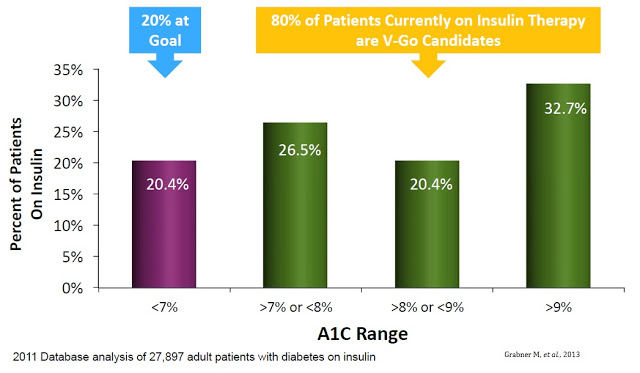

Diabetes is a significant public health crisis. The number of American’s with diabetes is soaring and will soon eclipse 30% of the population. Independent studies find that the vast majority of Type-2 diabetic patients do not achieve recommend A1C levels of less than 7% on insulin therapy. Compliance, complexity of dosing, and discretion of disease management are the key factors that lead to ineffective control for 60-80% of the Type-2 population.

Valeritas Holdings, Inc. (VLRX) has commercialized a small, wearable diabetes management device called V-Go Disposable Insulin Delivery Device (“V-Go”). V-Go is designed for patients with Type-2 diabetes who require daily insulin to achieve and maintain their target blood glucose goals. It is the first and only FDA-approved single-use, fully-disposable insulin delivery device with basal (background) and bolus (mealtime) capabilities on the market in the U.S.

V-Go is on the market and generating meaningful revenues for Valeritas. Though not yet profitable, I believe Valeritas is headed in the right direction. The company recently undertook a restructuring to streamline operations and improve profitability. With improved efficient and focused promotion, I believe Valeritas can achieve breakeven operations in the not too distant future. In the meantime, the company is reasonably valued on a revenue multiple basis and has tremendous upside as V-Go ramps over the next few years.

Diabetes Backgrounder

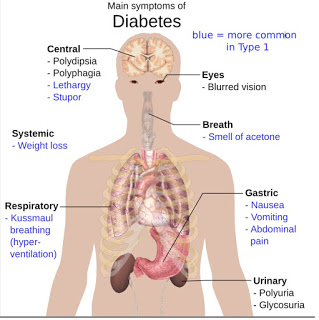

Diabetes mellitus is a group of metabolic diseases characterized by high blood glucose levels that result from defects in the body’s ability to produce and/or respond to insulin. The defect usually stems from a dysfunction of the pancreas to either produce insulin or because cells show decreased sensitivity to the insulin that is produced. The primary manifestation of the disease, high blood glucose levels, has far-reaching implications and classical symptoms, including polyuria (frequent urination), polydipsia (increased thirst) and polyphagia (increased hunger).

Diabetes is classified into three broad categories: Type-1 diabetes, Type-2 diabetes, and gestational diabetes. A fourth category, called pre-diabetes, is also considered important from a clinical perspective, and may be the largest patient population.

Type-1 Diabetes: Type-1 diabetes is usually diagnosed in children and young adults, and was previously known as juvenile onset diabetes. In Type-1 diabetes, the body does not produce insulin, most commonly the result of the body’s immune system destroying the insulin-producing cells in the pancreas called beta cells.

Type-2 Diabetes: Type-2 diabetes, once called non-insulin dependent or adult-onset diabetes, is the most common form of diabetes and accounts for approximately 90% of all cases worldwide. Type-2 diabetes is a metabolic disorder that is characterized by high blood glucose in the context of insulin resistance and therefore relative insulin deficiency at the level of the cell. This is in contrast to Type-1 diabetes, in which there is an absolute insulin deficiency in the body due to the destruction of islet cells in the pancreas.

Furthermore, unlike Type-1, obesity and physical inactivity is thought to be the primary cause of insulin resistance and Type-2 diabetes, in people who are genetically predisposed to the disease (1). However, the symptoms of uncontrolled Type-2 diabetes are similar, in polyuria (frequent urination), polydipsia (increased thirst), and polyphagia (increased hunger), as are the potential long term complications to nerves and blood vessels (i.e. eye disease, kidney disease, cardiovascular disease, and limb ulcers/amputations).

Gestational Diabetes: Gestational diabetes is a condition characterized by high blood sugar (glucose) levels that are first recognized during pregnancy. The condition occurs in approximately 3-5% of all pregnancies, and may improve or disappear after delivery; or it may develop into Type-2 diabetes, which occurs approximately 25% of the time. Though it may be transient, untreated gestational diabetes can damage the health of the fetus or mother. Risks to the baby include macrosomia (high birth weight), congenital cardiac and central nervous system anomalies, and skeletal muscle malformations. Increased fetal insulin may inhibit fetal surfactant production and cause respiratory distress syndrome.

An Enormous Market

According to the American Diabetes Association (ADA), there are an estimated 30 million Americans with diabetes, an astonishing 9% of the U.S. population (2); and, the number is increasing rapidly. In 2010, the CDC estimated only 25.8 million Americans had diabetes. Each year, approximately 1.4 million new Americans are diagnosed with diabetes. Between 90 and 95% of these cases are Type-2 diabetes. The CDC estimates that roughly 30% of Type-2 diabetics, or around 8 million individuals, are on insulin therapy (3).

The economic costs of diabetes are tremendous. A study conducted by the ADA in 2012 pegged the total estimated cost of diagnosed diabetes in 2012 is $245 billion, including $176 billion in direct medical costs and $69 billion in reduced productivity. The amount is a 41% increase from previous estimates of $174 billion (in 2007 dollars) (4). The largest components of medical expenditures are hospital inpatient care (43% of the total medical cost), prescription medications to treat the complications of diabetes (18%), antidiabetic agents and diabetes supplies (12%), physician office visits (9%), and nursing/residential facility stays (8%).

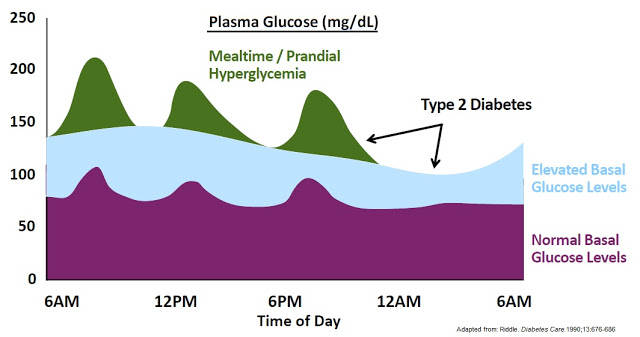

Managing DiabetesDiabetes is a chronic disease, for which there is no known cure. The primary goal in the treatment of diabetes is the improvement of glucose homeostasis by appropriately raising insulin levels (either enhanced release of endogenous insulin or pharmacological provision of insulin or slowing insulin breakdown) and attempting to restore insulin responsiveness, or by decreasing the absorption or production of glucose or enhancing glucose clearance. The clinical disease is managed by monitoring blood glucose levels, trying to avoid both hyperglycemia (high blood sugar) and hypoglycemia (low blood sugar), both between and after meals.Normally, the hormone insulin is secreted by the pancreas. When you eat a meal, carbohydrates (sugars) from food stimulate the pancreas to release insulin. Generally speaking, the amount that is released is proportional to the amount of carbohydrates in that particular meal. Insulin’s main role is to help move certain nutrients, mainly sugar, into the cells of the body’s tissues. Cells use sugars and other nutrients from meals as a source of energy to function. In non-diabetic individuals, the pancreas is able to appropriately increase or decrease the secretion of insulin and other hormones in response to the blood glucose level to maintain a relatively constant amount of sugar in the blood. Hence, as insulin transports sugar into the cells and the glucose load diminishes, the pancreas lower the amount of insulin secreted so that low blood sugar (hypoglycemia) does not develop.But the destruction or loss of sensitivity of the pancreatic beta cells that occurs in patients with diabetes disrupts this process. In people with diabetes, insulin is not available to transport sugar into the cells. The result is that sugar builds up in the blood, causing hyperglycemia. Because the sugar is not able to enter cells effectively, the body’s cells are starved for nutrients. Thus, other systems in the body must provide energy for important bodily functions.

Hyperglycemia can cause dehydration due to increased urination as the kidneys are unable to handle the increased amounts of glucose in the body. This may result in weight loss due to the frequent urination (caloric wasting). In the absence of insulin, the inability of the body to take up sugar (calories) and turn it into energy may further contribute to malnutrition and weight loss. If the insulin deficiency reaches a critical point, the body breaks down fat cells for energy in the absence of the ability to turn sugar into energy. A by-product of this metabolic pathway is the production of acidic molecules called ketones. The production of sugar by the liver in response to these ketones and to the perception of glucose starvation leads to further hyperglycemia and only compounds the problem. The combination of dehydration, frequent urination, and acid build-up in the body is known as diabetic ketoacidosis (DKA). DKA is the severe manifestation of insulin deficiency but is a relatively common occurrence and cause for acute symptoms, including hospitalization, in diabetics.

Over time, hyperglycemia and ketoacidosis can create damage to the nerves and small blood vessels of the eyes, kidneys, and heart, leading to several important health complications. According to the American Academy of Ophthalmology (AAO), over 80% percent of all diabetics will develop diabetic retinopathy after 15 to 20 years (7). Diabetes is the leading cause of blindness in the U.S. Kidney damage is also common. Diabetes accounts for 44% of all primary causes of kidney failure in the U.S. (8).

– Insulin Therapy

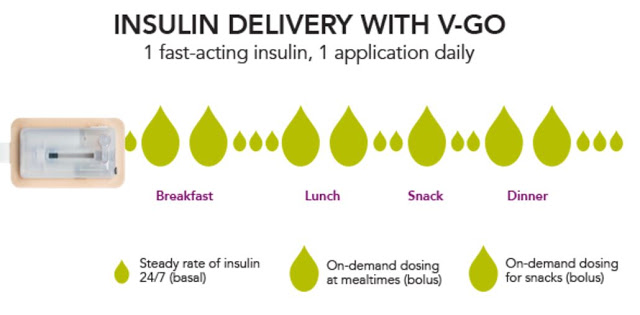

Exogenous insulin is standard of care for Type-1 and some Type-2 diabetics. Individuals with diabetes can mimic a healthy pancreas function by delivering background insulin (basal insulin) and insulin as needed prior to or following meals (bolus insulin). Basal insulin is the background insulin that is normally supplied by the pancreas and is present 24 hours a day, whether or not the individual eats.

For individuals with severe diabetes, the basal insulin secretion may be insufficient to control the continuous glucose output from the liver, thus administration of exogenous insulin is necessary to prevent hyperglycemia. There are 20+ different types of exogenous insulin sold in the U.S. They differ in how they are sourced, chemical makeup, duration of action, mode of administration, and dosing strategy. Two of the most commonly used rapid-acting insulins are insulin lispro (Humalog® – Eil Lilly) and insulin aspart (NovoLog® – Novo Nordisk), each with generated approximately 4 million prescriptions in 2015 (10). As noted above, the U.S. CDC estimates the number of Americans on insulin therapy, with or without separate oral medications, is approximately 8 million.

– Challenges of Injectable Insulin Therapy

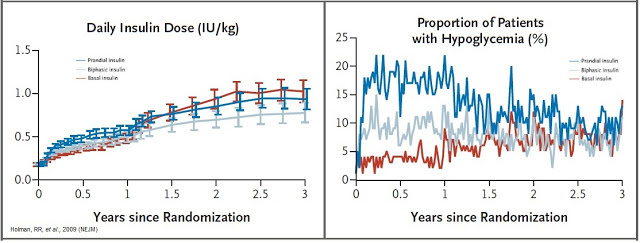

The central problem with exogenous insulin therapy is picking the right dose of insulin and the right timing to dose the insulin. Physiological regulation of blood glucose, as in the non-diabetic, would be best. Even the best diabetic treatment with synthetic human insulin or insulin analogs, however administered, falls far short of normal glucose control in the non-diabetic. Diabetics also tend to require increasing doses of insulin with disease progression. According to work published in the New England Journal of Medicine in 2009, 82% of Type-2 diabetics require supplemental prandial insulin on top of basal insulin to achieve adequate glycemic control (A1C goal of ≤ 7%) (11).

Getting the right dose of insulin is paramount to maintaining adequate glycemic control. Too much insulin and the patient risks hypoglycemia, which can lead to confusion, loss of consciousness, seizures, or death. Not enough insulin and the patient risks hyperglycemia, which can lead to nerve damage, kidney damage, atherosclerosis, and eye damage. A study published in Diabetes Care in 2011 found that only between 35-64% of Type-2 diabetics achieve A1C target of < 7% while on biphasic insulin. The numbers are even lower for only prandial or only basal insulin (12).

– Compliance Issues

Adherence to anti-diabetic medications may be the primary reason why less than 50% of diabetic patients achieve recommended glycemic goals. A retrospective analysis conducted by researchers at Eli Lilly found that adherence to insulin therapies was only 62% and 64% or long-term and new-start insulin users, respectively (13). Reasons for nonadherence to therapies include age, information, perception and duration of disease, the complexity of dosing regimen, polytherapy, psychological factors, safety, tolerability, and cost.

A separate retrospective study of nearly 28,000 diabetics identified using the HealthCore Integrated Research Database of medical and pharmacy claims for commercially insured patients found that only 20.4% achieved the recommended A1C goal of less than 7% (14). In fact, the majority of patients on insulin therapy still had an A1C level in excess of 9% (15)

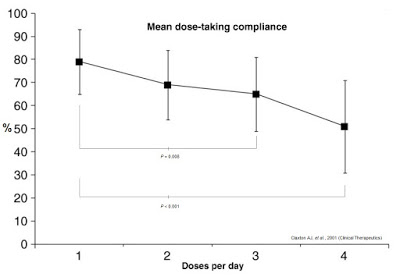

Frequency and complexity of dosing play a major role in anti-diabetic therapy non-compliance. Work published in Clinical Therapeutics in 2001 (shown below) found that daily compliance rates for medications were inversely correlated to the number of doses per day (16). Mean dose-taking compliance for TID (3x daily) dosing was found to be only 65±16%. TID dosing is analogous to injecting insulin before each meal: breakfast, lunch, and dinner (17). Many diabetics inject bolus insulin four times a day (QID), adding the fourth shot before bedtime. Claxton AJ, et al. found this compliance rate to be only 51±20%.

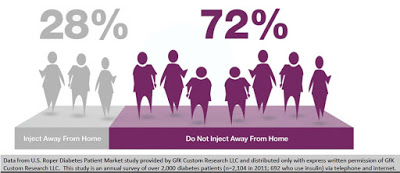

Discretion of dosing is yet another important factor that leads to non-adherence. Data from U.S. Roper Diabetes Patient Market study, a survey of 2,104 diabetes patients in 2011 conducted by Gfk Custom Research LLC, found that 72% of insulin-using diabetics do not inject away from home (18). This may be because of the need to carry around supplies, or the lack of needles when necessary, or simply because patients do not want to advertise their disease in public. The stigma of diabetes or simply using a needle in public to control an unknown disease is powerful. Nevertheless, whatever the reason, it is clear that non-adherence, convenience, and discretion are major driving factors for insulin-dependent diabetics.

V-Go® – Revolutionizing Insulin Treatment

Valeritas Holdings, Inc. is a commercial-stage medical technology company focused on developing innovative technologies to improve the health and quality of life of people with Type-2 diabetes. The company’s first FDA-approved product is V-Go Disposable Insulin Delivery Device (“V-Go”). V-Go is designed for patients with Type-2 diabetes who require daily insulin to achieve and maintain their target blood glucose goals. It is the first and only FDA-approved single-use, fully-disposable insulin delivery device with basal (background) and bolus (mealtime) capabilities on the market in the U.S.

V-Go solves many of the challenges with conventional insulin therapy noted above.

– V-Go is small and discreet. The tiny device can be worn on the upper arm or along the waist underneath a shirt. Type-2 diabetics can dose insulin prior to a meal without having to carry around needles, pens, injectors, sterilizing wipes, or bottles of insulin. Users of the product report they can dose in public without anyone knowing.

– V-Go is easy to use. Once applied to the skin, each device delivers a steady flow of insulin over a 24 hour period.

– V-Go is convenient. The product is available at pharmacies across the U.S., similar to other prescription medications, including insulin pens and injectors.

– V-Go is cost effective. The device costs roughly the same as traditional insulin pens and applicators to both patients and payors.

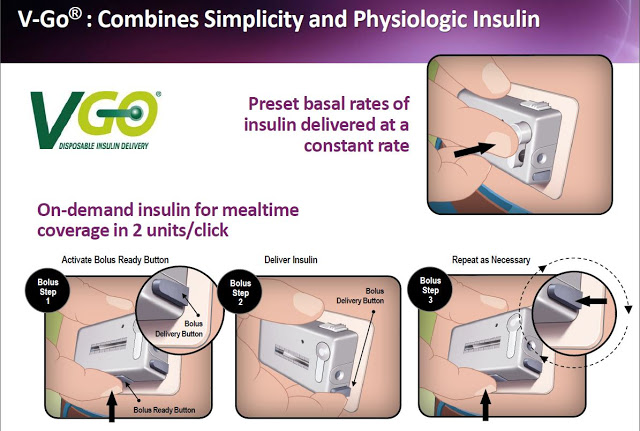

The concept of V-Go is simple and efficient. The device is small enough and easy enough to use that it can be worn under a shirt or blouse without anyone knowing it is there. There are no beeps or alerts or special procedures that the patient must perform to operate the device. The patient fills a new disposable device each morning with a rapid-acting insulin of their choice (e.g. Humalog or Novolog) and then adheres V-Go to their skin. Once activated by simply pushing down a button on the top of V-Go, the device immediately starts delivering insulin at a continuous rate over 24 hours that enables patients to closely mimic the body’s normal physiologic pattern of insulin delivery throughout the day. This allows patients to manage their diabetes without the need to plan a daily routine around multiple daily injections.

Patients can give themselves bonus injections during mealtime by simply pushing a button on V-Go. And importantly, this can be accomplished without seeing the device or broadcasting their disease to the world through needles, pumps, or pens in public. The slide below shows the simple steps a patient follows with V-Go once filled at home.

Each disposable device provides a steady rate of insulin, with the potential for bolus injections during mealtime or a snack, with one daily application.

And Valeritas has generated the clinical data to prove that V-Go is effective in helping patients reduce A1C. The following slide from the Valeritas investor presentation highlights ten clinical studies that have taken place with V-Go showing the product helps patients reduce A1C by clinically meaningful levels (-0.5%). In fact, the average reduction in A1C from baseline in the ten clinical studies noted below was 1.9%. For reference, a paper published in the British Medical Journal by researchers out of Oxford University found that for every 1% reduction in A1C, the incidence of clinical complications from diabetes such as death, heart attack, microvascular complications, and peripheral vascular disease dropped by 21%, 14%, 37%, and 43% respectively (19).

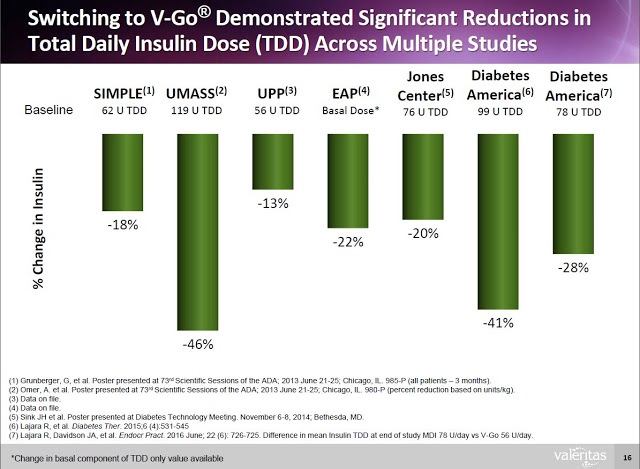

Additionally, clinical data (peer-review and on file) shows that Type-2 diabetics can switch to V-Go from multiple daily injections (MDI) and get better A1c control with actually using less insulin.

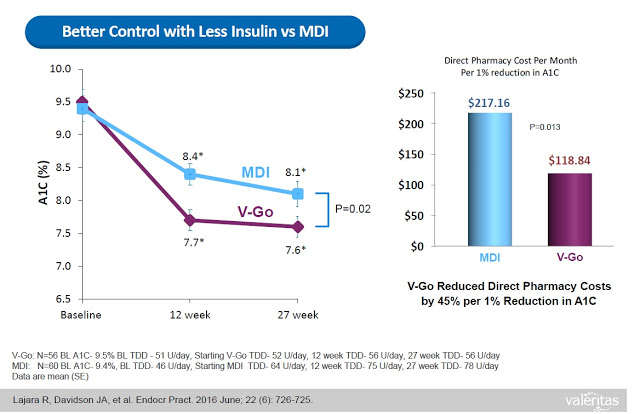

This represents a significant benefit to both patients and payors. Data from a retrospective study of patients that transitioned to V-Go in a real-world clinical setting shows that patients on V-Go (n=56) saw a mean change in baseline A1C of -1.98% vs. a mean change of only -1.34% for patients that used multiple daily injections (n=60). The V-Go patients used less insulin per day (56±17 units/day vs. 78±40 units/day, P<0.001) to achieve the better A1C control results, which resulted in a direct cost savings of nearly $100 per month ($118.84 vs. $217.16) at the pharmacy (20).

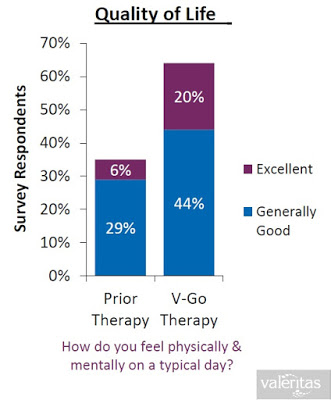

When all of the above are taking into consideration (i.e. the convenience, the discretion, the simplicity, the lower insulin costs, and the improved clinical effects), it is not surprising to see that Valeritas market research shows V-Go is a product patients truly believe improves their quality of life.

The Business To Date

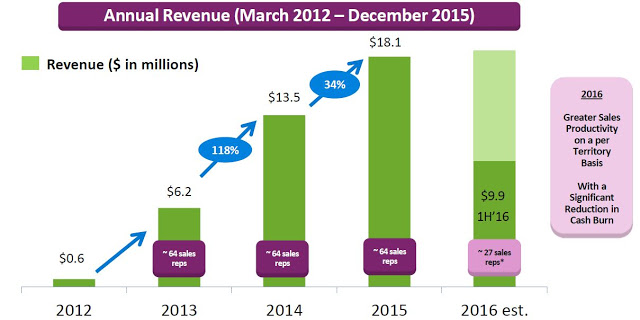

Valeritas recently reported financial results for the second quarter ending June 30, 2016. Total revenues in the quarter were $4.9 million, up 6.2% from the $4.6 million reported in the second quarter 2015. Revenues for the first half of the year totaled $9.9 million, a 13.0% increase from the first six months of 2015. On the second quarter conference call, management stopped short of giving specific guidance for 2016, only stating that total revenues for the full year will likely be flat to slightly up compared to the $18.1 million reported in 2015.

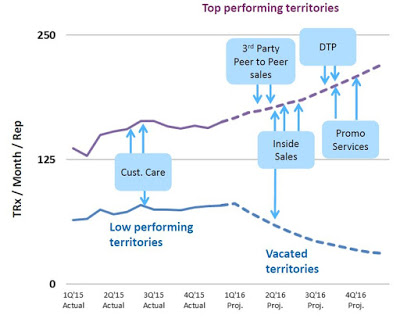

On the surface, this is nothing to get excited about; but, Valeritas is going through a transition as they have moved to a more capital efficient model. Starting in early 2013 up until February 2016, the company employed over five dozen sale representatives. In fact, throughout 2015 the company promoted V-Go with up to 64 representatives with an average of 59 territories filled throughout the year around the U.S. The thinking was that to effectively compete against blockbuster products like Lantus® and Levemir®, each which are promoted by over 1,000 full-time reps, V-Go would need to build a sizable sales force.

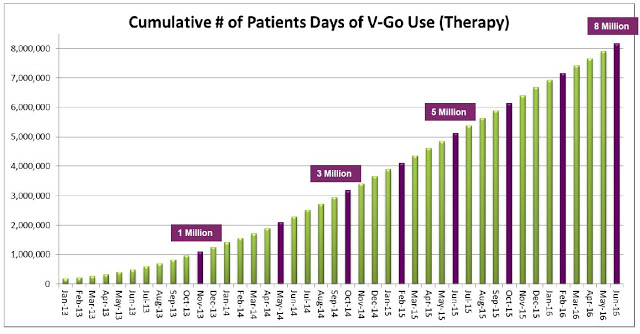

Unfortunately, while the strategy was effective and ramping up sales and use of the product, the business model was not profitable. The gross margin during the second quarter 2015 was only 13.9% and net loss totaled $16.2 million. Today, Valeritas has cut the size of its sales force by over 60%. In fact, on the second quarter call management noted the number of territories has been reduced to 28. The strategy going forward will be to focus on fewer high volume territories and drive sales rep productivity. Additionally, as the number of units sold increases (see chart below), management has been able to see the gross margin increase as well. Gross margin in the second quarter 2016 totaled 35.3%.

Management estimated 92,000 V-Go prescriptions were written in 2015 to an estimated 11,500 patients. Assuming 37 units per script (the current number), this equates to roughly 3.4 million total units sold. The roughly $5 million in revenue in the second quarter was derived from approximately 23,000 prescriptions. The current manufacturing capacity of the product supports over $100 million in revenue and management believes the business can achieve breakeven operations at around $60-75 million in annual revenue.

The current revenue trajectory is a balancing act between driving increased use in high performing areas while minimizing the loss of vacated territories. Beyond the reps in the field, the company is utilizing an inside sales team, third party call teams, focused promotional spend, and targeted direct-to-patient advertising. The net result is a greater emphasis on high volume prescribers and patients, with a less capital-intensive model.

– The Upside

The investment thesis around Valeritas centers on the company’s ability to drive increased uptake of V-Go through more focused and efficient promotion. This should allow for a reasonable path to positive cash flow. The old business model of pounding the street was clearly not going to get Valeritas to breakeven. The new model is far more strategic. It allows for increased focus and frequency of contacts with prescribers in high volume areas while cutting expenses in territories where the company was seeing a less efficient uptake of the device.

The upside is pretty clear. The CDC estimates there are 8 million diabetics in the U.S. on daily insulin therapy. Work published in the NEJM estimates only 35-64% of these patients are achieving their recommended A1C goal. Compliance with recommended dosing regimens is only 62-64%, and roughly 72% of individuals do not want to dose outside their home. V-Go helps patients get to goal and solves the compliance and discretion issues. There were roughly 11,500 patients on V-Go in 2015. The target market is between 3 and 4 million. There were 92,000 million prescriptions in 2015. Lantus and Levemir totaled 8 million prescriptions.

Conclusion

In the coming weeks, I will be continuing to take a look at Valeritas and its main product, V-Go Disposable Insulin Delivery Device. The company has some very interesting growth plans in the coming years, including offering a prefilled V-Go device, expanding V-Go sales outside the U.S. through commercial partnerships and collaborations, and leveraging the H-patch technology platform that V-Go is built upon to tackle other diseases where a constant daily flow of medication delivered subcutaneously might offer an improved solution for patients.

Over the near-term, the focus is on improving reimbursement and patient access to the device, which is actually not a device (i.e. it’s not “durable medical equipment”) and instead covered like a drug by private plans and under Medicare Part D. In fact, 90% of the sales are through wholesalers such as Cardinal Health, MeKesson, and AmeriSourceBergen. The product is available at local pharmacies, and as of the end of July 2016, management reports 70%+ reimbursement on commercial plans and 60%+ under Medicare. I’ll tackle the reimbursement and pharmaco-economics of V-Go for investors in a separate article.

I also plan to tackle the most important question for investors – What’s Valeritas Worth? In the meantime, the current market value of Valeritas, which came public via a public offering in May 2016 is $65 million. Assuming the company reports revenues in 2016 of $20 million (essentially doubling the revenues from the Q1 + Q2), the current Price-to-Sales ratio of 3.2X in 2016 revenues looks cheap compared to the average “big med-tech company” (21). This essentially means investors can purchase Valeritas today and any upside to the revenue numbers over the next few quarters should result in out-performance of the stock.