In March 2016, I wrote an article on BioSig Technologies, Inc. (BSGM) and why I believe the company’s electrophysiology recording platform, PURE EP™ System, is positioned to change the market. Investors can read that article >> LINK.

A lot has happened since my first article on BioSig came out. The company recently raised cash and is targeting an uplist to the NASDAQ or NYSE later in 2016. In April, Abbott Labs agreed to acquire St. Jude Medical, a major player in electrophysiology (EP) with approximately 35% market share. Consolidation remains hot in this segment of the industry. But most importantly, researchers at the Mayo Clinic presented pre-clinical data at the International Dead Sea Symposium (IDSS) demonstrating the utility of PURE EP™ System. Below is a quick update on BioSig, as well as a review of the data presented at IDSS.

Quick Review Of BioSig

I recently came across a presentation by BioSig Founder & Executive Chairman, Ken Londoner, to a group of investors at the Drexel Hamilton Micro-Cap Investor Forum held on May 12, 2016. I’m sharing this because I think it is a very good overview of the company and the opportunities that lie ahead. Unfortunately, it’s only an audio presentation, but investors can grab the most recent investor presentation and follow along easily with Mr. Londoner.

Audio presentation >> LINK (22 mins)

May Investor Presentation >> LINK (21 slides)

BioSig Technologies is a Minnesota-based medical device company developing a proprietary technology platform designed to improve the rapidly growing multi-billion dollar electrophysiology (EP) marketplace. The company’s leading product is PURE EP™ System, a surface electrocardiogram (EKG) and intracardiac multichannel recording and analysis system designed to assist electrophysiologists during catheter ablation procedures to treat cardiac arrhythmia.

An electrophysiology study (EPS) is a diagnostic procedure performed by a specialized cardiologist, called an electrophysiologist, with the intent to understand the nature of an abnormal heart rhythm. An EPS takes place in an electrophysiology lab, usually under mild sedation. The procedure usually last several hours during which time an immense amount of information is recorded and analyzed. The primary diagnostic signals during an electrophysiology study are electrocardiogram (ECG) and electrogram or intracardiac (IC). This cardiac mapping allows the electrophysiologist to locate where arrhythmias are coming. Once identified, these targets can be eliminated during cardiac ablation.

Atrial fibrillation (AF) is the most common form of complex arrhythmia. The rapid, abnormal firing of electrical impulses causes the atria to quiver or beat in a chaotic (irregular) fashion. This causes the ventricles to pump the blood ineffectively throughout the body. According to the American Heart Association (AHA), an estimated 2.7 million Americans are living with AF. Untreated AF doubles the risk of cardiovascular-related death and causes a 4-5-fold increase in the risk of stroke (source: AHA). According to the U.S. Center for Disease Control and Prevention (CDC), more than 750,000 hospitalizations and 130,000 deaths occur each year in the U.S. because of AF. AF is the underlying cause for 15-20% of ischemic strokes and costs the U.S. an estimated $6 billion in direct medical expense each year.

The primary treatment options for AF include procedures designed to control the heart’s rhythm and rate, medications to reduce the workload of the heart, and/or medications to prevent the formation of clots to reduce the risk of stroke. For many patients, pharmaceutical options are not sufficient to control the arrhythmia. In these patients, pacemakers or cardiac defibrillators may be surgically implanted to provide low-energy pulses to the heart to restore rhythm and monitor the heart to prevent sudden cardiac arrest. In the U.S., over 225,000 pacemakers and 135,000 cardiac defibrillators are implanted each year.

However, medications or cardioversion to control atrial fibrillation is not always effective. In these cases, a cardiologist may perform a procedure to ablate the area of heart tissue that’s causing the erratic electrical signals in an effort to restore the heart to a normal rhythm. This is done by the use of specialized catheters that deliver radiofrequency energy, extreme cold (cryotherapy), or heat to ablate small areas of the heart, either by isolating or destroying the tissue causing the erroneous signal. This corrects the arrhythmia without the need for medications or implantable devices. However, determining the exact tissue to isolate that is causing the erratic electrical signals is paramount to a successful catheter ablation procedure, hence the importance of cardiac mapping and real-time information during the electrophysiology study.

A cardiac mapping system with low fidelity or high signal-to-noise ratio can result in incomplete ablation of the target area, which results in recurring arrhythmia and the potential for a repeat procedure at some point in the future. A poor signal quality might also lead to longer procedure time, adding cost to the hospital and potential detrimental adverse effects on the patient. For example, recent data published in the Journal of the American Medical Association (JAMA) found that radiofrequency catheter ablation procedures had a success rate of only 46% on the first try. In fact, nearly half of the study population had symptomatic recurrences of atrial tachyarrhythmia and declining quality of life measures within two years of the procedure (1).

– Cutting Out The Noise

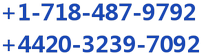

High-quality information provided by the recording system is essential for an electrophysiologist to determine ablation strategies during the termination of various arrhythmias. The EP lab is a noisy environment, with significant interference. The slide below is taken from the presentation by Mayo Clinic cardiologist, Dr. Ammar M. Killu, M.D., given to the 13th Annual International Dead Sea Symposium (IDSS) in March 2016. It shows the significant electrical noise and radiofrequency interference that impacts acquisition and display of intracardiac signals.

Acquisition of clean signal is fundamental to the diagnosis of arrhythmias. An electrophysiologist needs to be able to clearly visualize the signal in order to treat the patient. Existing systems with restricted dynamic range, low sampling rates, and signal saturation, make it difficult for the electrophysiologist to fully differentiate signal of interest from noise. Notch filters are often used in conjunction with EP recording systems, but they can distort the signal by changing the signal amplitude and appearance. These and other issues can mislead the electrophysiologist to a false interpretation of the intracardiac electrogram.

Acquisition of clean signal is fundamental to the diagnosis of arrhythmias. An electrophysiologist needs to be able to clearly visualize the signal in order to treat the patient. Existing systems with restricted dynamic range, low sampling rates, and signal saturation, make it difficult for the electrophysiologist to fully differentiate signal of interest from noise. Notch filters are often used in conjunction with EP recording systems, but they can distort the signal by changing the signal amplitude and appearance. These and other issues can mislead the electrophysiologist to a false interpretation of the intracardiac electrogram.

BioSig’s PURE EP™ System is a novel hardware and software platform designed to obtain and display high fidelity, low amplitude signals where existing EP systems fail during an electrophysiology procedure. PURE EP™ System was designed to deliver precise and uninterrupted real-time electrocardiograms and electrograms to assist the electrophysiologist in evaluation during the EP studies and ablation procedures.

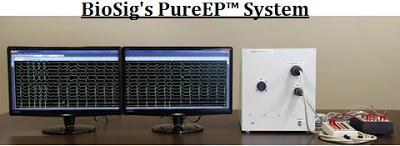

And importantly, PURE EP™ System is designed to be used in conjunction with existing EP recording devices, essentially creating a new category within the market where EP labs can add on the platform without the significant cost of replacing or upgrading the expense technology already in place. It is designed to improve the signal and recording so that analysis at previously undetectable levels can be conducted with high accuracy. This is the key to the BioSig investment thesis, as the company is not competing with industry behemoths Boston Scientific, St. Jude Medical, and GE Healthcare, but instead bringing a new product to the market – and EP Information System – that makes interpretation and visualization of challenging signals possible.

And importantly, PURE EP™ System is designed to be used in conjunction with existing EP recording devices, essentially creating a new category within the market where EP labs can add on the platform without the significant cost of replacing or upgrading the expense technology already in place. It is designed to improve the signal and recording so that analysis at previously undetectable levels can be conducted with high accuracy. This is the key to the BioSig investment thesis, as the company is not competing with industry behemoths Boston Scientific, St. Jude Medical, and GE Healthcare, but instead bringing a new product to the market – and EP Information System – that makes interpretation and visualization of challenging signals possible.

– In Vivo Data

– In Vivo Data

PURE EP™ has been designated a Class II medical device by the U.S. FDA. As such, FDA approval is possible through a 510(k) application. This means BioSig should not need human clinical data as part of the application to the agency. Proof-of-concept and pre-clinical data gathering has already been achieved through the company’s collaboration with UCLA Labs and The Mayo Clinic.

BioSig has already initiated a technology development and manufacturing agreement with Minnetronix, an FDA registered and ISO Certified medical technology and innovation company with deep expertise in electronic and electromechanical devices. Management plans to file the 510(k) application in early 2017. The U.S. FDA is expected to make a decision 3-6 months later, which should put the company in the position to enter the large and rapidly growing EP market by the end of 2017. CE Mark in Europe should follow in 2018.

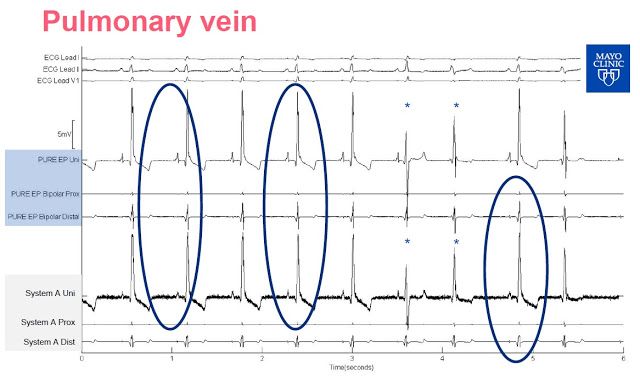

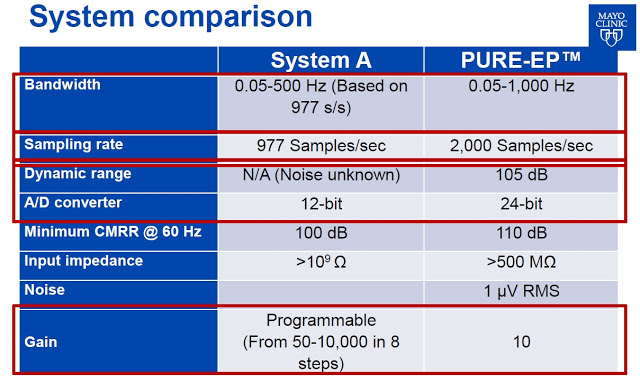

At the 13th Annual IDSS meeting in March 2016, researchers from the Mayo Clinic presented pre-clinical data from three canine studies comparing BioSig’s PURE EP™ System to a traditional FDA cleared recording system, System-A, which was later revealed to be CardioLab by GE Healthcare, the market leader in this area with 50% share. Analysis of the two systems was done head-to-head, simultaneously, in real-time. The following slides are taken from Dr. Ammar’s presentation:

Slide-1: This slide shows the output of mapping on the pulmonary vein. Notice how much less noise is inherent in the PURE EP™ System signals versus System A. This is because PURE EP™ System records the data in the raw (unprocessed) form and then applies any filter the physicians choose. Older systems process the data as they record it, potentially distorting the output during the procedure.

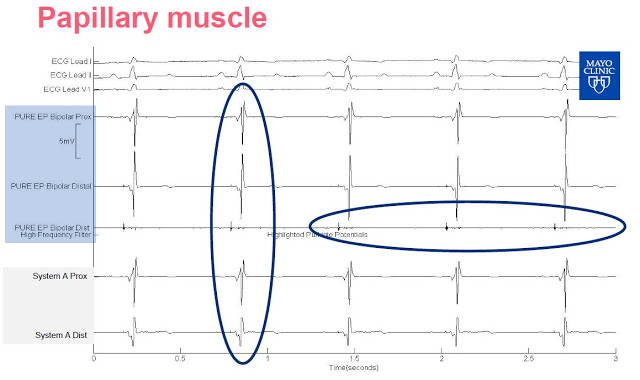

Slide-2: This slide shows the output of mapping on the papillary muscle. Again, investors can see the clarity difference between the signal output from the PURE EP™ System signal versus System A. Use of PURE EP™ bipolar distal with a high-frequency filter even shows the signal from Purkinje potentials, something not easily visible on System A. Purkinje fibers allow the heart’s conduction system to create synchronized contractions of its ventricles. This is likely because the PURE EP™ System proprietary amplifier technology coupled with a higher sampling rate (2,000 per second vs. 1,000 per second) and lower background noise (1µV RMS vs. ~30 µV RMS) than the GE system.

Slide-2: This slide shows the output of mapping on the papillary muscle. Again, investors can see the clarity difference between the signal output from the PURE EP™ System signal versus System A. Use of PURE EP™ bipolar distal with a high-frequency filter even shows the signal from Purkinje potentials, something not easily visible on System A. Purkinje fibers allow the heart’s conduction system to create synchronized contractions of its ventricles. This is likely because the PURE EP™ System proprietary amplifier technology coupled with a higher sampling rate (2,000 per second vs. 1,000 per second) and lower background noise (1µV RMS vs. ~30 µV RMS) than the GE system.

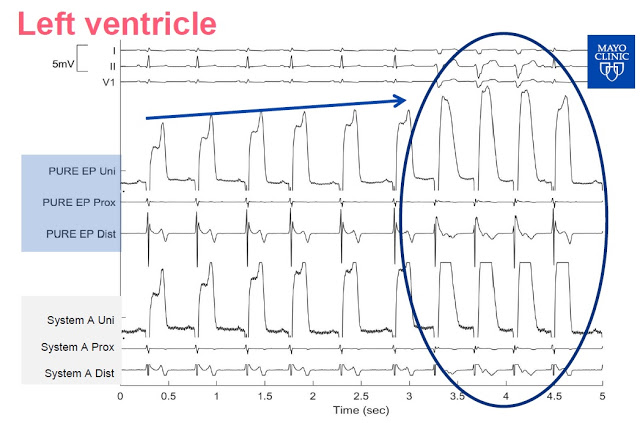

Slide-3: This slide shows the signal from the left ventricle. PURE EP System allows for continuous visualization, System A needs a change of gain as the signal is clipped.

Slide-3: This slide shows the signal from the left ventricle. PURE EP System allows for continuous visualization, System A needs a change of gain as the signal is clipped.

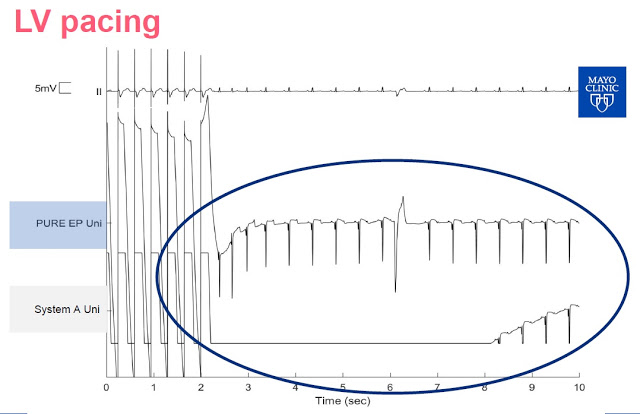

Slide-4: This slide shows left ventricle pacing The PURE EP™ System is able to maintain signal and provide real-time feedback to the electrophysiologist. Notice that System A goes flat for a period of time following pacing is due to saturation of the amplifiers.

Slide-4: This slide shows left ventricle pacing The PURE EP™ System is able to maintain signal and provide real-time feedback to the electrophysiologist. Notice that System A goes flat for a period of time following pacing is due to saturation of the amplifiers.

Dr. Ammar M. Killu, M.D concluded the presentation with the obligatory, “Further work needed”, but noted that the PURE EP™ System provided improved cardiac signal recording (signal-to-noise ratio and visualization of juxtaposed signals) versus GE’s CardioLab, and is likely of value to electrophysiologists during EP procedures. Below is a comparison by Dr. Killu of PURE EP™ System vs. System A.

Dr. Ammar M. Killu, M.D concluded the presentation with the obligatory, “Further work needed”, but noted that the PURE EP™ System provided improved cardiac signal recording (signal-to-noise ratio and visualization of juxtaposed signals) versus GE’s CardioLab, and is likely of value to electrophysiologists during EP procedures. Below is a comparison by Dr. Killu of PURE EP™ System vs. System A.

Huge Market Potential

According to Global Industry Analysis, the electrophysiology device market will grow at a 12.1% compound annual growth rate, from $2.5 billion in 2012 to $5.5 billion by 2019, making it one of the fastest growing medical device segments. Accordingly, the number of catheter ablation procedures done in the U.S. is expected to grow at 10.5% CAGR between 2012 and 2017. In 2014, there were a total of 260,000 and 600,000 catheter ablation procedures done in the U.S. and worldwide, respectively. Approximately half of these procedures are for atrial fibrillation or ventricular tachycardia. The average price of such a procedure ranges between $20,000 and $40,000 in the U.S.

From a market penetration standpoint, BioSig could see significant uptake of the PURE EP™ system upon commercialization in 2017. As noted above, PURE EP™ is designed to deliver improved signals and information over the existing already installed equipment, making the product a nice add-on to the incredibly expensive systems (~ $250,000 per install) in place at EP labs across the world. There are a growing number of EP labs in the world, with an estimated 3,500 in the U.S. and another 2,000 outside the U.S. It’s a relatively straightforward pitch for BioSig, or a potential commercial partner like Boston Scientific, St. Jude (now Abbott Labs), or GE Healthcare that already have sizable share and a vested interest in keeping those very important working relationships with cardiac electrophysiologists.

This creates an obvious exit strategy for BioSig once PURE EP™ is on the market and generating revenues. Deals have been plentiful in this space over the past few years (see below). One has to look no further than the two recent deals that Abbott Labs has done. Abbott acquired privately-held Topera, Inc. for $250 million in October 2014 and St. Jude for $25 billion in April 2016.

Conclusion

Earlier in May 2016, BioSig Technologies raised approximately $4.5 million through a private placement. The company is now well-funded and has plans to uplist to the NASDAQ or NYSE later this year. This should be a major catalyst for investors concerned with buying an OTC-listed stock. BioSig shows none of the signs of an OTC company. The company has a highly experienced management team and one of the most impressive Boards I’ve seen for a small-cap company.

I think BioSig has a unique opportunity to provide a product that can deliver a meaningful improvement in diagnostic effect and therapeutic outcome in the large and rapidly growing EP market. I like the investment story here because PURE EP™ has the potential to be a highly complementary product to an existing installed base that is dominated by industry behemoths like GE, Abbott, and Boston Scientific. BioSig is developing a credible threat in this space, and that will likely result in a highly lucrative end-game scenario for shareholders.

From a valuation standpoint, BioSig is an estimated 15-18 months away from revenue generation, with peak sales likely five years later based on PURE EP™ system installs. I model that PURE EP™ offers a $650 million cumulative revenue opportunity once launched. Revenue in year five is likely $175 million based on peak system install penetration, with subsequent revenues booked over the next decade following thanks to both hardware and software upgrades and yearly service contracts.

If we apply the industry average EV/Rev multiple noted above to our projected peak sales estimate of $150 million in 2022, and then discount back to present day at 15%, we arrive at a fair market value for BioSig of $212 million. If we assume the industry average EBITDA margin of 28% and apply a similar valuation methodology, only this time using the industry average EV/EBITDA multiple from above, we arrive at a fair market value for BioSig of $217 million. The blended average of these two methods yields a target market value of $215 million. This equates to $10 per share on a basic count.