zarate et al used several well-accepted depression scales. Below I show the results on the MADRS scale (the same scale show with the Abilify data above). The results are quite impressive, and show the rapid and sustained effect that ketamine has in patients with severe depression (6).

So while drugs like Abilify take up to two weeks to work, ketamine works in less than an hour! That is because ketamine, and AV101, is a fundamentally different pathway from standard antidepressants like SSRI and SNRI molecules. And importantly, AV101 has a similar glutamatergic AMPA-dependent pathway of ketamine; but, without the potential negative side effects of NMDA ion channel blocking (i.e. addiction and potential for hallucinations and delusion).

It is for these reasons that VistaGen, and renowned KOL’s in the depression space like Dr. Zarate and Dr. Maurizio Fava of Harvard/MGH, are so excited about AV101. Abilify is the most successful CNS drug of all time, and there are clear attributes were AV101 offers the potential to be a superior option for patients with treatment-resistant depression.

Status of AV101

AV-101 is currently being studied in an NIMH-sponsored Phase 2a clinical trial taking place at the U.S. NIH Clinical Center in Bethesda, MD, under the principal investigation of Dr. Carlos A. Zarate, MD. Dr. Zarate is one of the nation’s foremost experts in the field of depression and has authored over 100 papers on the subject, including paradigm-shifting work with ketamine recently published in Nature. Target enrollment for this study is 24 to 28 adult subjects with treatment-resistant MDD. Data are expected during the first half of 2017.

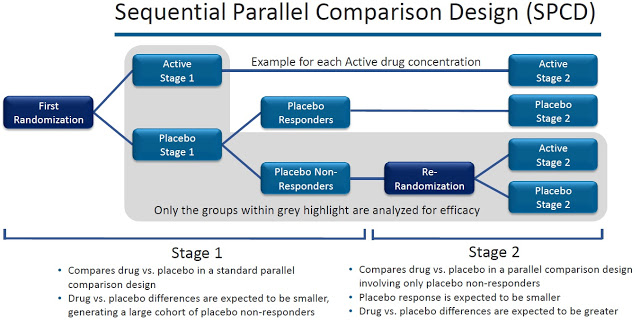

VistaGen is also planning a company-sponsored Phase 2b study with AV-101 separate from the NIMH-sponsored Phase 2a study noted above. The Phase 2b study will be a randomized, double-blind, placebo-controlled study targeting enrollment of 200-300 patients with inadequate response to standard antidepressants. Oral doses of AV-101 will be studied as an adjunctive treatment to background antidepressants in a sequential parallel comparison design (SPCD). Dr. Maurizio Fava of Harvard/MGH is the principal investigator of this program.

Alkermes Surge Validates My “This Is Big” Thinking

On October 20, 2016, Alkermes reported positive topline data from its Phase 3 clinical trial, dubbed FORWARD-5, with ALKS-5461 as an adjunctive treatment of major depressive disorder. Recall, this is the exact label that caused Abilify prescriptions to go parabolic between 2007 and 2013. FORWARD-5 met its prespecified primary endpoint showing treatment with ALKS 5461 significantly reduced symptoms of depression in patients with MDD compared to placebo. The company added nearly $2.5 billion in market value on October 21, 2016, as a result of the positive data.

The Alkermes data is relevant to VistaGen for a number of reasons. Firstly, if gives investors a good sense of what type of market reaction can be expected for a positive Phase 3 trial in treatment-resistant depression – i.e about $2.5 billion. Recall, in previous articles I noted positive Phase 2 data was worth $400 – 500 million in value, citing several examples including the acquisition of Naurex by Allergan in July 2015, the positive Phase 2 data from Minerva Neurosciences in May 2016, and the positive Phase 2 data from Sage Therapeutics in July 2016. VistaGen’s current market value is only $33 million, and Phase 2 data from the NIMH are expected early 2017.

Secondly, there are clear similarities between ALKS-5461 and AV101; not in the mechanism of action, but in approach and methodology. Both drugs are oral, like Abilify, likely giving them a leg-up against direct competition from J&J’s esketamine (intranasal) or Allergan’s rapastinel (intravenous). Both are new approached to treat depression and look like leaps forward compared to generic SSRI or SNRI molecules.

And perhaps most importantly, both are deploying the SPCD trial protocol to mitigate placebo response. SPCD was established by the Massachusetts General Hospital Psychiatry Academy to mitigate placebo-response and assess the true efficacy of the drug over a two-stage format. The patents to this design are held by Dr. Maurizio Fava at Harvard. Dr. Fava is the principal investigator of VistaGen’s planned Phase 2b.

Investors should note that FORWARD-5 was the third Phase 3 trial with ALKS-5461. The first two failed in January 2016. Alkermes press release noted, “significant placebo response”. The first Phase 3 study, FORWARD-3, did not use the SPCD design protocol. I think the SPCD trial design was a big reason why FORWARD-5 succeeded.

Yet despite all the excitement over the positive results from FORWARD-5, investors should keep in mind that ALKS-5461 is a combination 1:1 of buprenorphine and samidorphan. Buprenorphine is a weak partial agonist of the μ-opioid and nociceptin receptors and a weak antagonist of the κ-opioid and δ-opioid receptors. It’s a Schedule III substance by the U.S. DEA. Samidorphan also plays on the μ-opioid, κ-opioid, δ-opioid receptors. ALKS-5461 will be a Schedule III drug. Ketamine is currently a Schedule III drug, although some agencies are considering making it Schedule I. AV101 will have a significant prescribing advantage over ALKS-5461 (and ketamine and esketamine) due to lack of DEA scheduling.

Conclusion

My valuation work on VistaGen tells me the stock is worth many multiples of the current value, which sits at only $33 million as of today. Comparable analysis, including Allergan’s acquisition of privately-held Naurex in July 2015, shows that VistaGen should be worth $500+ million if the current Phase 2 trials are successful. Alkermes added $2.5 billion in market value after the positive topline data from FORWARD-5, and use of ALKS-5461 will be limited by DEA scheduling.

In the meantime, Abilify is the 800-pound gorilla of CNS drugs. It is approved for schizophrenia, bipolar mania, irritability associated with autistic disorder, Tourette’s, agitation associated with schizophrenia or bipolar mania, and as an adjunctive treatment of major depressive disorder. It’s the combination of all these indications that allowed Abilify to generate $9.5 billion in peak sales in 2013.

VistaGen will be starting Phase 2b clinical development to test AV-101 as an adjunctive antidepressant treatment in MDD for patients with inadequate response to standard antidepressants, but as noted above, management thinks the AV101 mechanism holds validity in other psychiatric disorders such as bipolar depression, suicidal ideation, obsessive-compulsive disorder, anxiety, and in neurodegenerative diseases like Huntington’s disease or in patients following a traumatic brain injury. This makes VistaGen an important company to watch when the Phase 2 data are released in mid-2017.