On February 25, 2016, RedHill Biopharma Ltd. (RDHL) reported financial results for the fourth quarter and full year ending December 31, 2015. The company also hosted a conference call with investors to highlight the operational results from 2015 and provide an update on the late-stage pipeline. There are a tremendous number of catalysts for RedHill in the coming months; and, given the strong balance sheet and solid institutional support, the company looks well-positioned for the future. In my article below, I provide for investors a review of the recent financial results and an overview of the key products and opportunities at RedHill.

Recent Financial Results

RedHill reported immaterial revenues in 2015. In 2014, the company reported just over $7.0 million in revenues almost entirely associated with the upfront payment from Salix Pharmaceuticals and the exclusive license of RedHill’s RHB-106 encapsulated formulation for bowel preparation and rights to other purgative developments. Net loss for 2015 totaled $21.1 million, driven primarily by $17.8 million in R&D and $4.2 million in G&A expense. The company burned approximately $17.8 million in cash from operating activities in 2015. Cash and equivalents as of December 31, 2015, stood at $58.3 million, and there is no debt. While I expect the company to continue to ramp-up R&D in 2016 given the three Phase 3 products in development, the current cash balance looks sufficient to fund operations for at least the next several years.

The Pipeline

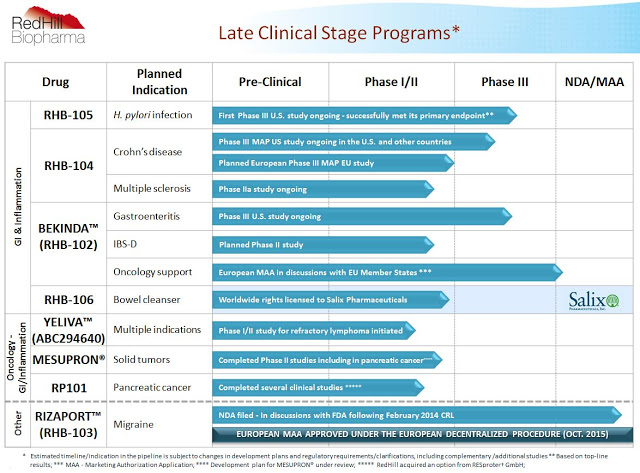

As noted above, RedHill has a significant number of catalysts on the horizon. The chart below shows both the breadth and depth of the pipeline, with a core focus on late clinical-stage, proprietary orally administered small molecule drugs for gastrointestinal diseases, inflammatory diseases, and cancer. RedHill is pursuing a “multiple shots on goal” strategy, with the ultimate goal to become a fully-integrated and diversified specialty pharmaceutical company. That being said, the company is also opportunistically pursuing partnership on the commercial and development side, and the advancing late-stage pipeline presents several opportunities for inking potential lucrative joint ventures in the coming years.

RHB-105: Phase 3 For H. pylori Infection

Earlier in February 2016, I wrote a fairly detailed article from the medical perspective looking at RedHill’s RHB-105, a Phase 3 triple combination therapy for the eradication of H. pylori infection in humans. RHB-105 is a fixed-dose combination therapy of two antibiotics, amoxicillin and rifabutin, and a proton pump inhibitor, omeprazole. RedHill has successfully completed the first of two required Phase 3 studies with RHB-105, having reported positive top-line data from the ERADICATE-Hp study in June 2015.

The results show that patients on RHB-105 achieved 89.4% eradication of H. pylori at the end of the study compared to only 63% for physician’s choice standard-of-care, which included an FDA-approved product called PrevPac®, a fixed-dose combination of amoxicillin, clarithromycin, and lansoprazole. Widespread H. pylori resistance to clarithromycin has caused far below acceptable eradication rates for the current standard-of-care (1, 2). Based on the results of the first Phase 3 trial, RedHill’s RHB-105 looks like it will become the new physician’s first choice once approved.

In November 2014, the U.S FDA granted RHB-105 QIDP designation under the Generating Antibiotics Incentives Now Act. The GAIN Act was put into law to provide incentives for the development of new treatments for serious or life-threatening infections. These incentives include extending market exclusivity by an additional five years over NCE or NME status, for a total of eight years post-approval, fast track designation, “rolling review” of submitted sections to the new drug application (NDA), and priority review once the filing is accepted by the FDA.

RedHill is now planning the second, confirmatory Phase 3 study with RHB-105. The company has a meeting scheduled with the U.S. FDA in April 2016 to discuss the planned protocol. It is likely this second Phase 3 trial will include a head-to-head active comparator, potentially PrevPac®, a product approved back in 1997 that generated over $500 million in annual peak sales.

Approximately 100 million Americans and over half of the world’s population is estimated to be infected with H. pylori and approximately three million patients are treated annually in the U.S. to eradicate H. pylori in individuals with peptic ulcer disease. Resistance to the current standards are growing and there have been no new therapies approved for this indication in over a decade. RedHill estimates the current global market for eradication is $4.8 billion, with about $1.4 billion coming from the U.S.

However, only patients with active peptic ulcer disease are recommended for eradication. The U.S. FDA, thanks to significant peer-reviewed literature and a massive 190-page report from the International Agency for Research on Cancer (IARC), a division of the World Health Organization (WHO), is now considering a “test and treat” strategy for all Americans. If approved for this broader label, RHB-105 would be the first and only FDA-approved product for the eradication of H. pylori in all populations, not just high-risk peptic ulcer patients, potentially increasing the market size by 30-fold. The outcome of the April 2016 FDA meeting is a major event for RedHill, as is the start of the confirmatory Phase 3 trial around the middle of the year.

RHB-104: A Potential Game-Changer For Crohn’s Disease

During the second half of 2016, RedHill will release interim results from the ongoing 270 patient Phase 3 MAP-US study of RHB-104 for the treatment of Crohn’s disease. RHB-104 represents a potential new mechanism of action for the treatment of Crohn’s disease, a chronic inflammatory bowel disease (IBD) that affects nearly one million Americans. Standard of care for Crohn’s disease is high dose corticosteroids, followed by immunomodulators. Despite the use of some very large biologic drugs, including J&J’s Remicade® and Simponi®, AbbVie’s Humira®, UCB’s Cimzia®, Biogen’s Tysabri®, and Takeda’s Entyvio®, the $6 billion global Crohn’s market remains vastly underserved. Approximately 75% of people with Crohn’s will eventually require surgery, and 60% who have surgery will still experience a recurrence of symptoms within ten years (3).

RHB-104 is a patented combination of three active pharmaceutical ingredients, clarithromycin, rifabutin, and clofazimine, in a single oral capsule. RHB-104 is designed to treat what many believe to be the root cause of Crohn’s disease, infection by mycobacterium avium paratuberculosis (MAP). The “MAP Hypothesis” with respect to the etiology of Crohn’s disease is something I explored in great detail for investors in October 2015. Beyond several peer-review publications concluding that a link exists between MAP infection and Crohn’s (4, 5, 6, 7), both the American Academy of Microbiology (8) and the European Directorate General of Health and Consumer Protection (9) have published detailed independent analyses citing MAP as a causative agent in Crohn’s pathophysiology.

Existing Phase 2 data on RHB-104 validates the market opportunity for RedHill. Additionally, the company presented a poster October 2013 American College of Gastroenterology Annual Scientific Meeting showing positive results from a retrospective study with 10 pediatric patients suffering from Crohn’s disease treated with RHB-104 by Professor Thomas J. Borody at the Centre for Digestive Diseases in Sydney, Australia. The results show a clinical remission rate of 80% in 10 pediatric Crohn’s disease patients, aged 8 to 17 (median: 14.3), treated for six to 117 months.

RedHill obtained U.S. FDA Orphan Drug status for RHB-104 for the treatment of Crohn’s disease in the pediatric population. RHB-104 is patent protected until 2029, with potential expansion of that under the GAIN act to 2034. Yes, the components of RHB-104 are three generic molecules, but given the optimized dosing of the single capsule and the fact that compounding pharmacies cannot legally recreate the formulation under the FDA’s Drug Quality and Security Act of 2013, I believe RHB-104 has significant market potential in Crohn’s disease. As noted above, there are nearly one million Americans suffering from Crohn’s disease and approximately 75% are failing existing medications (10). RedHill and Quest Diagnostics continue to make progress with the development of the MAP companion diagnostic test following a pre-submission meeting with the FDA in 2015. As such, with pricing even half that of the TNF-alpha biologic drugs, RHB-104 represents a potential $500-750 million opportunity for RedHill.

Beyond Crohn’s, RedHill is also exploring the potential for RHB-104 in additional indications, including Multiple Sclerosis, Lupus, Type-1 Diabetes, and Psoriasis. The most advanced of these follow-on indications is in MS, where the company has recently completed a Phase 2 clinical study called CEASE-MS. Data are expected in March or April 2016.

Published literature does support a link between MAP and MS, albeit not as well researched as Crohn’s. However, the potential for RHB-104 in MS seems to stem from the potent anti-inflammatory and immunomodulatory effects of the drug, which includes rather selectively blocking the Kv1.3 potassium channel, upregulated lysosomal enzyme activity, pronounced concentration-related reduction of IL-1b, IL-6, IL-10, TNF-alpha, CCL3, CCL5, CCL20, CCL22, CXCL1, CXCL5, and upregulation of pro-inflammatory cytokines, IL-1b, IL-6, and TNF-alpha. I wrote about this potential mechanism for RHB-104 in January 2016.

Bekinda: Gastroenteritis and Irritable Bowel Syndrome

Bekinda™ is RedHill’s improved once-daily oral formulation of ondansetron for the treatment of various inflammatory GI conditions, including gastroenteritis, gastritis, and irritable bowel syndrome with diarrhea. Bekinda™ offers virtually identical onset of action to generic ondansetron but with superior TMAX and AUC that allows for once-daily dosing. Ondansetron, previously sold as Zofran® by GlaxoSmithKline, achieved peak sales of approximately $1.7 billion in 2006 for the prevention of chemotherapy and radiation-induced nausea and vomiting, and prevention of postoperative nausea and vomiting.

Top-line results from the GUARD Study are expected in the second half of 2016. GUARD is a Phase 3 randomized, placebo-controlled, registration study designed to compare 24 mg Bekinda™ to placebo in 320 patients age 12 to 85 years old with acute gastroenteritis or gastritis that have presented to an emergency center and have vomited at least twice in the four hours preceding consent into the study. I’m confident in the outcome of GUARD. Ondansetron has already been proven to work in this market, and the superior pharmacokinetics of RedHill’s improved formulation should lead to higher compliance and better outcomes for patients. In my article from November 2015, I showed statistical modeling predicting over 95% power for success. GUARD is only the first Phase 3 trial with Bekinda™, but based on management conversations with the U.S. FDA, it may be all the company needs to gain approval.

In February 2016, RedHill announced the submission to the FDA the Investigation New Drug (IND) protocol for the Phase 2 clinical study with 12 mg Bekinda™ for irritable bowel syndrome with diarrhea (IBS-D). The company plans to initiate this trial in the coming weeks, subject to final preparations. The randomized, double-blind, 2-arm parallel group Phase 2 clinical study is designed to evaluate the safety and efficacy of the drug in 120 patients suffering from IBS-D at up to 12 clinical sites in the U.S.

The opportunity for Bekinda™ is attractive. Gastroenteritis affects an enormous number of Americans each year. In 2013, the U.S. CDC estimated 21 million people in the U.S. got infected with norovirus and develop acute gastroenteritis. The norovirus alone accounted for 14,000 hospitalizations, 281,000 ER visits, and 627,000 outpatient visits between 2009 and 2010. And although the norovirus is the number one cause of acute gastroenteritis in the U.S., it still only accounts for 21% of the cases (10). Doing the math, one can back-calculate that there is likely 100 million episodes of acute gastroenteritis in the U.S. each year. With modest pricing and good formulary coverage, Bekinda™ looks like a $250 million opportunity in the U.S., with another $200 million for Europe once approved.

The opportunity in IBS-D looks equally, if not more attractive. Some 30 million Americans suffering from IBS, with at least half having diarrhea as the predominant symptom. Physician acceptance of Bekinda™ for IBS-D is a market that will need to be developed by RedHill or its commercialization partner, but it is clear that awareness of the mechanism and familiarity with Zofran® is high amongst gastroenterologist. I see the potential for Bekinda™ to generate $500 million in peak sales in IBS-D.

Yeliva: An Oncology Pipeline Product

One of the most interesting candidates in RedHill’s pipeline is Yeliva™, a proprietary, first-in-class, orally-administered sphingosine kinase-2 (SK2) inhibitor, with anti-inflammatory and anti-cancer activities, targeting multiple oncology and inflammatory-GI diseases. RedHill acquired exclusive worldwide development and commercialization rights to Yeliva™ from privately-held Apogee Biotechnology Corp. of Hershey, Pennsylvania in March 2015.

In October 2015, the company announced positive top-line results from the Phase 1 study with Yeliva™ in patients with advanced solid tumors. The study successfully met its primary and secondary endpoints, providing key information about the drug’s safety, toxicities, PK, and PD. These data supports the ongoing and planned Phase 2 studies with the drug, which are significant in my view. For instance, in June 2015, management announced the initiation of a Phase 1/2 clinical study in the U.S. to evaluate Yeliva™ in patients with refractory/relapsed diffuse large B-cell lymphoma (DLBCL). The study is being conducted at LSU Health Science Center and is supported primarily by a grant awarded by the National Cancer Institute (NCI) STTR program awarded to Apogee.

A separate Phase 1/2 study for the treatment of refractory or relapsed multiple myeloma is planned to be initiated during the second quarter of 2016. The study will be conducted at Duke University Medical Center. The study is supported by a $2 million grant from the NCI Small Business Innovation Research Program (SBIR) awarded to Apogee in conjunction with Duke University, with additional support from RedHill. A third Phase 2 study is planned to evaluate the drug as a radioprotectant to prevent mucositis in cancer patients undergoing therapeutic radiotherapy. Yeliva™ represents an interesting strategy expansion for RedHill. This is something I took a detailed look at for investors in December 2015.

Rizaport, RHB-106, and Business Development

In November 2015, RedHill and its partner IntelGenx Corp. announced that the Federal Institute for Drugs and Medical Devices of Germany (BfArM) granted marketing authorization of Rizaport™ (RHB-103), an oral thin film formulation of rizatriptan benzoate for the treatment of acute migraines. The approval of Rizaport™ was granted under the European Decentralized Procedure (DCP), in which Germany served as the Reference Member State. This is the first national marketing approval of Rizaport™ in Europe, an area where an estimated 50 million individuals suffer from migraine headaches.

Rizatriptan, sold by Merck as Maxalt®, is part of a class of drugs called triptans that dominate the prescription migraine market. In fact, according to IMS Health, triptans controlled 94% of the prescription migraine market in 2010, with rizatriptan formulations holding 16% share within the class. The majority of these prescriptions, roughly 80%, are oral formulations. However, roughly 10-20% of migraine sufferers have dysphagia and nearly 50% experience nausea and vomiting when taking oral medications (11). This has lead to the approval of injectable, intranasal, and transdermal triptan formulations. Rizaport™ is a quick-dissolving oral thin film formulation designed to provide convenience, comfort, and rapid onset of action to these migraine sufferers.

In February 2016, the U.S. Patent and Trademark Office issued a Notice of Allowance for a new patent covering Rizaport™, which once granted, will be valid until 2034. RedHill and IntelGenx continue to work together to secure commercialization partners for Rizaport™ as well as FDA marketing approval in the U.S. Once the U.S. NDA goes under review, I expect RedHill and IntelGenx to intensify efforts to secure commercialization partners for Rizaport™ in Europe and the U.S.

As noted above, in March 2014, RedHill Bio licensed the exclusive worldwide rights to RHB-106 to Salix Pharmaceuticals, now part of Valeant Pharmaceuticals. RHB-106 is an encapsulated formulation intended for the preparation and cleansing of the gastrointestinal tract prior to the performance of abdominal procedures, including diagnostic tests, such as colonoscopy, barium enema or virtual colonoscopy, as well as surgical interventions, such as a laparotomy. The RHB-106 preparation is a tasteless solid oral dosage potentially allowing an unobstructed procedure with reduced side-effects and improved compliance. It avoids patient exposure to the often unacceptable taste of current products. RedHill reports working with Valeant in efforts to move RHB-106 into late-stage trials shortly.

Beyond the company’s goal to ink a commercial partnership for Rizaport™ and see RHB-106 move forward at Valeant, I would not be surprised to see additional business development activities at RedHill in 2016. The potential exists to enter into out-licensing or co-promotion agreements for any of the three late-stage products, RHB-104, RHB-105, and Bekinda™, as well as sign early-stage oncology collaborations around Yeliva™, RP101, and Mesupron®. For example, RedHill is currently conducting a large-scale preclinical program with RP101 and hopes to enter the clinical with the drug for the treatment of a high unmet oncology need during 2016.

That being said, with $58 million in cash on hand, RedHill can afford to be selective and seek the best possible transaction for shareholders. As I’ve noted in previous articles, the company’s institutional shareholder base includes highly creditable healthcare-focused firms such as Orbimed, Broadfin, Special Situations, Visium, Longwood, Sabby, Rosalind, and Fred Alger, so I do not think management is under and pressure to enter into unnecessary transactions. In fact, on the fourth quarter conference call, management noted already turning down several inadequate proposals for various RedHill products.

The strong cash balance also affords management the opportunity to expand the pipeline through in-licensing activity, perhaps picking up a GI-related commercial-stage asset, or continue to do preclinical work looking for the next candidate to enter the clinic after RP101. For example, RedHill has an active preclinical collaboration with a U.S. government agency to test the antiviral activity of its proprietary oral combination therapy for the treatment of Ebola virus disease. I hope to learn more about RedHill’s Ebola program later in 2016.

Conclusion

Below I’ve put together a quick slide to highlight some of the pending catalysts for RedHill Biopharma expected in 2016. For a market capitalization of only $118 million, this is one of the deepest and most catalyst-rich pipelines in small-cap specialty pharma. The enterprise value is only $60 million, baffling for a company with one approved drug and a handful of late-stage assets. The specialty pharmaceutical industry currently trades with a median EV/Revenue multiple of 5x. This would suggest, on a discounted basis, RedHill has potential peak sales of only $12 million between RHB-104, RHB-105, Bekinda™, Yeliva™, and royalties on Rizaport™ and RHB-106. I simply think that is absurd, as the number is likely in the billions, and I plan to develop and share my financial model on RedHill shortly so investors can better understand the potential upside valuation in the shares.