Relmada Therapeutics (OTC: RLMD) is developing REL-1017 for the treatment of depression and neuropathic pain. REL-1017, also known as dextromethadone or d-methadone, is a non-competitive antagonist of the N-methyl-D-aspartic acid (NMDA) receptor. This mechanism of action has received significant attention from the psychiatric community over the past several years due to the expected rapid onset of action versus weeks or even months for first and second generation antidepressant. The potential exists that REL-1017 could be a potential breakthrough approach to treating patients with major depressive disorder that are resistant to current FDA-approved antidepressants.

REL-1017 represents a potentially significant commercial opportunity for Relmada. Several biopharma companies, including behemoths like J&J and Allergan, along with upstarts like Relmada, are attempting to develop new treatment options for severely depressed patients by targeting the NMDA receptor. In this area of research several smaller and more innovative companies, including Relmada, have the potential to bring competitive new drugs to the market that could generate blockbuster sales. To learn more, I decided to speak with senior management at Relmada.

BioNap: Hi guys, thanks for taking the time to speak with me today. I want to focus primarily on REL-1017 and the potential to treat severely depressed patients resistant to existing medications. Perhaps we can start out with an overview of the depression market and who exactly Relmada thinks is the target for a drug like REL-1017?

Relmada Therapeutics (RLMD): Thanks, Jason. An estimated 16 million people are affected by major depression in the U.S., but only about half, or approximately 8 million people, receive treatment. With currently available therapies only about two-thirds of the patients achieve some level of benefit. That means that approximately 3 million patients currently in treatment are not responding. REL-1017 has a unique mechanism of action based on a different pharmacological approach that may represent a more effective option for all patients including those that do not respond to current therapies. Pending confirmation of key findings related to REL-1017’s safety and tolerability showing a benign profile and rapid onset of effect (being effective in a few hours rather than weeks or even months like all currently available therapies), the market for REL-1017 can potentially expand to the broad major depression patient population, either as a monotherapy or in combination with existing drugs.

BioNap: Some physicians have been using ketamine, another NMDA receptor antagonist, off-label in these treatment-resistant patients for years. A recent paper published in Nature (Zanos P, et al., 2016) notes that ketamine exerts rapid and sustained antidepressant effects after a single dose in patients with depression, but that the drug’s use is associated with undesirable side effects. Can you compare REL-1017 to ketamine, specifically for its use in depression?

RLMD: Off-label use of ketamine for depression is risky, as chronic (versus acute) use of the drug has not been widely studied. There is evidence that ketamine is neurotoxic based on animal studies that show apoptotic neurodegeneration induced by NMDAR antagonists in the developing rodent brain.

Ketamine, memantine (NAMENDA XR®), and REL-1017 share the same core mechanism of action, inhibiting the NMDA receptor directly as channel blockers. Ketamine and its metabolites are also thought to have other activities in the brain that may be responsible for some of its effects.

Ketamine enters the NMDA receptor channel when it is activated, blocking its unwanted function and showing significant activity in reducing symptoms of depression within a few hours after administration. However, it remains “trapped” in the channel to a high degree after closure. This prolonged blocking activity is believed to be a causative factor in ketamine’s unfavorable side effects including hallucinations, delusion and delirium, which are found even at therapeutic doses

REL-1017 acts very similarly by blocking the NMDA receptor at a channel level when the receptor is activated and potentially showing similar rapid therapeutic effect. However, several studies have demonstrated that differences in the degree of trapping exist among use-dependent NMDA receptor antagonists and that these differences are correlated with efficacy and safety. For example, the NMDA receptor antagonist memantine is currently FDA approved to treat Alzheimer’s disease, but it hasn’t shown efficacy in treating depression or neuropathic pain in studies to-date. In contrast to ketamine, memantine also has a relatively benign safety profile; the most common side effects associated with treatment are headache, diarrhea, and dizziness. These differences may be attributed to the fact that memantine has been shown to remain trapped in the NMDA channel to a lesser degree than ketamine.

So far, we have administered REL-1017 in over 70 patients in three different Phase I studies with dosing up to 10 consecutive days. In these trials, we did not observe any serious adverse events. In particular, we have seen no signs of psychotomimetic symptoms, even at the highest doses.

We expect REL-1017 to show similar efficacy and rapid onset to ketamine while avoiding the safety and tolerability issues that limit more expanded use of ketamine for the treatment of major depression. Additionally, unlike ketamine that needs to be administered via injection, REL-1017 is expected to be taken as a simple once a day oral pill.

BioNap: That Nature paper I referenced in the previous question notes that a metabolite of ketamine increases the levels of another neuronal receptor protein, α-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid (AMPA). The authors conclude that targeting AMPA may implicate a novel mechanism to treat depression. Coincidently, a separate group of researchers published a different paper in Nature (Duman RS, et al., 2016) that offers a broader potential mechanism of action for the antidepressant effects of NMDA receptor antagonists. Can you help us understand the difference between AMPA and NMDA with respect to targeting patients for depression?

RLMD: In a publication in Nature, Zanos et al demonstrated that the metabolism of racemic (R,S)-ketamine to (2S,6S;2R,6R)-hydroxynorketamine (HNK) is essential for its antidepressant effects, and that it is the (2R,6R)-HNK enantiomer that exerts behavioral, electroencephalographic, electrophysiological and cellular antidepressant-related actions in mice. The data indicate that the antidepressant actions are independent of NMDAR inhibition but involve early and sustained activation of post-synaptic AMPA receptors, another type of glutamate receptor.

This may represent another mechanism and target for the treatment of depression, but it is not necessarily the only pathway that could be effective. The (2R,6R)-HNK is a metabolite of the [R] enantiomer of racemic ketamine. However, the [S] enantiomer ([S]-ketamine) being developed by J&J has demonstrated clinical efficacy and would not be metabolized to (2R,6R)-HNK.

It is likely that both NMDA and AMPA receptors provide targets for intervening in major depressive disorder. This is encouraging news for patients in need of effective treatment. Advancements in our knowledge of the neurobiology of depression related to these options will only come from additional clinical and non-clinical studies.

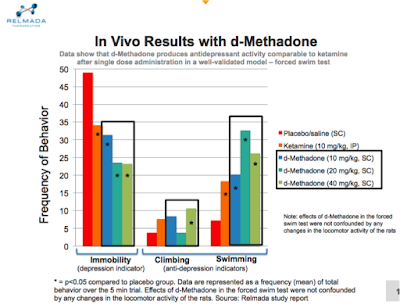

BioNap: Tell us about your preclinical data released earlier in the year. You studied REL-1017 in a well-validated rodent behavioral despair test. What did you find?

RLMD: We found a rapid antidepressant activity signal within the first 24 hours after administration, similar to ketamine in a rodent model of depression.

When rats are forced to swim in a small cylinder from which no escape is possible, they readily adopt a characteristic immobile posture and make no further attempts to escape except for small movements needed to prevent them from drowning. The immobility induced by the procedure can be reversed or largely decreased by a wide variety of antidepressants, suggesting that this test is sensitive to antidepressant-like effects.

The study evaluated the antidepressant-like efficacy of three different doses of REL-1017 following a single administration, 24 hours prior to test. At all doses tested, REL-1017 significantly decreased immobility of the rats compared to the placebo, suggesting antidepressant-like activity. In addition, the effect of REL-1017 on immobility was more significant than the effect seen with a single dose of ketamine.

This provides strong support for the Phase II proof-of-concept study that we plan to initiate in the months ahead.

BioNap: The company has also completed multiple Phase I studies with REL-1017. Can you tell us a little about these studies and the results?

BioNap: The company has also completed multiple Phase I studies with REL-1017. Can you tell us a little about these studies and the results?

RLMD: We conducted three Phase I studies aimed at determining safety and the maximum tolerated dose of REL-1017, information very important in the design of the planned proof-of-concept study. REL-1017 was administered in over 70 subjects and up to 10 consecutive days. We are pleased to report that at doses planned in the Phase II proof-of-concept study, REL-1017 appears to be safe and exempt from severe adverse events. In particular, even at the highest doses tested, we have not observed any psychotomimetic effects such as those that constitute a serious limiting factor for ketamine.

BioNap: Relmada is planning to initiate a Phase II study with REL-1017 in the next few months. Can you tell us about this trial and what investors can expect over the next year?

BioNap: Relmada is planning to initiate a Phase II study with REL-1017 in the next few months. Can you tell us about this trial and what investors can expect over the next year?

RLMD: The Phase II program involves a proof-of-concept, double blind, placebo-controlled, 7-day course of therapy with follow-up at day 14 in patients with Treatment Resistant Depression (TRD) and endpoints focused on safety in patients with TRD and rapid efficacy based on the traditional HAM-D and MADRS rating scales. This trial is expected to start at the end of this year or early in the first quarter of 2017, with data available in the second half of 2017. This trial will establish proof-of-concept and represent the most important inflection point for Relmada over the next 12 months.

In parallel with the first trial, we will prepare for a larger 150 to 200 patient study in TRD with the goal of being ready to enroll the first patient right after we will get the results from the previous trial. The details of the protocol for this second trial will be adjusted based on the information obtained in the first study. We believe that this second study could be part of the NDA filing package together with the Phase III trials.

BioNap: Phase 2 data are often the gating factor ahead of a major valuation inflection. We’ve seen some rather impressive stock movements over the past few months based on Phase 2 data in depression. For example, in May 2016, Minerva Neurosciences (NASDAQ: NERV) added $360 million in market value shortly after reporting positive results from a Phase 2a study with MIN-117, a serotonin and dopamine transporter, in patients with MDD. In July 2016, Sage Therapeutics (NASDAQ: SAGE) added over $500 million in market value when the company reported positive Phase 2 data with SAGE-547 in only 21 subjects with postpartum depression. We’ve also seen that this is an area big pharma is clearly interested in. In July 2015, Allergan (NYSE: AGN) acquired privately-held Naurex for $572 million in upfront cash and the potential for over $1 billion in milestones.

BioNap: Phase 2 data are often the gating factor ahead of a major valuation inflection. We’ve seen some rather impressive stock movements over the past few months based on Phase 2 data in depression. For example, in May 2016, Minerva Neurosciences (NASDAQ: NERV) added $360 million in market value shortly after reporting positive results from a Phase 2a study with MIN-117, a serotonin and dopamine transporter, in patients with MDD. In July 2016, Sage Therapeutics (NASDAQ: SAGE) added over $500 million in market value when the company reported positive Phase 2 data with SAGE-547 in only 21 subjects with postpartum depression. We’ve also seen that this is an area big pharma is clearly interested in. In July 2015, Allergan (NYSE: AGN) acquired privately-held Naurex for $572 million in upfront cash and the potential for over $1 billion in milestones.

Can you talk about Relmada’s long-term plans? If the Phase 2 study is positive, what’s the next step for the company? And can you also talk about the competitive landscape for the drug?

RLMD: The long-term plan for Relmada is focused and designed to maximize the value of its pipeline. Currently, REL-1017 is positioned as the drug candidate with the highest commercial opportunity. As we look at the recent events you mentioned, the Phase II results are a major inflection point for the Company. If they are positive, the data could attract considerable interest among investors and larger companies. The strategic decision at that point will be driven by the available opportunities at that time. We know that the Phase III program will be extensive (J&J has a Phase III program for esketamine targeting more than 1,400 patients). We believe that it may be a wise strategy to partner with a larger player that can offer the infrastructure and resources necessary to conduct an extensive and successful Phase III program.

Regarding competition, we are addressing one of the larger markets in the pharmaceutical industry with 8 million patients receiving treatment in the US alone. Accordingly, we believe that there is room for more than one successful drug. J&J’s nasal esketamine is the most advanced program with Phase III data expected in mid-2017. Ketamine, esketamine, memantine and REL-1017 are all NMDA inhibitors that act directly as channel blockers. Allergan (through the acquisition of Naurex) is expected to start Phase III trials over the next few months with the injectable rapastinel, a selective, mixed antagonist/agonist of an allosteric site of the glycine site of the NMDA receptor complex. This therapy, which was bought at a premium by Allergan, showed good Phase II results with rapid onset of action. Other smaller players are VistaGen Therapeutics (NASDAQ: VTGN), also with an oral NMDA receptor glycine-binding (GlyB) site antagonist pro-drug with Phase IIa data expected in the first half of 2017, and Cerecor (NASDAQ: CERC) with an oral NR2B-specific NMDA antagonist (a subunit of the NMDA receptor complex) with Phase II results expected before year end.

– See BioNap’s overview of the NMDAR market >> HERE

With a once a day oral pill acting directly in the NMDA channel that has shown a favorable safety and tolerability profile even at high doses and a strong IP protection until 2033 at the earliest, we believe Relmada is very well positioned to be successful in this attractive and unsatisfied market.

BioNap: Can you tell us more about the intellectual property protection for REL-1017?

RLMD: REL-1017 has a strong IP protection. The original patent covering use of REL-1017 as an analgesic expires in early 2018. The most important IP protection is provided by the allowed patent that covers the use of REL-1017 as “Treatment of Psychiatric Symptoms” (depression, anxiety, and others). That patent has been filed in all the major markets and was allowed in the U.S. in June of this year. We expect it to be issued before year-end. This patent protects the exclusivity of REL-1017 until 2033, at the earliest. REL-1017 in the psychiatric symptoms indication is designated as a new chemical entity (NCE) and is entitled to the 5-year market exclusivity. Additionally, REL-1017 has been granted Orphan Status Designation for its use to treat neuropathic pain associated with Post Herpetic Neuralgia (PHN) that allows for 7-year market exclusivity.

BioNap: What’s the company’s financial position as of today? How much do you anticipate the Phase II trial with REL-1017 is going to cost?

RLMD: Relmada reported $8.5 million in cash and equivalents as of June 30, 2016, which is the company’s latest reported financial period. With no debt, we believe that we have sufficient capital on hand to fund future operations until the end of 2017. However, this excludes the projected $3-5 million cost for the REL-1017 proof-of-concept study, and we are always exploring alternatives to access additional capital.

BioNap: What are the key milestones that investors should be on the lookout for over the next few months with REL-1017 and the rest of the pipeline?

RLMD: The Phase II results for REL-1017 expected in the second half of next year represent the most important near-term milestone for Relmada and a significant inflection point in its value. However, we have also been working on LevoCap ER, an extended release, abuse deterrent, proprietary formulation of the potent opioid levorphanol. We conducted three pharmacokinetic studies and we have the final formulation ready for Phase III development, representing the most advanced program in our pipeline.

We are planning to meet with the FDA in the near future to discuss our Phase III development plan and, depending on the FDA feedback, to conduct a multiple ascending dose study and Phase III studies as soon as possible. The FDA feedback is particularly important for this program as it will provide clarity on the timing and cost of the Phase III trial and potentially open the way for a partnership in the United States and abroad.

– See BioNap’s analysis of LevoCap ER >> HERE

With four programs in development, we will have other news to announce, but the two milestones discussed represent the major value creation events within the next 12 months.

BioNap: Thank you guys for taking the time to speak with me today!

Conclusion

I find Relmada Therapeutics to be an interesting potential investment opportunity because the company is developing a portfolio of products over the entire spectrum of chronic pain. The candidate portfolio, coupled with the bafflingly low valuation of only $15 million, is intriguing given some of the issues larger pain-focused specialty pharmaceutical players such as Horizon, Endo, and Mallinckrodt are having finding growth. Depomed recently reiterated its intent to continue to expand its portfolio and the company’s recent deal to acquire cebranopadol suggests they are not shying away from doing R&D. Finally, now that the OxyContin® patent has expired, one would think privately-held Purdue Pharma is also looking to enhance its pipeline with several new pain assets.

On the CNS side, the number of independent studies reporting utility for ketamine in the treatment of depression is now too great to count. Researchers out of the NIMH are excited enough to call recent data a “breakthrough” and clearly, both biopharma companies and investors are interested in this area given some of the recent news about Naurex and spin-out Aptinyx Inc.

Ketamine has been called the “next big thing” by Current Psychiatry. If Relmada can show efficacy and safety with d-methadone in depression in an upcoming Phase II study, new players with cross-over platforms in both pain and neurology, like Lilly, Pfizer, Merck, J&J, or Allergan, might think it is the “next big thing” and come calling. Either way, I like the potential here. Relmada looks to be in a good position with a bright future.