BrainStorm Cell Therapeutics, Inc. (NASDAQ: BCLI) is biopharmaceutical company developing adult stem cell-based therapies for a variety of neurodegenerative diseases such as amyotrophic lateral sclerosis (ALS), multiple sclerosis (MS), and Parkinson’s disease (PD). The company’s NurOwn® technology is based on the use of mesenchymal stem cells (MSCs) that are engineered ex vivo to express increased amount of neurotrophic factors (NTFs). The company has tested single-dose treatments of NurOwn in ALS patients in two Phase 1/2 clinical trials and most recently in a randomized, double-blind, placebo-controlled Phase 2 clinical trial.

The results from these trials are very encouraging and show NurOwn has the potential to stop or slow ALS disease progression in a subset of patients. While a number of analyses have been performed on the data, what I intend to do with this article is perform a compare and contrast between BrainStorm and other companies developing treatments targeting debilitating, degenerative, and/or fatal diseases. When viewed in comparison with these companies, BrainStorm’s paltry market cap of $45 million is perplexing, and offers investors the potential for substantial returns.

Brief Background on BrainStorm and NurOwn®

BrainStorm’s proprietary NurOwn technology uses a novel differentiation protocol such that mesenchymal stem cells (MSCs) are converted into neurotrophic factor-secreting cells (MSC-NTF cells). Neurotrophic factors (NTFs) are a group of small proteins and peptides that support the growth, survival, and differentiation of developing and mature neurons (1). Unfortunately, the transient administration of NTFs is not a feasible treatment option due to their short half-life and limited concentration at target sites. However, cell-based delivery of NTFs could result in sustained delivery and increased therapeutic response.

MSCs are a type of adult stem cell that can become many different cell types (pluripotent), including cartilage, bone, and fat. MSCs are located in various tissues throughout the body including the bone marrow, fat, and muscle; for BrainStorm’s technology, the cells are harvested from the patient’s bone marrow. Following isolation, the cells are cultured in a series of specialized growth mediums in order to induce production of NTFs. These MSC-NTF cells are then re-administered to the patient through either intramuscular (IM) or intrathecal (IT) injections, or both.

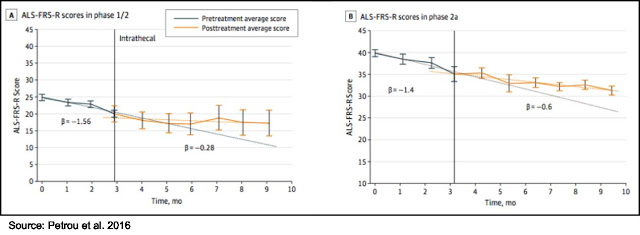

BrainStorm has previously tested NurOwn as a treatment for ALS in a Phase 1/2 and a Phase 2a open-label clinical trial, as well as a recent Phase 2 randomized, double-blind, placebo-controlled clinical trial (NCT02017912). While safety was the primary outcome for these trials, a secondary outcome measure was performed using the ALS Functional Rating Scale – Revised (ALSFRS-R), which rates 12 symptoms of the disease on a 0-4 point scale, with 48 being the best score and 0 equaling death (2).

Data from the Phase 1/2 and 2a clinical trials were published in JAMA Neurology in 2016 (3). The most important data from those trials was that a single IT treatment with NurOwn slowed progression of the disease when compared to the three months leading up to treatment, as shown in the following figure.

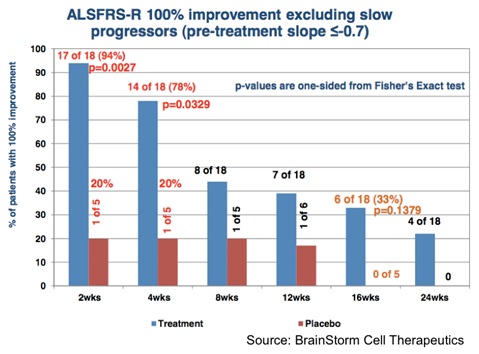

The Phase 2 results showed that NurOwn treatment was well tolerated and resulted in stopping the progression of the disease in a subset of patients, particularly in those whose disease was progressing the fastest. The following chart shows that in the cohort of patients whose disease was progressing fastest (e.g., those with a pre-treatment progression slope > -0.7 points per month), a single treatment of NurOwn halted disease progression (exhibited by a 100% improvement in the slope of the decrease of ALSFRS-R) in 78% of those patients for one month, which was statistically significant compared to the placebo-treated patients (P=0.0329). For additional information on the Phase 2 clinical trial results, see this analysis by Zacks analyst David Bautz.

The most important takeaway from the data that BrainStorm has accumulated thus far is that a single treatment of NurOwn is able to slow progression of ALS in a subset of patients. Is ALS being cured? No, however for terminal diseases such as ALS, an incremental improvement that can potentially lead to an increased life span and/or an improved quality of life has the potential to be a blockbuster treatment. And keep in mind, this was a single treatment of NurOwn. Future U.S. studies aim to test subsequent injections. The graph above shows the encouraging efficacy of NurOwn after four weeks of treatment. Subsequent follow-on injections on a monthly or bi-monthly basis could extend the therapeutic effect and provide a longer-lasting benefit to patients.

Plus, there are many examples of commercially successful medications that only work in a subset of patients, some in terminal diseases, which have had peak sales in excess of $1 billion. In addition, companies developing treatments using a patients’ own stem cells and for terminal illnesses are typically valued at many multiples above where BrainStorm is currently valued.

Brainstorm’s Strategy and Pathway Is Validated

There are a number of companies developing treatments for debilitating, degenerative, and/or fatal conditions such as ALS that can serve as a proxy for determining a proper valuation for BrainStorm. Similar to NurOwn, the results from these therapies show them to offer incremental improvements in outcome and/or they only work in a subset of patients. Two such companies are highlighted below.

– Sarepta Therapeutics

Sarepta Therapeutics (NASDAQ: SRPT) is a biotechnology company focused on developing RNA-targeting therapeutics for rare, infectious, and other diseases. The company is currently primarily focused on the lead product candidate eteplirsen as a potential treatment for Duchenne Muscular Dystrophy (DMD), which is a rare genetic disorder that results in progressive muscle degeneration and weakness, respiratory failure, and premature death (typically by the mid-20’s) (4). DMD is an X-linked recessive disorder that affects approximately 9,000 – 12,000 (mostly) boys in the U.S.

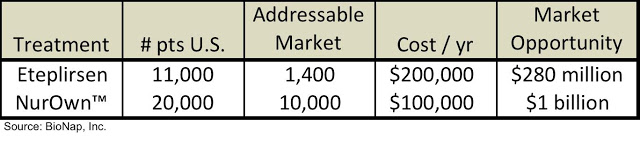

Sarepta is developing eteplirsen for the treatment of DMD. The drug is a synthetic antisense RNA molecule that corrects for mutations in the DMD gene that encodes for dystrophin, a protein involved in muscle movement. Eteplirsen specifically targets a mutation found in approximately 13% of DMD patients, thus the addressable market opportunity for Sarepta is approximately 1,300 – 1,500 patients.

Sarepta has performed pivotal Study 201 and its ongoing extension, Study 202, as part of the regulatory submission for approval of eteplirsen using the FDA’s Accelerated Approval pathway. Study 201 was a 24-week double-blind, placebo-controlled study of eteplirsen in 12 ambulatory boys with DMD. Patients were dosed weekly with 30 mg/kg eteplirsen (n=4), 50 mg/kg eteplirsen (n=4), or placebo for 24-weeks, after which the four placebo patients rolled over to the open-label portion of the study (Study 202) to receive 30 mg/kg eteplirsen (n=2) or 50 mg/kg eteplirsen (n=2). The primary endpoint of Study 201 was dystrophin production at Weeks 12 and 24. Results showed that the 50 mg/kg cohort did not have significant dystrophin production at Week 12; however, the 30 mg/kg cohort did have significant dystrophin production at Week 24.

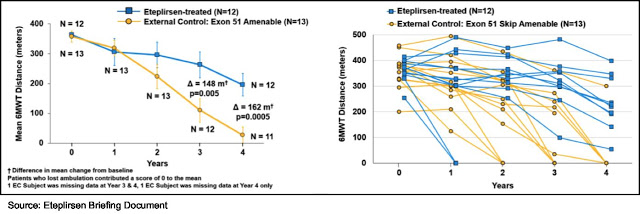

The primary functional endpoint of Study 202 was the comparison of week 48 six minute walk test (6MWT), which is a standard clinical outcome for testing DMD treatments that involves having patients walk a pre-set course for six minutes and allows for a global assessment of muscle function along with endurance as measured by cardiac and respiratory function. At 48 weeks, there was no difference in the 6MWT between eteplirsen- and placebo-treated patients. However, two of the eteplirsen-treated patients showed a rapid decline in 6MWT at the onset of the trial, and based on the data from Study 201 showing it takes 24 weeks to see significant dystrophin production, an exploratory analysis with those two patients removed showed a 67 m advantage in 6MWT in those receiving eteplirsen compared to placebo. This data served as the basis for continuing Study 202 for an extended period of time.

Since there was no placebo-controlled group for Study 202, Sarepta identified two external observational registries with longitudinal clinical outcome data from which to select patients to use as a comparator cohort. A total of 13 patients were selected for the external control cohort using key prognostic entry criteria for Study 201. Sarepta now has data out to four years, and as the following graphs show there is a statistically significant difference in 6MWT between eteplirsen-treated patients and the historical control group. Patients with a 0 for the 6MWT are no longer ambulatory and are confined to a wheelchair.

In Aug. 2015, Sarepta announced that the New Drug Application (NDA) for eteplirsen was accepted by the FDA and that the PDUFA date was Feb. 26, 2016. On Feb. 8, 2016, Sarepta announced that the PDUFA date was extended to May 26, 2016, due to the company submitting additional data in January 2016. On Apr. 25, 2016 the FDA held an advisory committee meeting to review the NDA at which time the committee voted 3-7, with three abstentions, against finding substantial evidence based on the clinical results of Study 201/202 that eteplirsen is effective for treatment of DMD. On May 25, 2016, Sarepta announced that the FDA would not be able to complete the review of the NDA for eteplirsen by the PDUFA date of May 26, 2016, and that they would complete the review “in as timely a manner as possible.”

– Bluebird Bio

Bluebird Bio (NASDAQ: BLUE) is a biotechnology company developing treatments based on the company’s gene therapy and T cell-based immunotherapy platforms. The company is currently developing gene therapies for β-thalassemia, severe sickle-cell disease (SCD), and cerebral adrenoleukodystrophy (CALD). In addition, Bluebird is developing oncology treatments using both chimeric antigen receptor (CAR) and T-cell receptor (TCR) cell therapies.

The company’s gene therapy platform consists of Lentiglobin, a treatment for both β-thalassemia and SCD, and Lenti-D, for the treatment of CALD. The technology involves extraction of a patient’s hematopoietic stem cells (HSCs) followed by the ex vivo insertion of a functional β-globin gene (with a single codon variant to serve as a biomarker) for Lentiglobin or a functional ABCD1 protein for CALD. The transduced cells are then re-injected back into the patient following myeloablation.

Bluebird is currently conducting two clinical trials with Lentiglobin: 1) A Phase 1/2 clinical trial in France for patients with β-thalassemia and SCD (Study HGB-205); 2) A Phase 1/2 clinical trial in the U.S., Australia, and Thailand for SCD (Study HGB-206).

β-thalassemia is a serious, life-long disease with a number of potential complications. The severity of the disease is dependent upon the type of mutation found, with β0/β0 patients (those incapable of producing any functional hemoglobin) having the most severe disease that requires constant blood transfusions. Data from Study HGB-205 showed that β-thalassemia patients who were not β0/β0 responded best to treatment with Lentiglobin. The non-β0/β0 patients were transfusion-free following treatment with Lentiglobin, while the β0/β0 patients continued to require transfusions, but with a reduction in the transfusion volume.

Bluebird has indicated that it will seek approval in the U.S. for non-β0/β0 patients through a Phase 3 program (Studies HGB-207 and HGB-208). The company may seek conditional approval in the E.U. based on data from the HGB-204 and HGB-205 studies; however, the strategy for gaining approval to treat β0/β0 patients in the E.U. has not been determined.

How Sarepta and Bluebird Compare to BrainStorm

– The similarities between NurOwn and eteplirsen include:

1) Neither NurOwn nor eteplirsen is a cure for the conditions they are treating, but do show the potential to be disease modifying. This is in contrast to the vast majority of pharmaceutical products for degenerative or fatal diseases on the market today are palliative at best.

2) NurOwn treatment appears to be most effective in a subset of patients; those whose disease is progressing fastest. Eteplirsen also appears to be most effective in a subset of patients; those who are not as far along in the disease.

3) Both NurOwn and eteplirsen appear to slow the progression of disease (decrease in the slope of the curve), which could potentially lead to an increased quality of life and perhaps an increased lifespan.

4) Both NurOwn and eteplirsen have been benchmarked against historic controls patients to gauge safety and efficacy; although, Brainstorm’s most recent Phase 2 trial did have a placebo control arm.

While the two treatments show many similarities clinically, the investment community views the companies developing each of the treatments very differently. Sarepta currently has a market cap of $1.3 billion while BrainStorm’s market cap is $45 million. Sarepta’s valuation is nearly 30x that of BrainStorm’s! Eteplirsen could potentially be approved soon, thus it isn’t surprising that Sarepta is valued higher than BrainStorm; however, the magnitude of the difference is what is so striking, particularly given the fact that the market opportunity for NurOwn is more than three times as large as for eteplirsen:

The FDA is set to announce a decision on Sarepta’s NDA filing very soon, thus the company’s valuation may change dramatically once that is announced. However, as it currently stands, BrainStorm appears to be quite undervalued on this comparative basis.

– BrainStorm and Bluebird are similar in that:

1) Both treatments being developed by each company involve extraction of stem cells from a patient, manipulation of those stem cells to produce the desired effect, and re-introduction of those cells back into the patient.

2) Both NurOwn and Lentiglobin appear to be most effective in a subset of the target patient population.

3) Both NurOwn and Lentiglobin are ready to be tested in Phase 3 clinical studies.

Since Bluebird is also developing oncology therapies (the first of which is in a Phase 1 trial) and gene therapies for multiple indications, a direct comparison between BrainStorm and Bluebird is more difficult. Bluebird has multiple shots on goal, including β-thal, SCD, and CALD. Brainstorm believes that NurOwn has utility in MS, PD, and potential autism, but these programs have yet to begin. However, once again there is an enormous difference in valuation between these two companies, with Bluebird currently valued at $2 billion compared to BrainStorm’s $45 million.

The comparison to both Sarepta and Bluebird is not done to say either of those companies is overvalued, but that BrainStorm is vastly undervalued. In addition, once investors realize the potential for NurOwn, it shows the type of valuation that BrainStorm could command in the future.

Many Blockbuster Drugs Offer Incremental Results or Are Effective in a Subset of Patients

I believe that part of the reason BrainStorm is currently valued at only $45 million is due to Investors believing that, outside of oncology, data that is only incrementally better than what patients can expect with a standard of care treatment is not good enough for that treatment to generate significant revenues. While many believe an oncology treatment that can extend patients lives for a few months is worthy of a lofty valuation, this same attitude is not shared for other terminal illnesses such as ALS.

With ALS, where patients typically only live for two to three years following diagnosis, a treatment that could potentially extend the time someone is able to function independently or extend their life from two to three years past diagnosis to four to five years is going to be a successful drug! It is akin to the treatment of certain cancer’s (particularly pancreatic and brain), which are terminal diseases for almost all of those diagnosed. As shown below, drugs that target those conditions have been commercial successes even though the benefit they offer is palliative at best:

– Temodar® (temozolomide): Originally approved to treat glioblastoma multiforme (a type of brain cancer), this drug was shown to improve median overall survival in patients from 12.1 months to 14.6 months (5). The drug is now off patent, however prior to that, it generated peak sales of $1.1 billion worldwide in 2009 (EvaluatePharma).

– Abraxane® (protein-bound paclitaxel): This drug is currently approved to treat pancreatic cancer, non-small cell lung cancer, and metastatic breast cancer. A Phase 3 clinical trial in pancreatic cancer showed the addition of Abraxane® to standard of care gemcitabine improved median overall survival from 6.7 months to 8.5 months (6). It generated $967 million in revenues in 2015 for all indications, with approximately $435 million due to the treatment of pancreatic cancer (EvaluatePharma). Analyst forecasts estimate Abraxane will generate peak revenues of $1 billion in pancreatic cancer alone.

If investors would view ALS in a similar way as they do cancer, which is entirely justified given the terminal nature of both diseases, I believe that NurOwn would be viewed in a different light and perhaps be valued at a more appropriate level.

Conclusion

BrainStorm’s NurOwn therapy is now the leading clinical-stage stem cell candidate for treating ALS. Key competitor, Neuralstem (NASDAQ: CUR), recently announced a reorganization to focus on development of NSI-189 for depression. The company is examining business development opportunities before continuing development of NSI-566, a stem cell treatment for ALS. Another CNS-focused cell therapy company, StemCells, Inc. (NASDAQ: STEM) has recently initiated a wind down of operations.

Currently, there is no treatment in development for ALS that could potentially cure the disease. While a cure could come one day, for now, effective treatments for ALS will consist of incremental improvements in clinical outcome, which will most likely only be effective in a subset of patients. However, as mentioned earlier, drugs that target terminal diseases can be commercially successful when offering only a limited clinical enhancement over the current standard of care. The data for eteplirsen shows that the drug, while not a cure, slows the progression of DMD compared to an untreated historical control group. That data has propelled Sarepta to a $1.3 billion valuation.

NurOwn appears as though it is most effective in a subset of patients with ALS. Treatments that are only effective in a portion of a patient population can be very successful. Humira® (adalimumab) is the best-selling drug in the world, with 2015 worldwide revenues of $14 billion. However, for rheumatoid arthritis and psoriasis, Humira is only effective for 50% (ACR-20 and 75% (PASI-75) of patients, respectively. Even so, physicians still prescribe Humira at a very high rate, even with so many other available treatment options. There are no truly effective treatment options for patients with ALS. NurOwn would be the first if approved.

BrainStorm’s next step in the development of NurOwn is to test multiple doses to determine if that enhances the efficacy of treatment over a single dose. A Phase 2 clinical trial testing multiple doses is in the process of approval in Israel (supported by $1.5M grant), and the company will be meeting with the FDA to plan a multiple dose program in the U.S. The data presented thus far with single doses of NurOwn has been encouraging, and I believe that multiple doses of NurOwn will likely prolong the encouraging efficacy response seen in the most recent Phase 2 study, potentially leading to a substantial improvement in length and quality of life for ALS patients.

The similarities in strategy and data between Brainstorm, Bluebird and Sarepta are striking. The discrepancies in valuation present an opportunity. As such, BrainStorm is certainly a company that investors might want to keep an eye on as they continue development of NurOwn.