How Nuvo Research Splitting Into Two Companies Is A Win-Win For Shareholders

Last week, Nuvo Research Inc. (NRI.TO) mailed a Management Information Circular to shareholders explaining the impetus and logistics for the planned separation of the company into two separately traded entities, a specialty pharmaceutical business to be called Nuvo Pharmaceuticals Inc., and a drug development business to be called Crescita Therapeutics Inc. The split into two separate publicly-traded companies was initially announced on September 15, 2015, and received unanimous approval from the company’s Board of Directors. Nuvo Research Inc. shareholders have been asked to attend the special meeting to be held at the International Plaza Hotel, 655 Dixon Road, Toronto, Ontario, M9W 1J3 on February 18, 2016, to vote on the proposed split.

Management believes that separating the company into these two distinct businesses will provide a number of benefits to shareholders, Nuvo Pharma and Crescita. Nuvo Pharma and Crescita will pursue independent growth strategies, each having greater flexibility to allocate capital and focus the respective businesses on maximizing return for shareholders. The split will also allow each company to have a sharper focus, enabling investors, analysts, and potential strategic partners to more accurately compare and evaluate each company. This will also help provide business-specific incentives to management, enhancing each company’s ability to better attract, retain, and motivate key personnel.

The splitting of Nuvo Research Inc. into Nuvo Pharma and Crescita makes good strategic sense. I agree with management that separating the company into two distinct businesses should unlock value because right now investors I speak with are confused as to the key growth drivers for the company and how to accurately value the combined organization. Nuvo Research Inc. exited the third quarter ending September 30, 2015, with $50.8 million (CAD) in cash and investments ($35.5 million USD) and no debt. The market capitalization as of today is $65 million CAD ($45 million USD). Below I outline the potential growth drivers and take a stab at the potential valuation for each company. I conclude that there is significant value in Nuvo Research Inc. pre-split and believe long-term shareholders will be rewarded by participating in the transaction.

A Detailed Look At Nuvo Pharmaceuticals Inc.

The specialty pharmaceutical company, to be called Nuvo Pharmaceuticals Inc., will be comprised of a portfolio of commercial products and pharmaceutical manufacturing capabilities. Nuvo Pharma will have three commercial products that are available in a number of countries, Pennsaid®, Pennsaid® 2%, and the HLT Patch®. Nuvo Pharma will be focused on licensing the rights to Pennsaid 2% in those territories that are available as well as looking for new contract manufacturing opportunities and strategic acquisitions to increase the commercial product portfolio and to expand the corporation’s manufacturing capacity and capabilities.

Pennsaid 2% is a non-steroidal anti-inflammatory drug (NSAID) containing 2% diclofenac sodium compared to 1.5% for original Pennsaid. It is more viscous than original Pennsaid, is supplied in a metered dose pump bottle, and has been approved in the U.S. for twice-daily dosing compared to four times a day for Pennsaid for the treatment of pain of osteoarthritis (OA) of the knee.

The company owns extensive intellectual property around Pennsaid 2% that consists of over 30 issued and pending international patents, the bulk of which do not expire until 2029-2030. Nuvo Pharma will retain the current Pennsaid® 2% manufacturing and distribution agreement with Horizon Pharma plc (HZNP) for the U.S. market and the existing Pennsaid license and distribution agreements with Paladin Labs Inc. in Canada, Vianex S.A. in Greece, Italchimici S.p.A. in Italy, and Movianto UK Limited in the UK. Additionally, licensing agreements for Pennsaid 2% have been signed with Paladin Labs Inc. for Canada and NovaMedica LLC for Russia and the Community of Independent States. All future international licensing and distribution agreements for Pennsaid and Pennsaid 2% will be entered into by Nuvo Pharma.

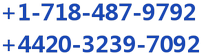

In June 2015, the company retained PricewaterhouseCoopers Corporate Finance Inc. (PWC) to assist it in securing international license agreements for Pennsaid 2%. Key regions available for out-licensing include South America, Central America, Africa, and Israel. The picture below shows the regions for which Pennsaid 2% is available for out-licensing and future potential sale. As investors can see, the available opportunity is significant.

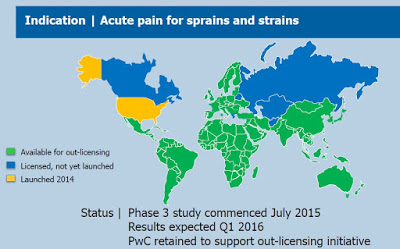

Pennsaid 2% was approved by the U.S. FDA in January 2014 and is currently being sold in the U.S. by Horizon Pharma. Horizon took over promotion for Pennsaid 2% in January 2015 after Nuvo regained the rights from previous development and commercialization partner, Mallinckrodt plc (MNK), in September 2014. Horizon paid Nuvo $45 million USD for the U.S. rights to the drug and continues to pay Nuvo a fixed transfer price for the commercial product (including any sampling that Horizon does) that Nuvo manufactures at its plant in Varennes, Quebec under a long-term exclusive supply agreement with the company.

According to IMS Health, approximately 97,000 and 204,000 Pennsaid 2% prescriptions were dispensed in the three and nine months ended September 30, 2015. The impressive growth of Pennsaid® 2% in the U.S. will translate into a growing and profitable revenue stream over at Nuvo Pharma.

Pennsaid and Pennsaid 2% product sales totaled CAD$5.0 million in the third quarter ending September 30, 2015. For the first nine months of the year, Pennsaid and Pennsaid 2% transfer sales totaled CAD$11.3 million. Revenues are being driven primarily by product shipped to Horizon Pharma. For the first nine months of the year, Horizon reported U.S. Pennsaid 2% sales of USD$91.6 million. Nuvo Research reported Pennsaid 2% product sales (to Horizon) of $9.3 million, so while not an exact science, Nuvo looks to be capturing around 11% of the reported USD end-user sales.

Horizon has not given individual product sales guidance for Pennsaid 2%, but research analysts that cover the company forecast U.S. Pennsaid 2% sales of USD$195 million in 2016 and USD$220 million in 2017 (source: Thomson-Reuters). This suggests to me that Nuvo Pharma will report Pennsaid 2% product sales in 2016 and 2017, assuming no other licensing transactions, of $21 million in 2016 and $23 million in 2017. However, an interesting phenomenon is having a material impact on Nuvo’s business, and that is the USD/CAD exchange rate. Horizon books and reports sales in USD. The transfer price paid to Nuvo Pharma is also in USD; however, Nuvo’s manufacturing plant is in Varennes, Quebec and the majority of expenses are paid in CAD. As the USD has materially strengthened against the CAD over the past year, Nuvo Pharma is capturing a higher margin on its operations. For example, in the third quarter 2015, when the USD/CAD rate averaged only 1.27, Nuvo reported CAD$0.8 million in foreign exchange gains

The USD/CAD rate is currently 1.45. Just this effect alone adds another 15% to the revenue line for Nuvo Pharma (at today’s rates), so it is likely that the Pennsaid 2% contribution from Horizon to Nuvo Pharma in 2016 will be $24 million. Besides Pennsaid 2%, Nuvo Pharma will continue to supply original Pennsaid to its commercial partners. Sales of Pennsaid totaled $2.1 million for the first nine months of 2015. Sales are declining due to patent expirations, the entry of generics, and transferring of marketing efforts over to Pennsaid 2%. Royalties on Pennsaid totaled $0.6 million for the nine months ending September 30, 2015. Royalties are received from Paladin Labs in Canada. Royalties are declining due to the emergence of generic diclofenac sodium in Canada. Paladin is also the Canadian commercial partner for Pennsaid 2%. Nuvo Pharma will also continue to sell Synera and HLT Patch, which generated just over $0.1 million in sales during the first nine months of the year.

Nuvo Pharma’s goal is to continue to help Horizon by providing Pennsaid 2% as the ramp gains steam throughout 2016. The manufacturing markup has not been disclosed by Nuvo management, but investors can see the gross margin line at Nuvo has been steadily improving. Management posted a pro forma income statement in the Information Circular mailed to shareholders last week. For the first nine months of the year, Nuvo Pharma would have reported $12.8 million in revenue and $2.6 million in EBITDA. The company has also released unaudited revenues for the fourth quarter and full year 2015 in a press release last week. For the full year 2015, the company sees revenues of CAD$21 million, CAD$7.5 million of which came in the fourth quarter of the year. That’s 32% sequential increase in revenues, and it is primarily coming from the growth of Pennsaid 2% in the U.S. at Horizon Pharma.

To gain approval for Pennsaid 2% outside of the U.S., management initiated a Phase 3 study of Pennsaid 2% for the treatment of acute pain in July 2015. It is important to note that the U.S. label is for the treatment of the pain of osteoarthritis of the knee(s). The Phase 3 study being conducted in Germany will evaluate the efficacy of Pennsaid 2% for the relief of pain associated with acute, localized muscle or joint injuries such as sprains, strains or sports-related injuries. This is a wider label indication than in the U.S. The company posted an update in December 2015, noting that the trial was near full enrollment and that data was expected in the first quarter of 2016.

Positive data will allow Paladin Labs to seek approval for Pennsaid 2% in Canada and position Nuvo Pharma to sign licensing and distribution agreements for Pennsaid 2% in Europe that will likely come with upfront cash and the potential for additional milestones or royalties in the future.

I expect management to look to expand Nuvo Pharma by acquiring businesses or products that can be nicely fit into the planned manufacturing and licensing strategy. This may include small contract manufacturing organizations (CMOs), other topical products that can be manufactured at the company’s plant in Varennes, Quebec, or commercial divisions from larger organizations that might be a better fit at a small company like Nuvo. I also see the potential that Nuvo Pharma looks to manufacture or distribute OTC products or generic products. The manufacturing capacity at Varennes seems more than adequate, with plenty of room to expand, and thus management’s strategy to strategically expand – in whatever direction – makes excellent sense.

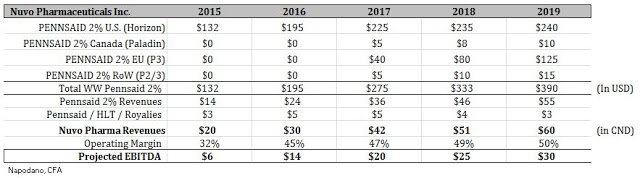

From an operational standpoint, I don’t see Nuvo Pharma having much overhead besides the plant in Varennes. The Information Circular notes that approximately $35 million in cash will be spun-out to Crescita Therapeutics. That means Nuvo Pharma will be capitalized with at least $10+ at the time of the closing of the transaction. Based on the current trajectory, I believe Nuvo Pharma will post revenues of approximately $28-30 million in 2016. This is in-line with the thinking I’ve outlined above. Based on the improving margins and ramp in Pennsaid 2% revenues, it is likely Nuvo Pharma will post EBITDA in 2016 of approximately $14 million based on the existing businesses. Below I’ve put together a quick revenue and EBITDA ramp for investors to get a sense of what I think Nuvo Pharma will look like in the coming years.

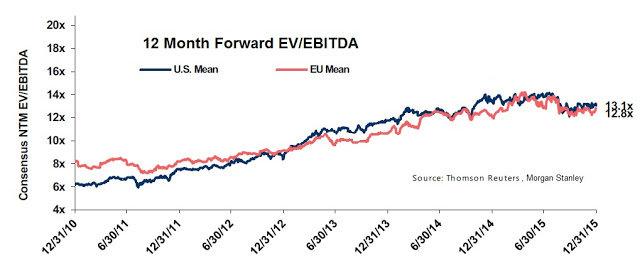

As investors can see, based on the projected ramp of Pennsaid 2% around the globe, Nuvo Pharma should be quite profitable and post some impressive growth on an EBITDA basis in the coming years. From a valuation standpoint, we can now get a sense of what Nuvo Pharma is worth. For example, according to data from Thomson-Reuters, put together by Morgan Stanley, specialty pharmaceuticals trades with an enterprise value (EV) as a group at approximately 13x EBITDA.

This may be an aggressive assumption for a company like Nuvo Pharma that does not commercialize any of its own drugs. It’s also the current valuation, whereas the five-year average from the chart above is roughly 9x EBITDA. Perhaps more relevant to Nuvo Pharma, companies that manufacture products for other companies (CMO’s) and companies that make generic pharmaceuticals trade at approximately 8x EBITDA today, or around 6x EBITDA based on the historical five-year average. If we take the most conservative approach and value Nuvo Pharma at 6x EBITDA, the company is worth approximately CAD$94 million in value (6*$14 million + $10 million cash). Again, this is the most conservative approach. Once could argue a multiple of 7-8x is more appropriate, putting the value of Nuvo Pharma at potentially CAD$120 million.

A Detailed Look At Crescita Therapeutics Inc.

Once separate from Nuvo Pharma, Crescita Therapeutics will be a biotech company with a portfolio of products and platform technologies. Crescita will operate two distinct business units: the TPT Group and the Immunology Group. The TPT Group will have one commercial product, Pliaglis®, that is licensed globally and a pipeline of topical and transdermal products focusing on various therapeutic areas, including pain and dermatology, and multiple drug delivery platforms that support the development of patented formulations that can deliver actives into or through the skin. The Immunology Group will have two commercial products, Oxoferin® and WF10. As noted above, Crescita will be seeded with approximately CAD$35 million in cash upon closing of the spin-out, which management estimates will be sufficient to fund operations and planned development activities for up to 24 months.

The TPT Group (Topical Products and Technology Group) will develop drugs for a variety of therapeutic areas with a focus on dermatology and pain. The strategy of the TPT Group will be to in-license commercial or late stage assets as well as develop drugs internally that can be commercialized with a small, focused, sales force in North America, and out-license in the rest of world to partners who will sell the products in their respective territories. Investors should keep in mind, this is the group that developed Pennsaid and Pennsaid 2%, so there is a proven track record here. The TPT Group will have one commercial topical product, Pliaglis, and multiple proprietary drug delivery platforms, which include Multiplexed Molecular Penetration Enhancer (MMPE) and DuraPeel™.

Pliaglis is a topical local anesthetic cream that provides safe and effective local dermal anesthesia on intact skin prior to superficial dermatological procedures, such as dermal filler injection, pulsed dye laser therapy, facial laser resurfacing and laser-assisted tattoo removal. The product contains lidocaine and tetracaine and utilizes proprietary phase-changing topical cream Peel technology. The Peel technology consists of a drug-containing cream which, once applied to a patient’s skin, dries to form a pliable layer that releases a drug into the skin.

Up until December 2015, Galderma held the worldwide sales and marketing rights for Pliaglis. Under the terms of the licensing agreement, Crescita earns royalties on the net sales of Pliaglis. Nuvo Research previously earned milestone payments from Galderma for receipt of specified approvals and the occurrence of certain launches, but these have all been earned and paid. Galderma is responsible for manufacturing Pliaglis. In December 2015, Nuvo reacquired the development and marketing rights for Pliaglis for the U.S., Canada and Mexico. Under the terms of the agreement, Nuvo paid Galderma 125,000 Swiss Francs (approximately CAD$174,000) and will pay an additional 125,000 Swiss Francs (approximately CAD$174,000) upon transfer of certain rights and documents. Beginning in 2021, Crescita has the right to reacquire the remaining global rights on a country-by-country basis without additional compensation if Galderma does not achieve minimum sales targets. Galderma will continue to market Pliaglis in the U.S. and Canada and pay a royalty on net sales during a transition period. Crescita will receive a fixed single digit royalty on net sales in the territories outside of North America that Galderma still owns.

Pliaglis was launched in the U.S. market in March 2013 and in the E.U. in April 2013. In the E.U., the regulatory approval required a post-approval commitment study, the cost of which will be shared equally by Galderma and Crescita. In South America, Pliaglis is approved and marketed in Brazil, Argentina, and Columbia. Pliaglis was launched in Brazil in March 2014. Pliaglis is also approved and marketed in Canada. Galderma is currently seeking approvals in additional countries. Royalties from Pliaglis in 2014 totaled approximately $0.2 million. For the first nine months of 2015, the royalties from Pliaglis totaled approximately $0.2 million.

As noted above, Crescita will have a broad portfolio of development stage products and proprietary platform technologies, including MMPE and DuraPeel. MMPE is a technology that uses synergistic combinations of pharmaceutical excipients included on the FDA’s Inactive Ingredient Guide for improved topical delivery of actives into or through the skin. The benefits of this technology include the potential for increased penetration of APIs with the possibility of improved efficacy, lower API concentration and/or reduced dosing. The DuraPeel technology is self-occluding, film-forming cream/gel formulations that provide extended release delivery to the site of application. The benefits of the DuraPeel technology include proven compatibility with a variety of active pharmaceutical ingredients (API), the self-occluding film reduces product transference risk, a fast drying time and easy application and removal and application to large and irregular skin surfaces.

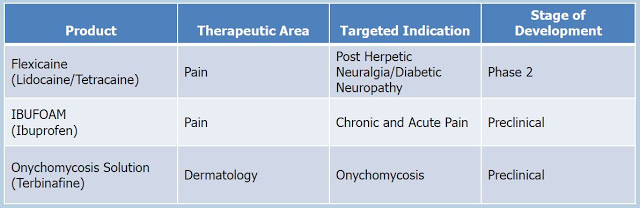

Crescita’s goal is to develop products on its own and also actively seek co-development partners to help advance its pipeline products and fund some or all of their development. Below is a snapshot of the Crescita pipeline within the TPT Group.

The three key assets are Flexicaine®, Ibufoam®, and an onychomycosis solution. Crescita will also have I briefly discuss each of these programs below:

1) Flexicaine is a 7% lidocaine / 7% tetracaine topical phase-changing cream under development for diabetic peripheral neuropathy and postherpetic neuralgia. The product is designed to be a more effective option than Lidoderm®, a product that posted sales of $825 million in the U.S. at Endo Pharma in 2011 before the patient expiration. Crescita plans on conducting a Phase 2 proof-of-concept study using Flexicaine for the treatment of postherpetic neuralgia after the split.

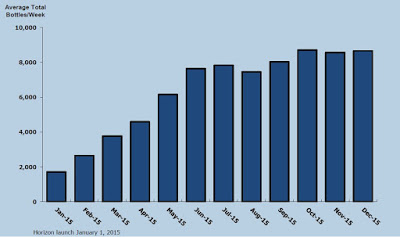

2) Ibufoam is a topical DMSO-based foam that contains ibuprofen, a commonly used NSAID. Crescita plans on conducting a Phase 2 clinical study in Germany for the relief of pain associated with acute, localized muscle or joint injuries such as sprains, strains or sports injuries in 2016 pending regulatory approval to conduct this study from BfArM (the Germany regulatory authority). The topical NSAID market, of which Pennsaid 2% is now a major player along with Voltaren® Gel, is an estimated $400-500 million market in the U.S. Ibufoam would be the first U.S. non-patch topical NSAID for acute pain and the first such NSAID product to use ibuprofen (Pennsaid and Voltaren both use diclofenac).

3) Onychomycosis is a fancy way of saying toenail fungus. Crescita plans to develop a topical terbinafine solution that has improved efficacy over currently available antifungal agents used for onychomycosis. The key competitors here is Jublia®, sold by Valeant Pharmaceuticals and Kerydin®, sold by Novartis. It’s an estimated $500 million market in the U.S.

The Immunology Group, based in Leipzig, Germany, is focused on developing drug products that modulate chronic inflammatory processes resulting in a therapeutic benefit. Such pathological, inflammatory processes play an important role in the onset of several diseases including allergic rhinitis, allergic asthma, rheumatoid arthritis and inflammatory bowel diseases. The two key assets are Oxoferin and WF10. These products are produced in the company’s small manufacturing facility in Wanzleben, Germany.

WF10 was the lead pipeline asset of the Immunology Group up until December 2015. Nuvo Research was previously developing WF10 as a treatment for allergic rhinitis. Unfortunately, in January 2015, the company reported disappointing results from a Phase 2b allergic rhinitis study conducted at 15 sites entirely in Germany. The data showed that the WF10 arm demonstrated a reduction in TNSS over the course of the observation period but the results were not statistically significant compared to placebo. The company hypothesized that the mild allergy season in Germany during the course of the trial may have limited the effectiveness of WF10 relative to placebo, so management decided to conduct one further study in patients where the exposure to allergens can be controlled in an environmental exposure chamber (EEC). The trial was conducted during the second half of 2015 at a facility in Ontario, Canada. Results of this study were reported in December 2015 and again were disappointing. Separation from placebo was not observed. Accordingly, future development of WF10 for allergic rhinitis has been discontinued.

Oxoferin, a topical wound healing agent, contains the same active ingredient as WF10, but at a lower concentration. Chronic, hard-to-heal wounds are a serious problem with an increasing incidence. Oxoferin is marketed by NMG and its partners in parts of Europe and Asia as a topical wound healing agent under the names Oxoferin and Oxovasin. The product is licensed to Sun Pharma for Malaysia, the Philippines, Vietnam, Singapore and other Indochina countries and Algeria, Tunisia and Morocco. In 2014, Sun Pharma received approval to market Oxoferin in Morocco, Malaysia and the Philippines and has launched in these territories. Crescita plans to work on an improved formulation of Oxoferin with enhanced wound healing abilities. Product sales Crescita are expected to be approximately $0.5 million in 2016.

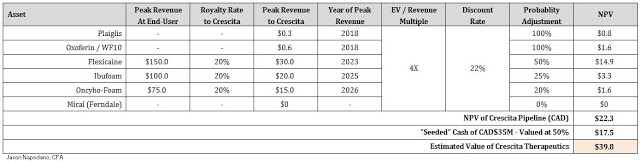

Valuing Crescita is a more difficult task than valuing Nuvo Pharma. Nuvo Pharma is relatively straight-forward. The company has revenues and projected EBITDA. Using some reasonable assumptions and historical multiples, I conclude that Nuvo Pharma should trade with an enterprise value of approximately CAD$94 million. Crescita is more difficult because we are valuing the pipeline. Yes, Crescita will have a few commercial products in Pliaglis and Oxoferin, but most of the value lies in the company’s ability to advance and monetize products like Flexicaine®, Ibufoam®, and the onychomycosis solution. I do not see the Immunology Group as a core part of the Crescita strategy beyond the split.

The good thing for shareholders is that there is a strong history of value-creating business development activities at Crescita. Ibufoam looks like a nice alternative product to Pennsaid or Voltaren Gel. This team partnered Pennsaid for $45 million USD in October 2014 with Horizon Pharma and it now looks like Horizon will deliver close to $200 million in end-user sales in the U.S. in 2016. Flexicaine, currently in Phase 2 trials, is the most advanced asset at Crescita and being designed as a superior alternative to Lidocaine Patch, a product that Endo Pharma achieved peak sales in the U.S. of $825 million at one point. Finally, the onychomycosis market in the U.S. is approximately $500 million in size. Although products like Jublia and Kerydin will be tough competition, there is a strong history of interest from big pharma in this area and the deals have been quite favorable for licensees. For example, Anacor out-licensed Kerydin to Novartis for $65 million just a few weeks after U.S. approval in July 2014.

To value Crescita, I’ve gone with a probability-adjusted future EV-to-Revenue model, applying a forward multiple on highly-discounted future peak sales for each asset. According to the same work referenced above by Morgan Stanley, using Thomson-Reuters data, the average EV-to-Revenue multiple for the specialty pharmaceutical industry over the past five years is approximately 4x (5x for specialty pharma and 3x for generic pharma). The rest of my assumptions can be seen in the table below.

Crescita will be seeded with CAD$35 million in cash ($24 million USD); however, for the purpose of my valuation model I am only attributing 50% of this value to my NPV. Based on the Management Information Circular, Crescita is burning cash at a rate of approximately CAD$1 million per month. I suspect the company will likely continue to burn cash for the foreseeable future, and will require much of that CAD$35 million to move the key pipeline assets forward. As such, I believe 50% value for the cash on hand is appropriate. Based on the above assumptions, I see Crescita Therapeutics worth approximately CAD$40 million in value.

Conclusion

The separation of Nuvo Pharmaceuticals and Crescita Therapeutics should allow each company to pursue independent and more focused growth strategies. With more focused strategic goals, each company can better allocate capital and attract and retain key management to execute on their respective business plan. This enables investors, analysts, and potential strategic partners to more accurately compare and evaluate each company, and should lead to higher reward shareholders.

Currently, Nuvo Research Inc. is stuck in the middle between pursuing EBITDA-positive commercial opportunities and high risk / high reward product development opportunities. Together, the market is only valuing the company at approximately $65 million CAD. My analysis shows that separately, Nuvo Pharmaceutical and Crescita Therapeutics are worth $94 million and $40 million, respectively. Thus, as separate organizations, I see as much as 105% upside post-split, with significantly more upside in the future as each company executes on their respective plans.