As many investors know, I’ve written extensively on RedHill Biopharma Ltd. (NASDAQ: RDHL) over the past year. My article in August 2016 (LINK) is a good synopsis for many of my past more detailed works. In that article, I noted the company has, “One of the deepest and most interesting pipelines in specialty pharma.” I also believe the company, which is well-capitalized, sitting on nearly $48 million in cash as of June 30, 2016, has a number of potential milestones and pending catalysts that could drive the shares meaningfully higher over the next year.

One question that I seem to get often with respect to RedHill is on valuation. The company currently trades with a market capitalization of $192 million. RedHill, which is pursuing a multiple-shots-on-goal strategy and has three drugs in Phase 3 clinical trials, is focused on the development and commercialization of late clinical-stage, proprietary, orally-administered, small molecule drugs for the treatment of gastrointestinal and inflammatory diseases, including cancer.

In my article below, I take a look at what I believe RedHill is worth based on a sum-of-parts analysis using industry average valuation multiples and a discounted probability of success. I conclude that the shares have a substantial upside to the tune of 2-3x return over the next 18-24 months.

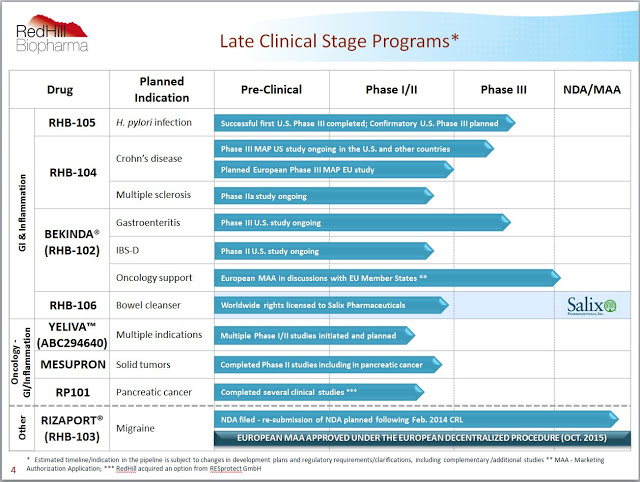

RedHill’s pipeline rivals that of larger biotech and specialty pharmaceutical companies. The company boasts twelve programs and eight drugs at various stages of clinical development, several of which are in Phase 3. The core focus is on gastrointestinal and inflammatory diseases, but management is making a strong push into cancer with some novel drugs in mid-stage trials.

– RHB-104

RHB-104 is a proprietary and potentially groundbreaking oral antibiotic combination therapy with potent intracellular, anti-mycobacterial, and anti-inflammatory properties, currently undergoing a first Phase 3 study for Crohn’s disease (CD) and a Phase 2a study for multiple sclerosis (MS). The development of RHB-104 is based on increasing evidence supporting the hypothesis that Crohn’s disease is caused by Mycobacterium avium paratuberculosis (MAP) infection in susceptible patients.

The Phase 3 MAP U.S. Study continues to enroll patients. According to management, approximately 200 subjects out of the planned total of 270 have been enrolled to date in the randomized, double-blind, placebo-controlled design. An interim data and safety monitoring board (DSMB) analysis is on track to take place in the fourth quarter of 2016. RedHill remains blinded to the interim and ongoing results. Management expects to provide an update on this in the coming weeks.

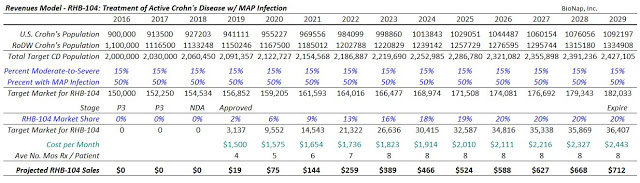

According to the Crohn’s and Colitis Foundation of America, there are an estimated 900,000 patients in the U.S. suffering from Crohn’s disease. There are easily another 1.1 million patients in commercially viable regions outside the U.S., such as Canada, Europe, and Israel. Approximately 50% of these 2.0 million patients are in remission or suffer from mild disease. Another 750,000 or so patients suffer from moderate disease and may achieve an adequate response to aminosalicylates, corticosteroids, and immunomodulators. This leaves approximately 150,000 CD patients worldwide that seek advanced treatment options such as the TNF-α and other biologics.

Using the Phase 3 infliximab data as a point of reference, 50-60% of patients ultimately fail on these biologic drugs, and 70% eventually require some sort of surgery resulting from chronic CD. The TNF-α drugs and biologics such as natalizumab are also dangerous and carry FDA (“Black Box”) warnings for risk of infection (1) and hematologic malignancies. They are also incredibly expensive drugs, ranging in price from $2,500 to over $5,000 per month depending on dose.

I see an enormous opportunity for RHB-104, not only as a treatment option for patients failing biologic medications but as a first-line therapy in patients with confirmed MAP infection as a potential cure for CD. In this regard, RedHill is developing a diagnostic test for MAP infection in collaboration with Quest Diagnostics. This should both help improve the efficacy of RHB-104 and provide meaningful pharmacoeconomic benefit in the eyes of payers once the drug is approved. Plus, RHB-104 has demonstrated good safety and it is an oral medication. All the biologic medications are IV/infusion.

I think RHB-104 is easily a multi-hundred million dollar drug. Pricing remains a wildcard at this point, but I’m going to assume that RHB-104 costs $1,500 per month, which is comparable to what the three individual generic components will cost (assuming one could theoretically obtain clofazimine in the U.S.). This is also 40% to 60% cheaper than the biologic drugs that only treat the symptoms of the disease. RHB-104 targets the underlying cause of the disease and is designed to eradicate MAP infection. I suspect a typical course of therapy for the drug may be 24-36 weeks.

As such, the estimated cost of treatment for RHB-104 is $9,000 to $12,000 per patient per year. Investors should keep in mind that this is still very cheap for an Orphan Drug. In fact, it is even less than biosimilar infliximab in the U.S. Using some conservative assumptions that 50% of severe CD patients have MAP infection, the target population for RHB-104 is still 150,000 patients in the U.S. + EU markets. At 20% penetration into these active CD / MAP infected patients, with expected market and pricing growth, RHB-104 is a $700+ million drug (see modeling below).

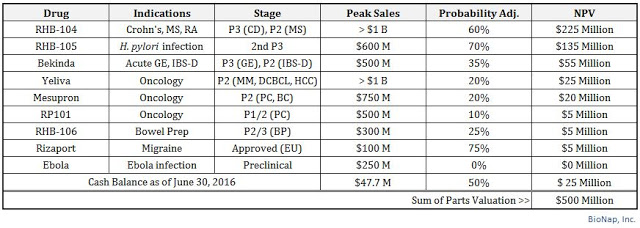

I project peak sales of RHB-104 in CD in 2029. I project that the drug has a 60% chance of success given the previous strong Phase 2 data and the historical success rate of Phase 3 autoimmune drugs targeting indications like Crohn’s (2). Based on the U.S. specialty pharmaceutical industry median Price/Sales multiple of 5X (3) and a 20% discount rate for the time value to peak, RHB-104 alone should worth $200 million today.

$700M Sales x 5X Multiple x 60% Probability @ 20% Discount to PV = $200 Million

So there you have it. I believe RHB-104 in CD alone is worth the entire value of the company today. And investors need to keep in mind, beyond Crohn’s, RedHill is also studying RHB-104 in relapsing and remitting multiple sclerosis. The company reported positive interim data from a Phase 2a study in March 2016. The last patient visit was recently announced, and top-line data are expected in the fourth quarter 2016. Similar to drugs like Remicade®, Humira®, Tysabri®, and Entyvio®, RedHill is hoping that RHB-104 can be a “pipeline in a product” with utility in multiple inflammatory indications.

I have yet to undertake a detailed modeling exercise for the use of RHB-104 in MS, but I believe the market opportunity is easily another $300 million given there are 400,000 individuals in the U.S. with MS and no treatment options today focus on the eradication of MAP infection to treat the disease. The risks here are certainly higher given the earlier-stage nature of the program, but even with a 25% chance at success, the drug is worth $25 million.

$300M Sales x 5X Multiple x 25% Probability @ 20% Discount to PV = $25 Million

As such, I believe the entire RHB-104 program is worth $225 million, greater than the entire market capitalization of the company today. Essentially, investors can buy RedHill’s stock today and pay fair value for RHB-104 in CD and get everything else, including RHB-104 in MS, for free.

– RHB-105

RHB-105 is a proprietary oral triple-antibiotic for the treatment of H. pylori infection. In June 2015, RedHill successfully completed a Phase 3 clinical trial with RHB-105 called ERADICATE-Hp. ERADICATE-Hp was a randomized, double-blind, placebo-controlled study in 118 patients that took place at 13 centers in the U.S. Top-line results demonstrated RHB-105 was 89.4% effective in eradicating H. pylori infection. This was highly statistically superior over the placebo and the 70% benchmark use for statistical modeling (p <0.001). More importantly, following the 14 day treatment period, patients on placebo were allowed to receive a current standard of care. Follow-up analysis from this portion of the study showed these patients achieved only 63% eradication.

Following the success first Phase 3 trial, RedHill met with the U.S. FDA in April 2016 to discuss the protocol and endpoints for a confirmatory Phase 3 trial to start in the next few months. The trial will be a two-arm, randomized, double-blind, active comparator confirmatory Phase 3 study with a target enrollment of 440 patients in up to 50 clinical sites in the U.S. Positive data from this study will support the filing of a New Drug Application, and I believe once approved RHB-105 will become the new standard-of-care.

In the U.S., H. pylori infection is rather common, with an estimated 30-40% of the population infected. Outside the U.S., infection rates are even higher, with prevalence tied closely to socioeconomic conditions (4). According to a WGO Global Study, up to 80% of individuals in under-developed areas of the world are H. pylori positive. Nevertheless, 80% of patients are asymptomatic. Thus, of the roughly 115 million individuals in the U.S. that are H. pylori positive, eradication therapy is only necessary for 20-25 million. This is still an enormous market, and the total target population eclipses 100 million when including Europe, Japan, and China.

The American College of Gastroenterology (ACG) estimates that 3.5 to 7.5 million Americans suffer from peptic ulcer disease (PUD), with an estimated 0.5 million new cases per year. The U.S. CDC estimates the number to be approximately 6.0 million per year, resulting in approximately 185,000 hospitalizations per year (5). Infection with H. pylori is the most significant cause of PUD in the U.S., with up to 80% of all gastric ulcers and 90% of duodenal ulcers believed to be associated with the bacterium. Interestingly, the number of Americans with functional dyspepsia (non-ulcerative disease) may be as much as five times as large (6).

The majority of these patients are treated with proton pump inhibitors or acid suppression therapy. The most common PPIs in the U.S. are omeprazole (Prilosec®), lansoprazole (Prevacid®), pantoprazole (Protonix®), rabeprazole (Aciphex®), and esomeprazole (Nexium®) (7). In fact, data listed in the Prilosec label demonstrates duodenal ulcer healing rates in excess of 80% after only four weeks of treatment. Data listed in the Nexium label is even superior, noting 90-94% healing rates after eight weeks of therapy. However, these drugs do not eradicate H. pylori; thus, recurrence rates are high.

Accordingly, the ACG recommends that all patients presenting with dyspepsia, who do not have alarm symptoms, have not been using NSAIDS, and who are not > 55 years of age, should be tested for H. pylori prior to being prescribed PPIs. As such, we suspect the targeted patient population in the U.S., when we eliminate NSAID-associated PUD and whittle down the remaining population to H. pylori infected individuals is in the neighborhood of 3.0 million patients.

There are a number of combination therapy products on the market in the U.S. These products include various combinations of PPIs and antibiotics. As noted above, these are relatively inexpensive products. According to the information I found on Healthcare Bluebook, 10 days of treatment with Omeclamox-Pak® (omeprazole + clarithromycin + amoxicillin) costs $585; however, recreating the branded therapy with the generic components costs far less, estimated at only around $105. Another branded product, PrevPac® (lansoprazole + clarithromycin + amoxicillin) costs approximately $800 for 14 days of treatment, whereas the generic components cost roughly $150. Pylera® (omeprazole + bismuth subcitrate potassium + metronidazole + tetracycline) costs a similar $625 for a course of treatment.

Conservatively, if RedHill Biopharma were to price RHB-105 at $500 for a course of treatment, the market opportunity for the drug in the U.S. would equate to approximately $1.5 billion (~3.0 million patients x $500 per treatment). I think it is fair to assume that RedHill’s RHB-105 becomes the new standard of care for H. pylori infection given the results of the first Phase 3 trial. After all, Phase 3 data demonstrated 42% superiority over the current standard (89.4% vs. 63%) and RHB-105 is a convenient all-in-one capsule. I expect the company to price the drug comparable to competitors, and with QIDP designation and a potential label advantage that includes all patients with H. pylori infection, not just those with peptic ulcer disease, RHB-105 is the best-in-class drug. Roughly 40% market penetration would yield peak sales of $600 million for the product.

Applying similar methodology to how I valued RHB-104 above, I believe that RHB-105 is worth $135 million. The odds of success for the second Phase 3 RHB-105 trial are at least 70% (7) and with QIDP designation I see RedHill enjoying nearly a decade of protected sales in this market.

$600M Sales x 5X Multiple x 70% Probability @ 20% Discount to PV = $135 Million

– BEKINDA®

In early 2017, RedHill expects to report data from an ongoing Phase 3 clinical trial examining Bekinda, an improved formulation of ondansetron, for the treatment of acute gastroenteritis and gastritis – known as the GUARD Study. GUARD is randomized, placebo-controlled, registration study designed to compare Bekinda to placebo in 320 patients age 12 to 85 years old with acute gastroenteritis or gastritis that have presented to an emergency center and have vomited at least twice in the four hours preceding consent into the study. The primary endpoint is the proportion of patients without vomiting and rescue medication from 30 minutes post dose over the subsequent 24 hours. If all goes well with GUARD, management may be in a position to file the NDA in 2017.

Beyond the Phase 3 study in gastroenteritis and gastritis, RedHill is also studying Bekinda in a Phase 2 trial for the treatment of diarrhea-predominant irritable bowel syndrome (IBS-D). The first patient in this trial was dosed in June 2016. The Phase 2 study is seeking to enroll 120 patients with IBS-D at 12 clinical sites in the U.S. Top-line results are expected around the middle of 2017.

Bekinda looks to have an interesting market potential for the treatment of some common gastrointestinal disorders, including gastroenteritis and gastritis and irritable bowel syndrome with diarrhea. The scientific merits of both indications are rooted deep with support from the literature and the once-daily administration should help improve patient compliance and convenience to dose.

Gastroenteritis affects an enormous number of Americans each year. In 2013, the U.S. CDC estimated 21 million people in the U.S. get infected with norovirus and develop acute gastroenteritis each year. The norovirus alone accounted for 14,000 hospitalizations, 281,000 ER visits, and 627,000 outpatient visits between 2009 and 2010. And although the norovirus is the number one cause of acute gastroenteritis in the U.S., it still only accounts for 21% of the cases (8). Doing the math, one can back-calculate that there is likely 100 million episodes of acute gastroenteritis in the U.S. each year. With modest pricing and good formulary coverage, Bekinda™ looks like a $200 million opportunity in the U.S., with another $100 million for Europe once approved.

The opportunity in IBS-D looks equally, if not more attractive. Some 30 million Americans suffering from IBS, with at least half having diarrhea as the predominant symptom. Physician acceptance of Bekinda for IBS-D is a market that will need to be developed by RedHill or its commercialization partner, but it is clear that awareness for 5-HT3 receptor antagonism and familiarity with Zofran® is high amongst gastroenterologist.

Investors should not discount the IBS market; it is large and underserved. For example, linaclotide (sold in the U.S. as Linzess®) will post over $500 million in sales in 2015 for Ironwood / Actavis, and independent research firm Decisions Resources thinks linaclotide will post sales of $1.2 billion at peak in IBS-C (9). The IBS-D market is equally as large and attractive as IBS-C.

It is also clear that use of ondansetron for the prevention of chemotherapy or radiotherapy-induced nausea and vomiting was a substantial market for Zofran® and that a once-daily formulation in Bekinda should see market share gains vs. the generic if approved for oncology support. EvaluatePharma estimated the worldwide size of the 5-HT3 receptor antagonism market in 2014 was nearly $1 billion, putting potential sales for Bekinda at another $200 million with 20% market share gains.

In total, I think Bekinda could have peak sales between the U.S. and EU totaling $800 million. However, given that the drug is a reformulation of generic ondansetron, I’m going to apply a very steep probability adjustment to my modeling for Bekinda. While I believe the drug will likely be a success in the Phase 3 gastroenteritis study, I’m less confident in IBS-D given that we have yet to see Phase 2 data. As such, I’m going to apply only a 35% probability of success here. I’m also going to knock the valuation multiple down from 5X to 3X, which is closer to the U.S. generic pharmaceutical industry average. This takes into account the risk for generic substitution and potential for ANDA challenges to the asset once approved. Taking all this into account, Bekinda still NPV’s at worth $55 million in value.

$800M Sales x 3X Multiple x 35% Probability @ 20% Discount to PV = $55 Million

– YELIVA™

One of the most interesting candidates in RedHill’s pipeline is Yeliva, a first-in-class SK2 selective inhibitor for the treatment of various cancers. The ongoing clinical work supported by research grants for Yeliva is impressive. For example, a Phase 1/2 study for the treatment of refractory or relapsed multiple myeloma at Duke University is supported in part by a $2 million grant from the National Cancer Institute (NCI). A separate grant from the NCI also supports another Phase 1/2 clinical study evaluating the drug in patients with refractory/relapsed diffuse large B-cell lymphoma (DLBCL) at the Louisiana State University. That study is currently on administrative hold, pending a protocol amendment aimed at improving overall recruitment prospects.

A Phase 2 study with Yeliva for the treatment of advanced hepatocellular carcinoma (HCC) is planned for later this year. The study will be conducted at the Medical University of South Carolina (MUSC) Hollings Cancer Center and additional clinical centers in the U.S. It is supported in part by a $1.8 million grant from the NCI awarded to MUSC, along with additional support from RedHill to fund a broad range of studies on the feasibility of targeting sphingolipid metabolism for the treatment of a variety of solid tumor cancers. In June 2016, RedHill reported positive Phase 1 data with Yeliva in cancer patients with advanced solid tumors.

Valuing a Phase 2 oncology asset is a bit of a daunting task. I believe Yeliva’s mechanism of action is solid and that RedHill should have ample opportunity to partner the drug as development continues (see my analysis HERE). That being said, most oncology assets do not hit valuation inflection until after Phase 2 or even Phase 3 data has been reported. RedHill will have an opportunity to deliver such data throughout 2017. In the meantime, I think the entire program is worth $25 million based purely on the potential some of the above indications advance into Phase 3.

– Mesupron

Mesupron is another mid-stage drug with the potential to expand the company’s focus into oncology. RedHill’s current development program for Mesupron includes non-clinical studies as well as re-analysis of certain prior clinical data. Mesupron is a first-in-class, orally-administered uPA inhibitor targeting gastrointestinal and other solid tumors. To date, a total of eight Phase 1 and two Phase 2 clinical studies have been completed with the drug. The ongoing nonclinical work is intended to define better the molecular markers and patient population for future clinical studies.

RedHill plans to initiate a Phase 2 development program with Mesupron in 2017, subject to a successful outcome in the ongoing non-clinical studies (see my analysis HERE). Given that Mesupron is slightly behind Yeliva in development, but still holds significant potential for advancement or business development in 2017, I peg the value of Mesupron today at $20 million.

– Other Key Programs

RedHill seems particularly excited about the signing of a recent research collaboration with the U.S. National Institute of Allergy and Infectious Disease (NIAID) in July 2016. The collaboration is intended to evaluate RedHill’s proprietary experimental therapy for the treatment of Ebola virus disease. Initiation of research programs is expected to commence in the fourth quarter of 2016. The company has shared encouraging results from preliminary non-clinical studies conducted in conjunction with NIAID. Top-line results from the first studies are expected in 2017. At this time, I assign no value to RedHill’s Ebola program, but this could certainly change in 2017.

Management is also planning a resubmission of the RIZAPORT® NDA to the U.S. FDA in the first half of 2017. RIZAPORT was approved for marketing in Germany under the European Decentralized Procedure (DCP) in October 2015, and a first commercialization agreement was recently signed with Grupo JUSTE S.A.Q.F for Spain and additional potential territories. The company is in discussion with additional potential commercialization partners for RIZAPORT in the U.S., Europe, and other territories. The drug is a proprietary oral fast dissolving thin film formulation of rizatriptan for the treatment of a migraine. I assign $5 million in value to RIZAPORT®.

Other programs in development include RP101, first-in-class Hsp27 inhibitor in Phase 2 development for pancreatic cancer. RP101 has completed several Phase 1 and Phase 2 trials with a total of 429 subjects. The drug has been granted Orphan designation in the U.S. and EU. I assign $5 million in value to RP101.

RHB-106 is a bowel preparation for gastrointestinal tract procedures such as a colonoscopy. Advantages of RHB-106 are that the product is an oral capsule and requires no liquid solution. I’ve had a colonoscopy, the worst part of the entire procedure is drinking the bowel preparation liquid the day before! A Phase 2a study with RHB-106 was conducted in Australia demonstrating safety and tolerability. RedHill licensed RHB-106 to Salix Pharmaceuticals in February 2014. Salix has since been acquired by Valeant Pharma, which confirmed it was still developing RHB-106 in 2015. Little has been said about the product since that time. As such, I only assign $5 million in value to RHB-106.

Sum-Of-Parts

Valuing biopharma stocks that do not have revenues or earnings is a bit of a challenge. There’s no magical formula and many of the inputs are subjective. I’ve done my best to use objective measures, including valuation multiples established by a reasonable peer group and historic success rates for similar assets at the same stage of development compiled by reputable organizations. Still, things like peak sales are highly subjective based on my own beliefs with respect to market share and penetration rates. Discount rates and time frames are generally known for these types of stocks, but certainly, delays do occur and could have a material impact on net present value calculations.

That being said, I believe RedHill BioPharma is worth approximately $500 million in value today. I see the most valuable asset as RHB-104 for Crohn’s disease, followed by RHB-105 for H. pylori infection. Other important assets include Bekinda for gastroenteritis and IBS-D, RHB-104 for MS, and Yeliva and Mesupron in mid-stage development for various oncology indications. The company also held $47.7 million in cash as of June 30, 2016, of which I’m including only $25 million into my sum-of-parts analysis. The company has no debt, but this at least gives me a little bit of a cash burn cushion, as well as a nice round number of $500 million!

Conclusion

Conclusion

I’ve stated in many reports in the past that RedHill is pursuing a multiple-shots-on-goal strategy, and thus the sum-of-parts valuation makes the most sense. Obviously, the company has overhead and ongoing R&D expenses, but with $47.7 million in the bank, this is hardly an area of concern. Burn has been very reasonable at RedHill over the past twelve months (averaging $1.5 million per month), and the sum-of-parts analysis gives investors the best grasp on what the pipeline is worth should the company announced positive (or negative) data on any candidate.

My target valuation of $500 million is 2.6x the current stock price. This equates to roughly $40 per share. It is now understandable by so many big institutions, including Broadfin, Orbimed, Menora, Sabby, Candriam, RBC, and Alger continue to be shareholders. I believe the company has a number of upcoming catalysts (see below) that should help investors realize this level in the next few years.