Last week, Allergan plc (AGN) acquired two companies on the same day, both in an effort to strengthen its focus on NASH. Allergan spent $615 million to acquire Tobira Therapeutics, Inc. (TBRA) and $50 million to acquire privately-held Akarna Therapeutics. The acquisition of Tobira gives Allergan cenicriviroc, an oral Phase 3 ready potent inhibitor of the chemokine receptors, CCR2 and CCR5, which are involved in the inflammatory and fibrogenic pathways in NASH and evogliptin, an oral DPP-4 inhibitor in Phase 1 studies for NASH. Allergan also committed to pay shareholders of Tobira another billion dollars in potential milestones upon the successful development of cenicriviroc and evogliptin. The smaller acquisition of Akarna brings in AKN-083, a preclinical farnesoid X receptor (FXR) agonist for the treatment of NASH that Allergan believes is complementary with cenicriviroc and evogliptin.

CF102 For Liver Disease – An Exciting New Opportunity

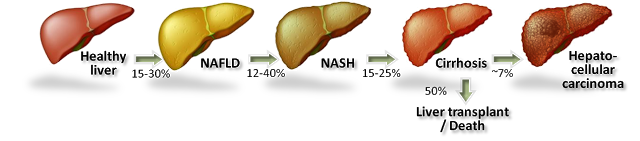

On November 23, 2015, Can-Fite announced the development of CF102 will be expanded into NASH based on compelling preclinical data. Non-alcoholic steatohepatitis (NASH) is believed to be the next big global pandemic given the soaring rates of obesity, diabetes, and metabolic syndrome all over the world. NASH, also called “fatty liver”, is a condition in which fat builds up in the liver causing inflammation. Prior to the presence of inflammation, the disease is simply referred to as non-alcoholic fatty liver disease (NAFLD), the most common form of liver disorder in the U.S.

The accumulation of macroglobular fat inside the liver causes oxidative stress that reduces the efficiency of the liver and can lead to increased liver enzymes such as alanine aminotransferase (ALT) and aspartate aminotransferase (AST). Loss of liver efficiency and oxidative stress leads to inflammation, liver cell ballooning, and the development of NASH. Prolonged inflammation results in cirrhosis (scar tissue), liver failure, or liver cancer.

Rates of NAFLD and NASH are increasing in the U.S. in concert with increasing rates of obesity and diabetes. In fact, NASH is now the third leading cause of liver transplant in the U.S. According to the U.S. National Institutes of Health, an estimated 15-30% of Americans have fatty liver, with approximately 20% going on to develop NASH. The American College of Gastroenterology estimates 2-5% of adult Americans and up to 20% of those who are obese may suffer from NASH, putting the target population in the country between 5 and 10 million individuals. There are currently no U.S. FDA approved treatment options for NASH.

– Preclinical Data in NASH –

Preclinical data studying CF102 in a mouse model of liver disease revealed the drug’s capability to improve liver pathology in NAFLD and NASH. The data showed:

– Preclinical Data in Liver Ischemia / Reperfusion Injury –

Last week, Can-Fite announced additional preclinical data on CF102 in liver disease was published in Molecular Medicine Report. The paper highlights the regenerative effects of CF102 in a Wistar rat model of ischemia / reperfusion injury. The data show a higher regeneration rate in the CF102 treatment group compared with the control group, suggesting that CF102 had a positive effect on the proliferation of hepatocytes following hepatectomy (Ohana G, et al., 2016).

Ischemia / reperfusion (I/R) injury occurs when the cellular damage of a hypoxic organ is increased subsequent to the restoration of oxygen delivery. Warm I/R injury may arise clinically in hepatic surgery, liver transplantation, hypovolemic shock, and various types of toxic liver injury. These conditions are induced by liver hypoxia and may lead to ischemic hepatitis. Cellular hypoxia leads to the activation of the transcriptional regulatory, NF-кB, which triggers the release of other inflammatory mediators, including activated Kupffer cells and neutrophils, TNF‑α, IL‑1, and nitric oxide (NO) (5, 6). The mechanism of action of CF102, modulation of the Wnt and NF-кB signaling pathway through activation of A3AR, with downstream effects on PI3K, PKB/Akt, and IKβ reduces liver inflammation and may protect against hypoxia-related injury.

The figure below shows the serum concentrations of two liver enzymes, SGOT and SGPT, were significantly reduced in the CF102 treatment group compared to the control group 48 hours after surgery (P<0.05). This is evidence that CF102 helps prevent cellular injury and apoptosis following liver injury.

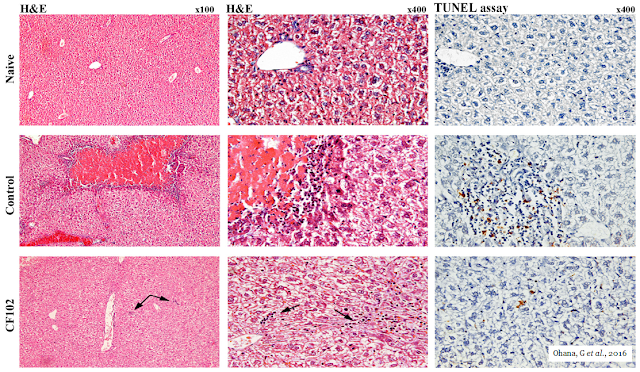

The picture below shows the histological evaluation of liver injury. No signs of necrosis, inflammation, or apoptosis were observed in the naïve liver. In the control group, large areas of necrosis and inflammatory cells were observed by H&E staining. The TUNEL assay revealed an abundance of cells undergoing apoptosis; however, in the CF102‑treated group, no area of necrosis was observed, and only a few inflammatory cells appeared in the liver parenchyma (indicated by the arrows). Only a few cells were undergoing apoptosis in the TUNEL assay.

Additionally, hepatic regeneration rates were higher in the CF102 treatment group compared with the saline‑treated control group 48 hours after the hepatectomy.

This preclinical data demonstrates that CF102, when administered during liver reperfusion, may attenuate cellular injury, apoptosis, and the extent of necrosis in liver subjected to I/R. Additionally, CF102 stimulated liver regeneration, which favored the survival of hepatocytes during I/R injury. Therefore, the ability of CF102 to protect against hepatic I/R injury may include an anti-inflammatory and an anti-apoptotic effect, combined with an increased rate of liver regeneration.

The mechanism of action for CF102 looks like a pan-hepatic improver of liver pathology, applicable to earlier-stage liver diseases such as NAFLD and NASH, for the treatment of ischemia / reperfusion (I/R) injury in patients following partial hepatectomy, and in the treatment of primary liver cancer, including advanced hepatocellular carcinoma (HCC). Can-Fite anticipates initiating a Phase 2 trial with CF102 in NASH before the end of 2016.

Big pharma has clearly shown a propensity to acquire early-stage assets for the treatment of NASH. Just last week, Allergan paid $50 million to acquire Ankara because the potential exists that its preclinical asset, AKN-083, may have synergistic effects with cenicriviroc and evogliptin. Can-Fite’s CF102 is orally administered, has a novel mechanism of action, and has been shown to be safe and generally well-tolerated in late-stage cancer patients.

Can-Fite’s entire market capitalization is only $36 million and I have to believe that the majority of that value is Phase 3 ready CF101 for the treatment of rheumatoid arthritis and psoriasis. CF102 has the potential to dwarf CF101 if successfully developed for NASH. I think once Can-Fite initiates the Phase 2 study with CF102 in NASH later this year, investors will start to view the story more and more as a “NASH play”, and that should set the stage for a major revaluation higher in 2017.